Key points:

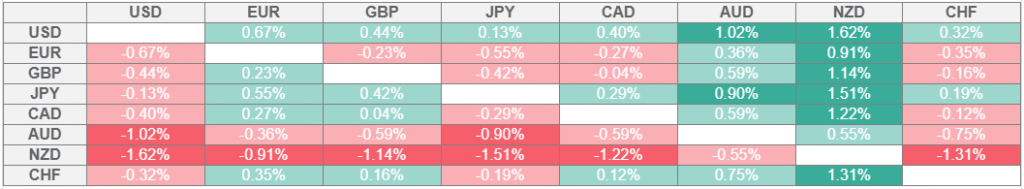

- US dollar wobbles in FX deals

- Fed minutes come Wednesday

- Fed boss Powell speaks Friday

US central bank drops minutes Wednesday and boss Powell will be sloshing billions (indirectly) when he takes the stage Friday.

😎 Dollar Dips, Then Flips

- The dollar index

DXY couldn’t make up its mind Tuesday, briefly sliding below 98.00 before bouncing back to a session high of 98.30.

- Traders are stuck in wait-and-see mode ahead of a bigFederal Reserve week that includes Wednesday’s meeting minutes and Jay Powell’s much-anticipated Jackson Hole speech.

- The greenback’s seesawing motions highlighted a market that’s jittery and unwilling to commit ahead of fresh Fed signals. Add in thin liquidity on a typical summer day and you’ve got yourself a market you don’t wanna test with two feet at the same time.

🤫 Fed Minutes & Policy Split

- Still, price action has been choppy, with forex bros fading moves both ways — a classic sign of directionless positioning ahead of high-volatility events.

- For the week so far, the odds of a September rate cut and mixed global growth signals are keeping a lid on optimism while Trump, Putin, and Zelensky are talking about peace efforts and security guarantees.

- Wednesday brings minutes from the Fed’s July meeting, where officials held rates steady but revealed a notable split: two policymakers actually wanted a cut then and there.

- Traders will parse the meeting summary for clues on inflation worries vs. growth concerns, trying to gauge how close the Fed is to pulling the trigger on easing. Any dovish tilt could crack the dollar index below 98 again, while hawkish undertones risk sending it back above 99.

👋 Powell’s Last Jackson Hole

- Friday’s Jackson Hole symposium is shaping up as the main event, with Powell set to deliver his final Jackson Hole speech as Fed chair before his term ends in May 2026.

- Markets expect Powell to thread the needle between acknowledging not-that-scary inflation and warning against early easing, a balancing act that could shake global assets.

- More broadly, traders are bracing for cross-asset volatility — Powell’s words tend to ripple across equities, bonds, and, yes, the entire forex board.

👀 Across the Board

Visited 1 times, 1 visit(s) today