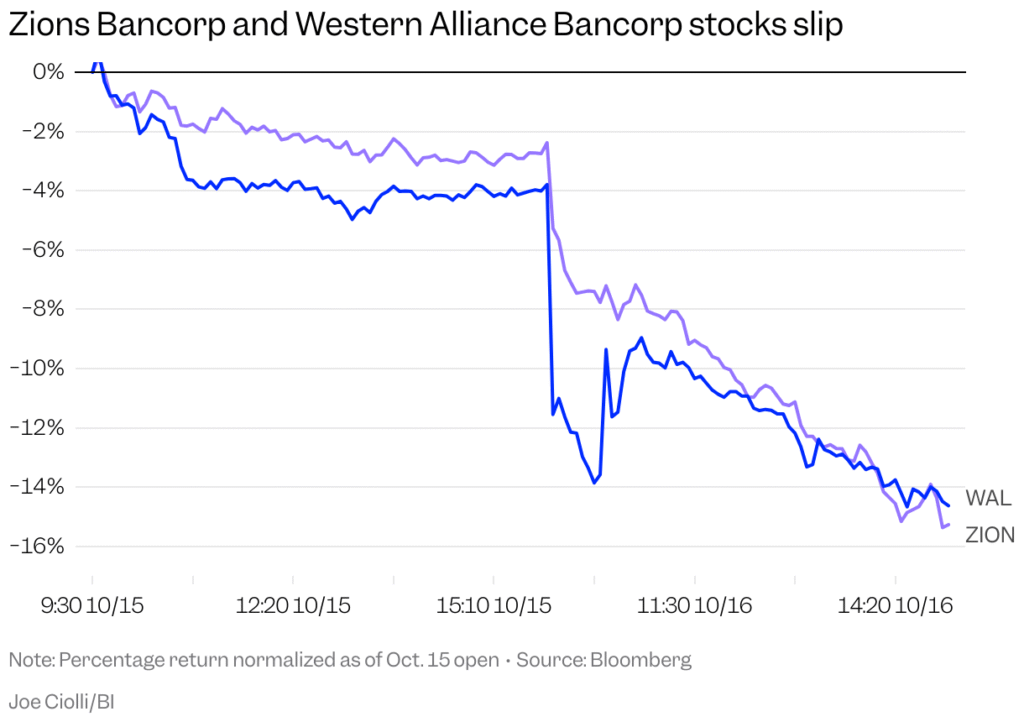

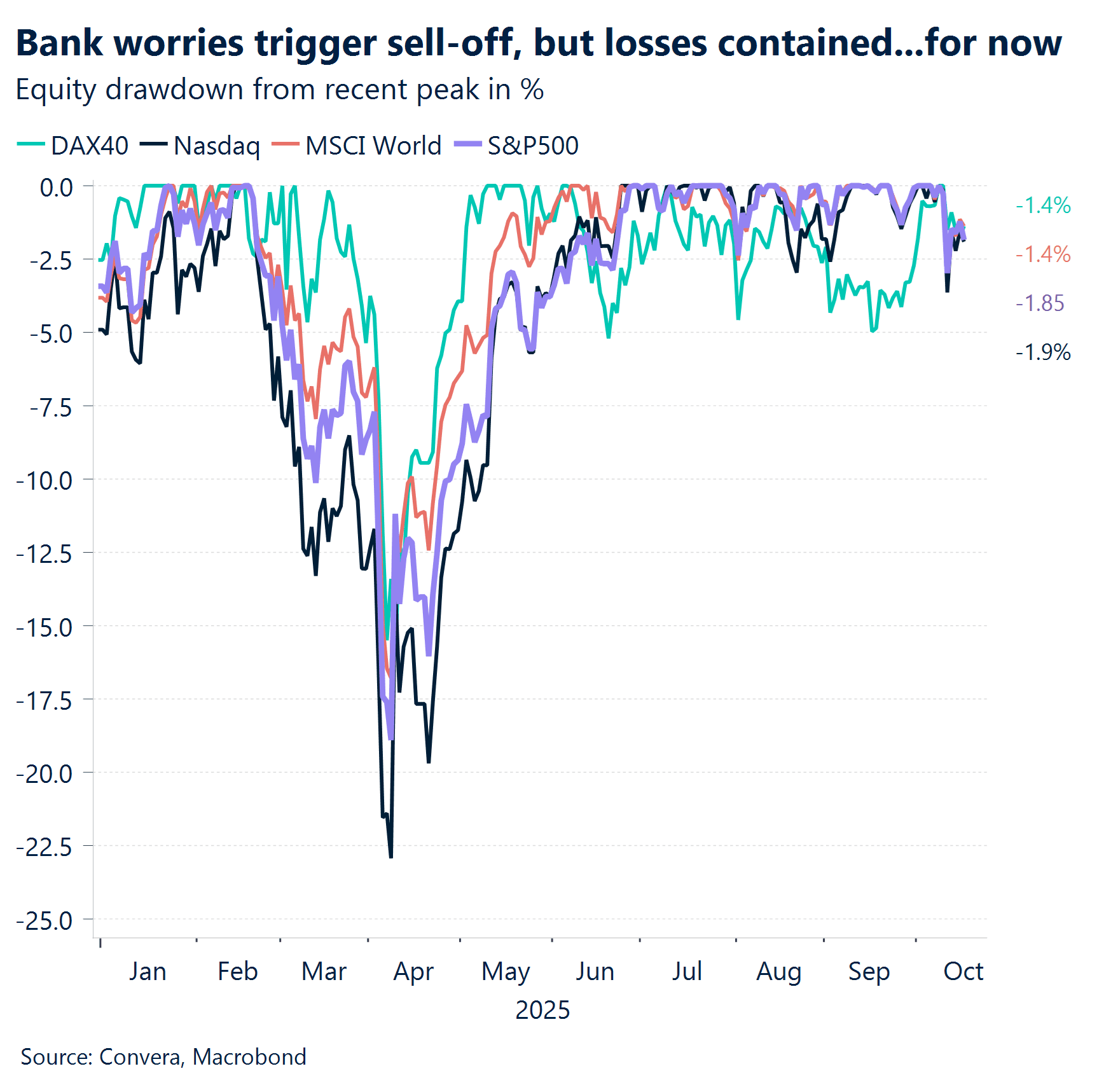

- Global markets were hit by renewed concerns around US banks that triggered a broad sell-off in equities. US auto parts manufacturing First Brands, car dealership Tircolor and lender Zions Bancorporation sparked concern. The US’s KBW regional banking index fell the most since April.

- The US dollar weakened as risk sentiment soured, with the greenback posting its biggest losses against traditional safe havens. USD/JPY and USD/CHF both dropped, reflecting investor demand for lower-risk assets.

- The US dollar was also pressured by the few data updates released over the week with the US government shutdown still in effect The Federal Reserve’s Beige Book showed economic momentum had slowed over the past eight weeks – reinforcing Fed Chair Powell’s Tuesday remarks that the economy still needs support. Stephen Miran, a recent Trump appointee who previously pushed for a 50-basis point cut, echoed calls for further easing.

- Markets had started the week on edge after US president Donald Trump announced new 100% tariffs on Chinese imports starting from next month. US Treasury Secretary Scott Bessent later said a key meeting between US president Donald Trump and Chinese Xi Jinping is still likely to go ahead.

- Further moves towards a lasting ceasefire in the Middle East supported markets. Crude oil market reacted to the growing hopes for peace with WTI crude falling below USD60 per barrel for the first time since June. Gold and silver kept surging, however, with both of the precious metals setting new all-time records. Gold traded above USD4300 per ounce while silver broke above USD54 per ounce helped further by the worries around the US banking system.#

Global Macro

Gold’s gleam in the data vacuum

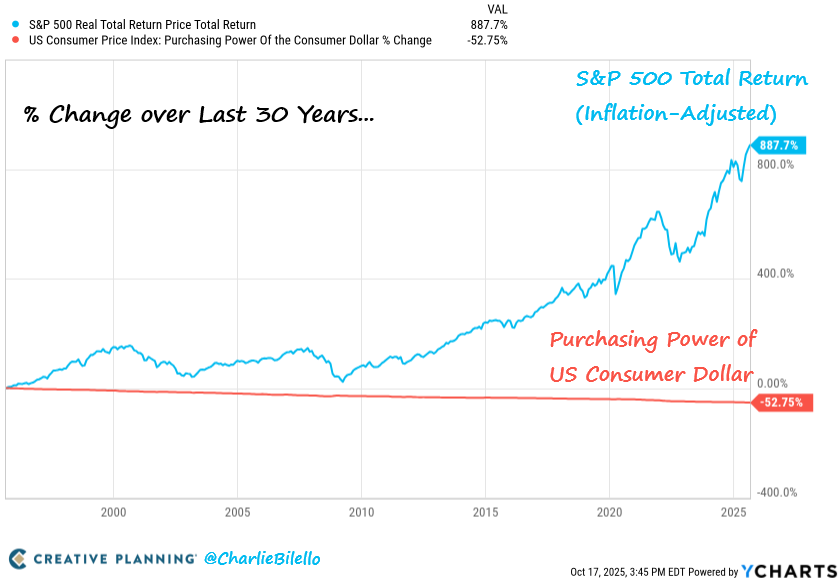

US Beige Book. No US CPI this week, will be released October 24. The October Beige Book was the key macro data point this week. It showed a broadly stagnant U.S. economy, with modest growth in three Fed Districts and slight declines in four. Consumer spending softened, especially among lower- and middle-income households, while sectoral activity remained weak across manufacturing, agriculture, energy, and transportation. Labor demand eased as firms trimmed headcounts and leaned on temporary hires, partly due to increased investment in AI. Inflation pressures persisted, driven by rising import and service costs, keeping price growth above the Fed’s 2% target. Gold continues making high after high, behaving more live a risk-asset.

Gold’s bull run redefined. Making high after high, the metal is trading like a high-octane risk asset rather than a safe haven, suggesting either powerful speculative demand or deep, underlying inflation and global fiscal fears.

Dovish Fed. This week a few Fed members reinforced concerns around the US labor market. Fed Chair Powell flagged slowing hiring trends, warning that further declines in job openings could eventually push unemployment higher. Governor Waller echoed Powell’s cautious stance, supporting a gradual approach to rate cuts aimed at balancing growth and inflation risks. In contrast, Governor Miran continues to advocate for a larger, half-point cut, citing downside risks from US-China trade tensions.

Tariffs. The US-China rare earths dispute has heightened expectations that, going forward, escalation as a path to resolution may become a defining feature of their trade relationship. China’s rare earth export controls underscore the persistence of tit-for-tat tactics.

Australia. The seasonally adjusted unemployment rate for September 2025 rose to 4.5%, up from 4.3% in August and higher than the consensus forecast, marking the highest jobless rate since November 2021, while total employment saw a smaller-than-expected increase of 14,900.

Week ahead

One beam through the fog

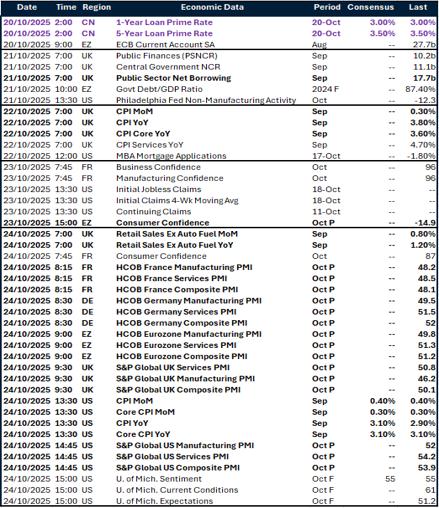

Fed’s soft talk meets hard data. We expect the infamous US inflation report to be released on 24 October – nine days later than originally scheduled, despite the ongoing shutdown. Following a dovish week from the Fed, shaped by the Beige Book and commentary from various officials, the September inflation print – expected to be orderly – could disrupt the Fed’s recent messaging, if it surprises to the upside. If a rate cut proceeds as planned, we anticipate a more cautious tone at the upcoming policy meeting, nonetheless.

PMIs mislead. A batch of PMIs will be released across the eurozone, the US, and the UK. For the eurozone, reliability took a hit: the October upbeat PMI release diverged from reality, with industrial production in Germany and the broader region coming in below expectations. This suggests manufacturing will likely be a drag on Q3 GDP growth.

Borrowing watch. As we approach the November Budget, the UK economy faces one of the tightest fiscal headrooms in recent years, compounded by a weakening economic outlook. We’re closely monitoring public finance data, with public sector net borrowing in particular focus.

PBoC in focus. China’s next rate-setting meeting is scheduled for Sunday, 19 October 2025 at 18:15 local time. While no change is expected, investors will parse the tone for future easing signals – amid recent concerns over slowing growth and rising deflation risks.

FX Views

Fed signals softening

USD Dollar stalls at 99.50. The dollar index (DXY) hit resistance at 99.5, after rallying on the politically turbulent backdrop faced by the euro and the yen. As political tensions eased, the dollar naturally gave back some gains. After all, the ongoing government shutdown offered no USD-driven catalyst to push the currency higher more sustainably. Meanwhile, the Fed appeared to have sufficient data to justify a dovish tilt in its communications this week, fully unwinding the dollar rebound. The Beige Book, along with remarks from several officials, highlighted a clearly softening labour market and suggested the central bank is open to rate cuts. Adding to this week’s soft dollar performance, concerns were reignited over poor credit lending standards in the US after two regional banks tanked, citing issues with loans linked to fraud. We don’t, however, expect significant dollar downside from this. On the Sino-American trade front, the dollar remains largely unfazed by escalation risks for now, staying more tightly tethered to rate expectations. With diplomatic talks still on the calendar, markets are clinging to hopes for a constructive outcome.

EUR Lecornu’s comeback lifts the euro. The euro edged higher against most G10 peers as a series of developments improved the political backdrop in France – the key risk event driving the common currency’s price action in recent weeks. President Macron’s reappointment of Prime Minister Lecornu, just days after his resignation, was initially met with skepticism, raising concerns over the lack of viable alternatives. However, Lecornu managed to secure support from the centre-left Socialists by suspending the controversial pension reform – the plan to raise the retirement age from 62 to 64 – until after the 2027 presidential election, in a bid to restore political stability. He went on to win Thursday’s confidence votes, backed by the same Socialist bloc and moderate lawmakers. We see EUR/USD consolidating around the 1.17 level, rising gradually to the fundamentally-justified 1.18 zone, as there is little near-term support for the dollar unless the shutdown is resolved.

GBP Pound stages recovery. The British pound has been higher over the last week as growing expectations for further Federal Reserve rate cuts caused the US dollar to ease. The GBP/USD rebounded from two-month lows. The GBP was mixed in other markets, up strongly versus the Australian and Canadian dollars, but weaker versus the Swiss franc and Japanese yen as safe havens outperformed. The GBP was also boosted as markets came to assume that the Bank of England is less likely to cut interest rates with inflation most recently at 3.8% — almost double the BoE’s 2.0% target. The GBP/USD now looks technically stronger with the pair above key moving averages. Support is seen at 1.3275 and resistance at 1.3525. Next week, September CPI, due Wednesday, is key.

CHF Banking crisis boosts franc. The Swiss franc was stronger over the last week benefiting from its safe haven status as a sell-off across the US banking sector resulted in a flight to safety. The USD/CHF fell to one-month lows. The Swiss franc was stronger in other markets with the EUR/CHF falling to the lowest level in six months as the franc’s safe haven appeal was boosted as French political worries weighed on the euro. Technically, the USD/CHF remains in a clear downtrend with the market trading below both short-term and long-term moving averages. Key support is seen at the ten-year lows at 0.7830. Looking forward, trade balance and SNB policy minutes are the upcoming week’s major events.

CNH Markets brace for China’s next move. China’s tightening grip on rare-earth exports has raised fresh concerns about global supply chain disruptions and inflationary spillovers. These trade restrictions, coupled with subdued domestic demand, are fueling uncertainty around China’s growth outlook and its impact on global markets. USD/CNH shows weak price momentum, with resistance at the 21-day EMA of 7.1342, followed by the 50-day EMA at 7.1427 and the 100-day EMA at 7.1627. Key support is seen at the 7.1200 handle. Markets will closely monitor Chinese economic indicators—including loan prime rates, industrial production, and unemployment—for clues on global growth and their potential spillover effects on European inflation and FX volatility.

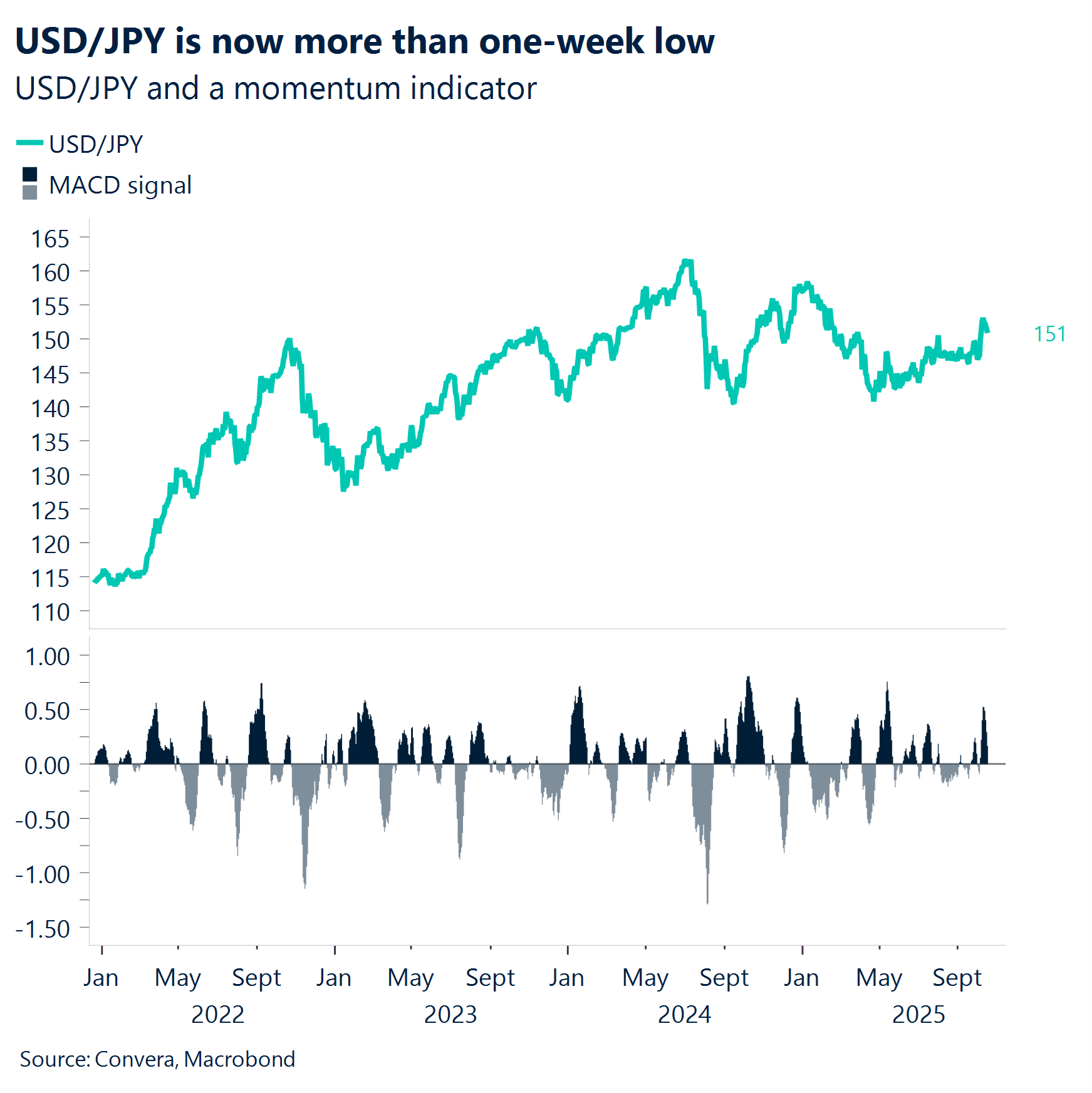

JPY Hawkish BoJ rhetoric. BoJ policy member Tamura’s call for rates closer to neutral had little impact on the yen, as his hawkish stance is already well-known. Fundamentally, the BoJ remains cautious, with policy still far from neutral amid persistent yen weakness and upside inflation risks. USD/JPY is hovering more than a one-week low. Key support levels are the 50-day EMA at 148.84 and the 100-day EMA at 148.08. USD buyers may look to step in at these levels, as the pair has not yet reached oversold territory. Upcoming trade data, and national CPI will be pivotal for any signs of policy recalibration.

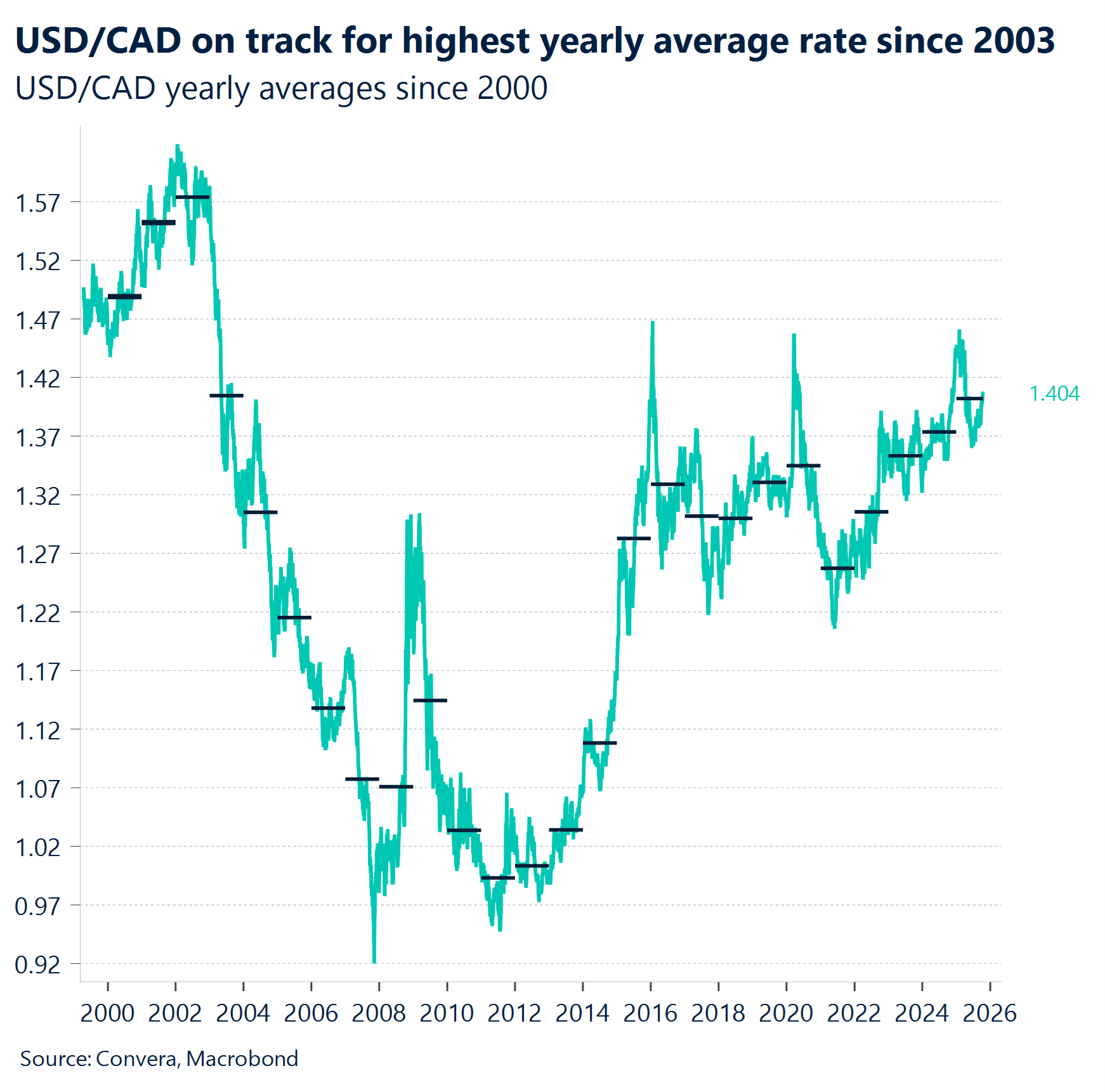

CAD Insufficient relief. The Canadian dollar has struggled to gain traction, even after a stronger-than-expected jobs report. Holding near 1.404 this week, the Loonie remains above its 200-day simple moving average, marking its highest level since April 10, yet continues to trade with a subdued tone. Despite renewed selling pressure on the US Dollar following dovish Fed commentary, the CAD has lagged behind its G10 peers, likely weighed down by a soft domestic macro backdrop and WTI prices dipping below $60 a barrel. Looking ahead, next week’s Canadian CPI release will be the final key data point before the Bank of Canada’s rate decision on October 29.

AUD Soft jobs data fuels RBA rate cut bets. Australia’s latest labor market report confirmed a weakening trend, with the unemployment rate rising to 4.5% and job creation falling short of expectations. A higher participation rate coupled with sluggish employment growth reinforces the case for a dovish Reserve Bank of Australia. With inflation trending lower and policy already considered “slightly restrictive,” the RBA has room to ease further—potentially as soon as November, with another cut likely by March 2026. From a technical standpoint, AUD/USD shows weak price momentum. Key resistance levels sit at the 21-day EMA of 0.6546 and the 50-day EMA of 0.6549. The next strong support lies at the 0.6400 handle, where AUD buyers may seek to capitalize on oversold conditions. Looking ahead, Australian manufacturing and services PMIs will be closely watched for signs of further economic softness.

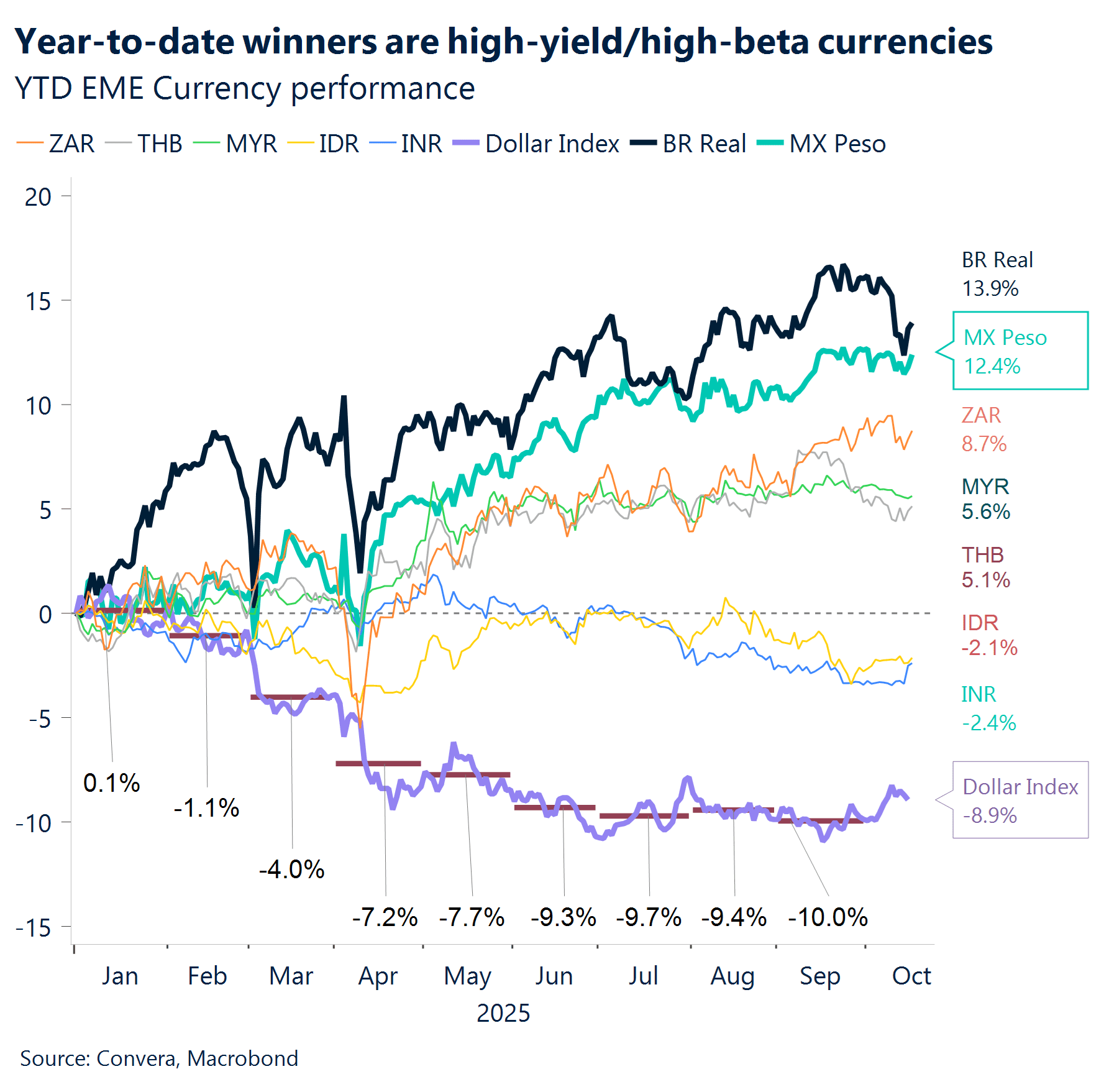

MXN 50-day SMA. Despite repeated attempts to break above the 50-day Simple Moving Average (SMA), the Mexican Peso has remained below this key medium-term trend indicator since April. Last week’s push toward 18.6 was short-lived, as dovish signals from the Fed weakened the US Dollar, sending the Peso back below its average and reaffirming 18.5 as a key resistance level. The USD/MXN pair, which had posted strong year-to-date gains on the back of robust carry trade appeal, has now entered a phase of choppy, sideways consolidation around the 18.40 mark. While recent geopolitical tensions, including the U.S.-China trade spat, briefly pushed the Peso higher, its retreat reflects a return to low-volatility trading, with support from Mexico’s solid macro fundamentals and interest rate differential likely keeping the pair range-bound in the near term. For the short-term, the USD/MXN is expected to continue this range-bound crawl, holding year-to-date gains at 12%.

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.