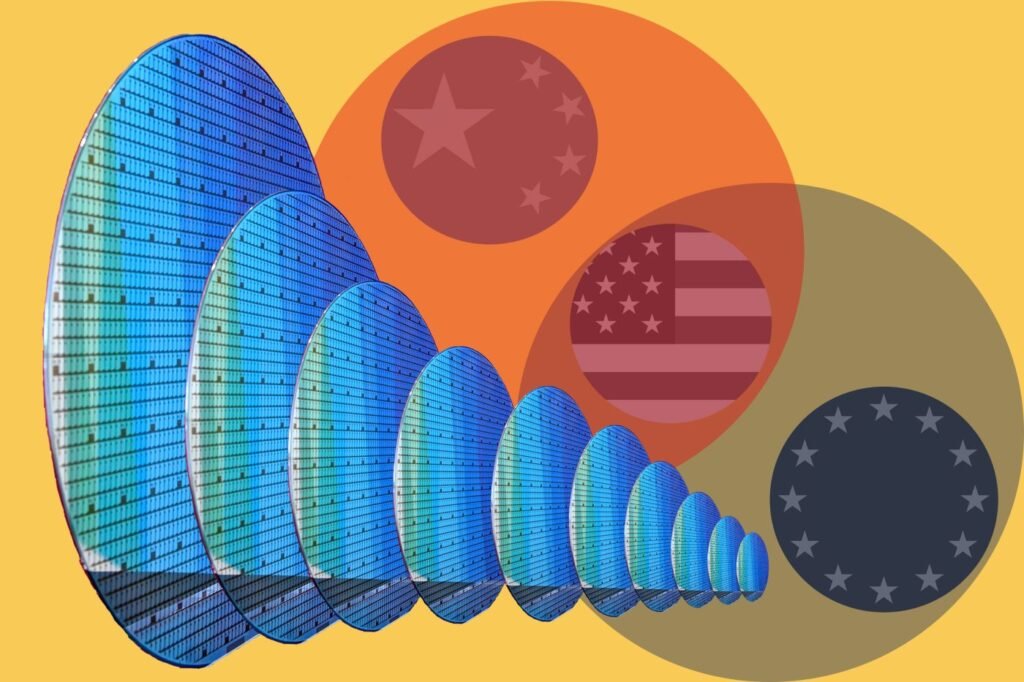

Earlier this month, China announced tightened export restrictions on rare earth minerals, including a complete prohibition on all exports for defense applications, potentially leaving the US defense industry without a key input across a range of weapons systems.

But during earnings calls this week, leadership at the country’s so-called prime defense contractors — Lockheed Martin (LMT), RTX Corporation (RTX), and Northrop Grumman (NOC) — downplayed concerns over the supply challenges, even as tensions between Washington and Beijing over the inputs remain high.

Read more: What Trump’s tariffs mean for the economy and your wallet

Rare earths are crucial components in the weapons systems used by the US, from F-35 fighter jets to Tomahawk missiles. Only recently have real efforts gone into developing a dependable domestic supply chain for the materials.

China currently controls approximately 70% of rare earth mining capacity, 90% of separation and processing capacity, and 93% of magnet manufacturing globally, giving Beijing immense control over global supply.

“We are days if not weeks away from a crisis when it comes to national security,” said Neha Mukherjee, a rare earths research manager at the consultancy and research firm Benchmark Mineral Intelligence.

Read more: The latest news and updates on Trump’s tariffs

So, why weren’t rare earths a bigger focus on defense contractors’ earnings calls? The issue may be less intense than the dominant narrative in the market suggests, said Morningstar equity analyst Nicolas Owens, who covers the defense and aerospace sectors.

“Defense primes have unusually high standards and sensitivity to where they get their stuff from, and they know very well what is a strategic resource that might come under restraint,” Owens told Yahoo Finance. “The whole defense department strategy is about countering China.”

Given their sensitivity to supply chain conditions, Owens said, it’s likely the major defense contractors have been stockpiling the materials for years.

On Northrop Grumman’s third quarter earnings call on Wednesday, president, CEO, and chairman of the board Kathy Warden said that the company has been proactively preparing for possible shortages driven by China or other market variables.

“Our dependency on rare earths has been mitigated by looking through our supply chain and getting well ahead of our sources of supply to ensure that we can produce those electronics,” Warden said on the call.

Asked about supply chain bottlenecks, but not rare earths specifically, Lockheed Martin CEO Jim Taiclet said this week, “We’ve worked with our US government partners and our key suppliers on especially some of those items that you just pointed to, and I’m much more confident today than I was a year or so ago about the ability of those industry partners to step up to the kinds of rates of production increase that we’re being asked to put into play.”

The company’s finance chief, Evan Scott, told attendees at an industry conference in May that “because of our long-cycle supply chain,” the defense contractor has enough supply of rare earth materials set aside to last at least through the rest of 2025.

There is also a plethora of rare earth material in existing US military technology that can be recycled as weapons systems are retired or replaced, Owens said, providing another pipeline of supply if needed.

“I think we’re a long way away from rare earths being the bottleneck for putting another F-35 into production,” Owens told Yahoo Finance.

General Dynamics (GD) will round out third quarter earnings from the prime defense contractors when the company reports on Friday.

The Trump administration has also begun taking steps to develop a domestic supply of rare earths minerals.

Over the summer, the Department of Defense invested $400 million for a 15% stake in mining company MP Materials (MP), the operator of the only large-scale and commercially operable rare earths mine in the US.

In recent months, the government has taken an equity stake in mining company Trilogy Metals (TMQ) and expressed interest in a critical minerals mining site being developed by Australian miner Nova Minerals (NVA). And on Monday, President Trump signed an agreement with Australian Prime Minister Anthony Albanese focused on expanded collaboration on rare earths between the allied nations.

Trump said on Monday that he expects “we’re going to end up having a fantastic deal with China” as the American leader is set to meet his Chinese counterpart, Xi Jinping, in South Korea later this month, where rare earths will be a focus.

The threat of a supply bottleneck for raw materials essential to the electronics embedded throughout US military munitions was addressed in a report from the Government Accountability Office published in September 2024, almost exactly a year before China tightened down its rare earth exports.

The Department of Defense found that it “faces significant risks in its supply chains for these materials and that there would be a high potential for harm to national security in the event of supply chain disruptions,” the GAO wrote.

“Of particular concern, most of these materials are mined and processed in China, which makes DOD’s weapon system programs vulnerable to supply chain disruptions by an adversary nation.”

The US is also already falling behind China in weapons systems developments, according to the Center for Strategic and International Studies, a Washington-based research firm. Beijing is scaling up its munitions manufacturing and weapons development at a rate five to six times faster than the US, according to the firm.

“Even before these latest measures, the US defense industrial base faced significant challenges and had limited production capacity and limited ability to rapidly scale to meet rising defense technology needs,” said Gracelin Baskaran, the director of CSIS’s critical minerals security program.

“The new restrictions will only deepen these vulnerabilities, further widening the capability gap.”

The primes have acknowledged the reality of supply chain tightness. In RTX’s second quarter earnings report, the weapons manufacturer told investors that supply chain difficulties were complicating its efforts to access the materials it needs.

“These disruptions impacted our ability to procure raw materials, including certain rare earth elements, microelectronics, and certain commodities on a timely basis and/or at expected prices,” the company wrote in its 10Q. “We have implemented actions and programs to mitigate some of the impacts but anticipate supply chain disruptions to continue.”

“The reason why there is so much noise about [it] is because there is no stockpile left,” Benchmark’s Mukherjee told Yahoo Finance.

Jake Conley is a breaking news reporter covering US equities for Yahoo Finance. Follow him on X at @byjakeconley or email him at jake.conley@yahooinc.com.

Click here for in-depth analysis of the latest stock market news and events moving stock prices

Read the latest financial and business news from Yahoo Finance

![[Latest] China Oil And Gas Market Strategic Importance](https://koala-by.com/wp-content/uploads/2025/10/La22291585_g.jpg)