Here is what you need to know on Monday, August 11:

The US Dollar (USD) trades modestly lower against its major rivals at the beginning of the week. On Tuesday, July Consumer Price Index (CPI) data from the US will be scrutinized by investors. In the meantime, markets will keep a close eye on fresh headlines surrounding the US-China trade talks ahead of the August 12 deadline for a deal.

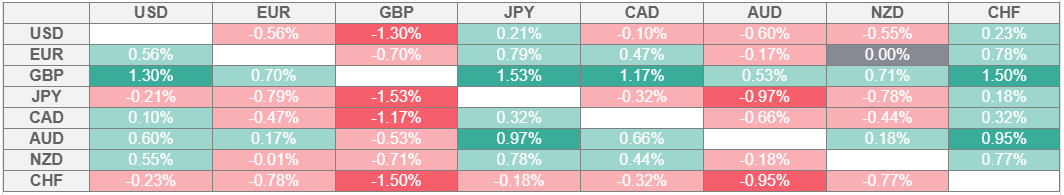

US Dollar PRICE Last 7 days

The table below shows the percentage change of US Dollar (USD) against listed major currencies last 7 days. US Dollar was the weakest against the British Pound.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index declines toward 98.00 after losing about 0.4% in the previous week. US President Donald Trump posted on Truth Social early Monday that he hopes China would quadruple its soybean orders from the US. and explained that this would be a way of “substantially reducing” Beijing’s trade deficit with Washington. Meanwhile, US stock index futures rise between 0.1% and 0.2%. Russia’s President Vladimir Putin and US President Trump will be meeting later in the week for Ukraine war talks.

AUD/USD trades in a narrow channel above 0.6500 after ending the previous week in positive territory. The Reserve Bank of Australia (RBA) will announce monetary policy decisions in the Asian session on Tuesday. Markets expect the RBA to cut the policy rate by 25 basis points to 3.6% following the August meeting.

New Zealand (NZ) Prime Minister Christopher Luxon said early Monday that the US unlikely to provide any relief from the 15% tariffs levied on NZ exports. NZD/USD trades under modest bearish pressure and trades slightly below 0.5950.

Gold climbed above $3,400 on Friday but failed to preserve its bullish momentum. After rising about 1% in the previous week, XAU/USD stays on the back foot and trades near $3,360, losing more than 1% on a daily basis.

EUR/USD fluctuates in a narrow channel at around 1.1650 in the European morning on Monday. On Tuesday, August ZEW Survey – Economic Sentiment data for Germany and the Eurozone will be featured in the European economic calendar.

GBP/USD rose more than 1% last week, supported by the Bank of England’s (BoE) hawkish rate cut. The pair holds its ground early Monday and trades above 1.3450.

USD/JPY struggles to find direction on Monday and trades in a narrow band slightly above 147.50.