Here is what you need to know on Thursday, July 31:

The US Dollar (USD) corrects lower after gathering strength against its rivals on Wednesday, supported by strong data releases and the Federal Reserve’s (Fed) cautious tone on policy-easing. The European economic calendar will feature preliminary July inflation data from Germany and the Eurozone Unemployment Rate for June. In the second half of the day, weekly Initial Jobless Claims and Personal Consumption Expenditures (PCE) Price Index data from the US will be watched closely by market participants.

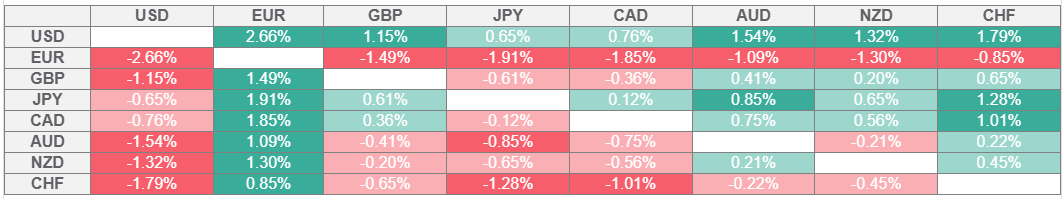

US Dollar PRICE This week

The table below shows the percentage change of US Dollar (USD) against listed major currencies this week. US Dollar was the strongest against the Euro.

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the US Dollar from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent USD (base)/JPY (quote).

The USD Index gained 1% on Wednesday and reached its highest level in two months near 100.00. The US Bureau of Economic Analysis’ first estimate showed that the United States’ (US) Gross Domestic Product (GDP) expanded at an annual rate of 3% in the second quarter. This reading followed the 0.5% contraction reported in the first quarter and beat the market expectation for an expansion of 2.4%. Additionally, the Automatic Data Processing (ADP) announced that employment in the private sector rose by 104,000 in July, surpassing analysts’ estimate of 78,000.

Later in the day, the Fed left the policy rate unchanged at the range of 4.25%-4.5%, as expected. The policy statement showed that Governor Christopher Waller and Governor Michelle Bowman voted in favor of a 25 basis points (bps) rate cut. In the post-meeting press conference, Fed Chairman Jerome Powell refrained from confirming a rate cut in September, citing the uncertainty surrounding the inflation outlook. Additionally, Powell acknowledged that the current policy was still modestly restrictive but added that it was not holding back the economy.

The Bank of Japan (BoJ) announced on Thursday that it maintained the short-term interest rate target in the range of 0.40%- 0.50%, as anticipated. The BoJ repeated in the policy statement that there is a high uncertainty surrounding trade policy developments and their impact on the economy, adding that they will continue to raise the policy rate if the economy, prices move in line with their forecasts. After climbing to its highest level since early April above 149.50 late Wednesday, USD/JPY corrects lower and trades below 149.00 in the European session on Thursday.

USD/CAD rose about 0.5% on Wednesday and closed the fifth consecutive day in positive territory. The Bank of Canada (BoC) held its policy rate steady at 2.75% and BoC Governor Tiff Macklem said that they are going to make sure that a tariff problem doesn’t become an inflation problem. Early Thursday, USD/CAD edges lower but manages to hold above 1.3800.

EUR/USD lost more than 1% on Wednesday and tested 1.1400. The pair stages a rebound in the European morning and trades in positive territory near 1.1450.

Following a short-lasting rebound early Wednesday, Gold turned south in the second half of the day and dropped to a fresh monthly low below $3,270, pressured by rising US Treasury bond yields. XAU/USD gathers recovery momentum in the European session on Thursday and trades slightly above $3,300.