By Jamie McGeever

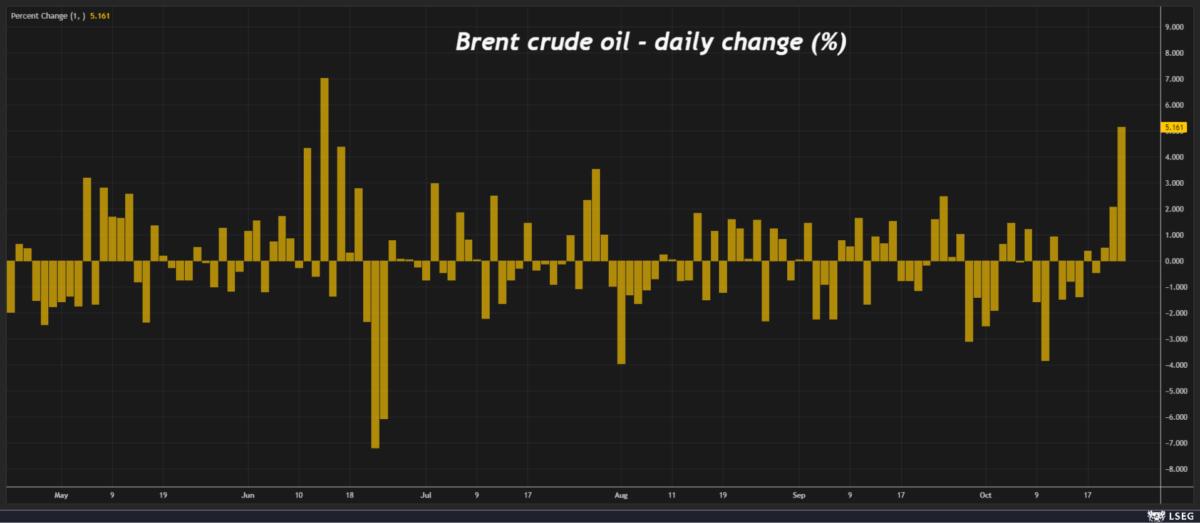

U.S. and world stocks rose on Thursday, boosted by a cooling in U.S.-China trade tensions, while oil prices rocketed 5% after Washington sanctioned two Russian oil giants, raising concern about global supply.

More on that below. In my column today, I look at whether the ‘Magnificent 7’ may be about to relinquish their total dominance on Wall Street, even if just a little. The current earnings season and earnings outlook for 2026 suggest it might.

If you have more time to read, here are a few articles I recommend to help you make sense of what happened in markets today.

-

China’s new five-year plan sharpens industry, tech focus as US tensions mount

-

Trump’s Russian oil sanctions gambit will test his tolerance for pain: Bousso

-

Dallas Fed chief’s rate target reform welcomed amid very uncertain timetable

-

Europe’s economy caught in 100-mph trade winds: Mike Dolan

-

Japan’s new coalition eyes big spending, but not Abenomics 2.0

Today’s Key Market Moves

-

STOCKS: Wall Street higher: Dow +0.3%, S&P 500 +0.6%, Nasdaq +0.9%. New highs for European stocks, Britain’s FTSE 100, South Korea’s Kospi. Japan’s Nikkei falls 1.35%.

-

SHARES/SECTORS: Quantum Computing +7%, Honeywell +7%. Oil lifts energy sector 2%, consumer staples -0.4%.

FX: Yen’s fall brings 153/$ into view, Norwegian crown up on oil, Aussie up 0.5%, Argentine peso claws back some ground.

-

BONDS: US yields up on oil spike, as much as 5 bps across the curve. 10-year yield back up to 4.00%.

-

COMMODITIES/METALS: Oil surges nearly 6% on US-Russia sanctions, gold up 1%, US copper up 2%.

Today’s Talking Points

* China’s 5-year plan

China’s Communist Party rulers just concluded their four-day closed-door ‘plenum’ meeting to lay out their economic plan for the next five years. It looks like the focus will be on building a modern industrial system and ensuring technological self-reliance, as the country’s rivalry with the U.S.n intensifies.

This is unsurprising, given that China and the U.S. are essentially in a technological arms race, at the center of which are the rare earths, microchips, and computing power and know-how that will power their respective economies and militaries.

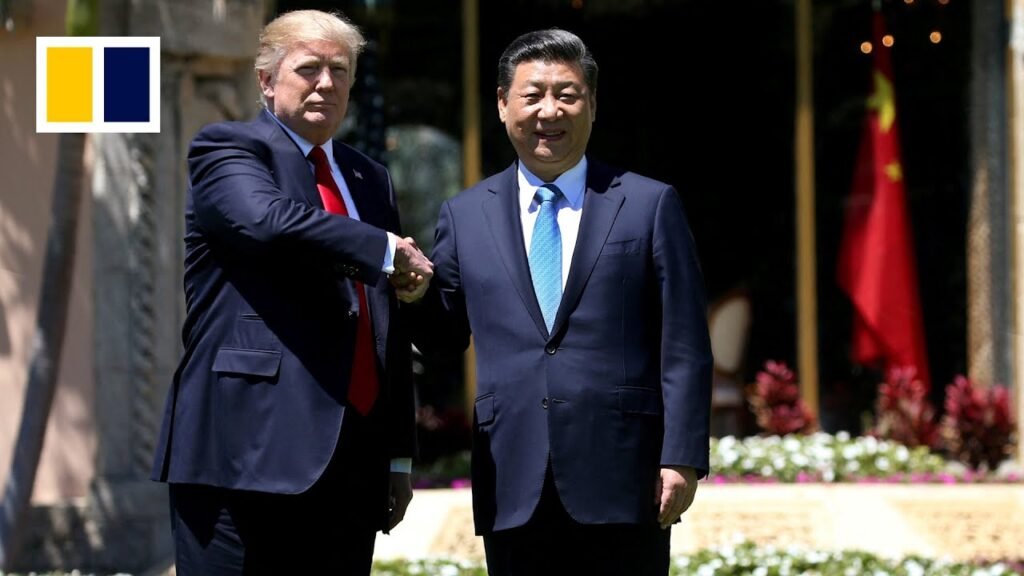

* US-China-Russia dance heats up

The U.S. has imposed sanctions on top Russian oil companies, citing Vladimir Putin’s “refusal to end this senseless war” with Ukraine. It was the first such move by President Donald Trump in his second term. One might ask why he hadn’t done so before.

Sources then told Reuters that Chinese state oil majors have suspended purchases of Russian oil due to the sanctions. China has been the biggest buyer of Russian crude, so this is an interesting twist coming, as it does, as U.S.-China trade tensions are boiling up ahead of next week’s Trump-Xi meeting.

* Casting an eye on U.S. CPI

U.S. consumer price inflation data for September will be published on Friday, a rare release of official U.S. economic data with the government shutdown – now the second-longest on record – about to enter its 24th day.

So it’s a big moment. Or is it? Barring a shock number significantly above forecast – which is 3.1% for annual core and headline – it’s hard to see fully priced market expectations of a 25 bps rate cut next week and again in December moving much. One suspects Fed thinking is the same.

Is Wall Street’s leadership finally about to broaden?

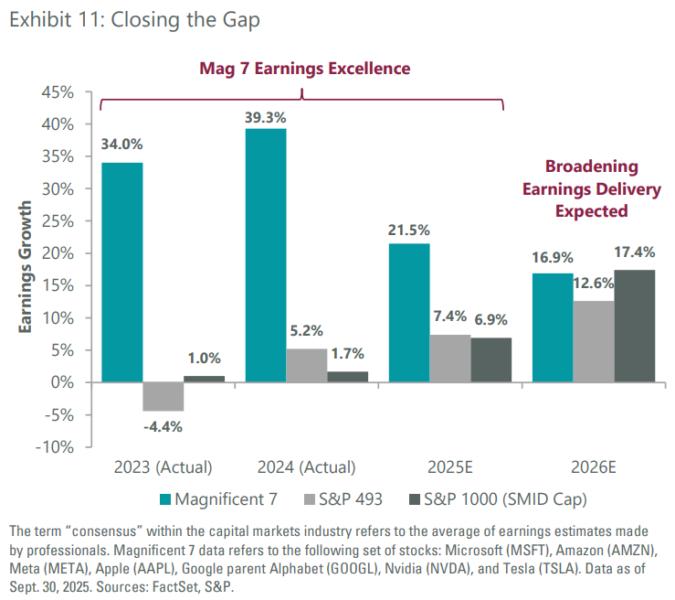

Could U.S. stock market leadership finally broaden beyond the U.S. tech megacaps? Early signs from the third quarter earnings season – particularly 2026 outlooks – suggest there’s a good chance.

The ‘Magnificent Seven’ – Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia and Tesla – have long dominated the S&P 500, in terms of profits, market cap and price momentum.

But that grip may be loosening, at least a little.

Tajinder Dhillon, senior research analyst at LSEG Data & Analytics, estimates Mag 7 earnings growth for the third quarter will be 16.6%, still comfortably outstripping the aggregate index’s expected 9.2%. But that spread of 7.4 percentage points is the narrowest since the fourth quarter of 2022, nearly three years ago.

In a similar vein, Jeff Schulze, head of strategy at ClearBridge Investments, estimates that the earnings growth gap between the Mag 7 and the S&P 493 in this calendar year will shrink to 14 percentage points from 34 percentage points last year, before contracting even further next year to less than five percentage points.

Indeed, Schulze reckons the S&P 1000 index of small- and medium-cap stocks will post higher earnings growth than the Mag 7 next year, marking a remarkable turnaround from recent years.

“Should the Mag 7’s growth advantage dissipate, market leadership could rotate towards the less expensively priced laggards,” Schulze says, adding that third quarter results so far have been “encouraging” in this regard.

Schulze argues that incoming monetary and fiscal stimulus will benefit a broader mix of companies next year, with cyclical sectors like industrials and consumer discretionary particularly well positioned.

WATCH THE LAGGARDS

BlackRock analysts are also calling for the market’s laggards to start closing the gap with the megacap leaders, citing two other factors that could underpin broader earnings growth.

The first is the resilience of the U.S. economy. Many economists see GDP growth increasing to 2% or higher next year. While BlackRock is only penciling in GDP growth of 1.5% this year, that is still far from the recession many were calling for a few quarters ago.

Second, there’s AI-related spending. True, this may be a symptom of the AI optimism that has helped the Mag 7 sustain their dominance. But all that capex should also benefit the construction firms building the data centers, the energy companies powering them, and the industrial, equipment-making and materials firms supplying them.

According to LSEG’s Dhillon, materials and industrials should be the second- and third-top sectors, respectively, for earnings growth in 2026, just behind technology. LSEG estimates point to 20% and 18% growth for these two sectors, respectively, behind tech’s 22% but comfortably above the predicted 14% for the aggregate S&P 500.

NETFLIX, TESLA WARNING SIGNS?

Perhaps a market re-balancing may already be underway. The Dow Jones Industrial Average has outperformed the Nasdaq and S&P 500 over the past month. Granted, that’s a very short timeframe, and the Dow’s advantage is only one percentage point.

But the shift needs to start somewhere, and there’s certainly plenty of room for reallocation. The Nasdaq has doubled the Dow’s 20% gains in the last six months. If U.S. economic growth remains healthy and earnings roll in as analysts expect, there’s every chance the performance gap will be narrowed.

However, there are plenty of reasons to doubt this rosy scenario, namely the creaking labor market, the looming impact of tariffs, and the U.S.-China trade war. And then there’s passive investing, momentum trading and the widespread ‘buy-the-dip’ mentality that could help maintain the Mag 7’s advantage regardless of what’s happening on the ground.

But the market has been very top-heavy for a very long time. If other Big Tech firms’ results are as disappointing as those just released by Tesla and Netflix, the long-awaited broadening might finally arrive.

What could move markets tomorrow?

-

Japan, UK, Germany, euro zone, US PMIs (October, flash)

-

Japan inflation (September)

-

UK retail sales (September)

-

US CPI inflation (September)

-

US University of Michigan inflation expectations, consumer sentiment (October, final)

-

US earnings, including Procter & Gamble, Newmont, Ford

Want to receive Trading Day in your inbox every weekday morning? Sign up for my newsletter here.

Opinions expressed are those of the author. They do not reflect the views of Reuters News, which, under the Trust Principles, is committed to integrity, independence, and freedom from bias.

![[News] China Reportedly Damaged DUV Machine in Reverse-Engineering, Called ASML for Help](https://koala-by.com/wp-content/uploads/2025/10/ASML-tools-624x624.jpg)