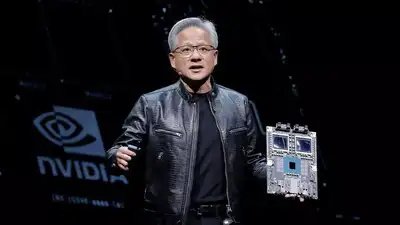

A shift is underway in the Trump administration’s approach to tech policy. Nvidia said on 14 July that the US government would soon grant it licenses to resume exports of its H20 chips to China. AMD is expecting the same for its MI308 chips. This may appear surprising after multiple statements from Trump administration officials that controls on the export to China of higher-end AI chips, such as the H20, were off the table.

This move doesn’t change the broader bipartisan consensus behind restricting China’s access to strategic tech, but rather fits into a pattern of recent decisions showing that tech export controls—previously viewed as a non-negotiable issue of US national security—can now be used as bargaining chips in trade talks with China. The next talks are scheduled for 28 and 29 July in Stockholm between Treasury Secretary Scott Bessent and his Chinese counterparts. This shift exacerbates uncertainty for domestic and international tech firms and will encourage Beijing to push for further loosening of controls in future negotiations.

In late May, the US Commerce Department’s Bureau of Industry and Security sent letters to semiconductor electronic design automation (EDA) software companies informing them with little warning or detail that the United States would impose restrictions on their business in China. Yet, just weeks later in early June, some Chinese customers once again were able to access EDA servers. This was shortly after US President Donald Trump’s 5 June call with Chinese President Xi Jinping.

On 3 July, reports emerged that the Department of Commerce had informed major EDA software providers that the restrictions had now been lifted, apparently as part of a framework agreement reached at US–China talks in Geneva and London. The imposition and then retraction of these restrictions offered an early hint that tech controls could be on the table; indeed, Bessent acknowledged that lifting chip restrictions was ‘all part of a mosaic’ in negotiations with Beijing.

Policy improvisation is nothing new for the Trump administration’s tech policy. Earlier this year, the administration sent mixed signals about whether it would restrict Nvidia’s H20 chips, which it ultimately did. And while Kevin Hassett, director of the National Economic Council, noted that high-end chips were not on the table around the time of the London talks, relenting on the EDA software controls despite strong bipartisan concerns over export of US chip-related technology to China marked the beginning of Washington’s shifting tech policy, which progressed to the H20 announcement.

That said, the instinct to hinder China’s access to strategic US technology is not gone. Jeffrey Kessler, under secretary of the Bureau of Industry and Security, threatened to revoke the waivers that allow South Korea’s Samsung and SK Hynix and Taiwan’s TSMC to export US chip-related tech to their fabrication plants in China. Additionally, Malaysia’s decision to require permits for exporting high-end US chips reflects Washington’s concerns of transshipment to China. But that instinct is now being balanced with efforts to soften some controls as part of trade negotiations to reduce some Chinese curbs on exports of critical minerals and rare earth magnets to the US.

Still, this means that US allies will feel pressure from the Trump administration to cooperate with US restrictions while feeling pressure from Beijing not to make deals that disadvantage China. For US and foreign businesses alike, shifting policies further exacerbate regulatory uncertainty. That challenges their abilities to make investment and supply chain decisions. Giving ground on these controls also may create an incentive for Beijing to make new demands for further easing of export controls.

From Beijing’s perspective, changes to Washington’s tech policy will not divert China from its current direction on promoting tech-led growth and self-sufficiency—if anything, it could further catalyse these trends. China’s upcoming five-year plan will emphasise ‘new quality productive forces’ (growth led by high-tech), investment towards innovation and research and development, and increased funding for AI and semiconductor development to improve cutting-edge capabilities and self-sufficiency. For example, Beijing recently revealed that its latest tech investment fund, dubbed ‘Big Fund III’, would target specific parts of the semiconductor supply chain where China historically lags the most: chip design (dominated by the US) and lithography equipment (concentrated in the Netherlands).

As trade negotiations continue with the US, Washington’s shifting approach to tech policy is likely to add further uncertainty for governments, national security practitioners, and businesses alike.