Beyond Meat skyrocketed on a short squeeze. Here’s what you need to know.

The meme stock marauders were back with a vengeance today, with a surge not seen since the days of GameStop and AMC Entertainment during the peak of the COVID-19 pandemic.

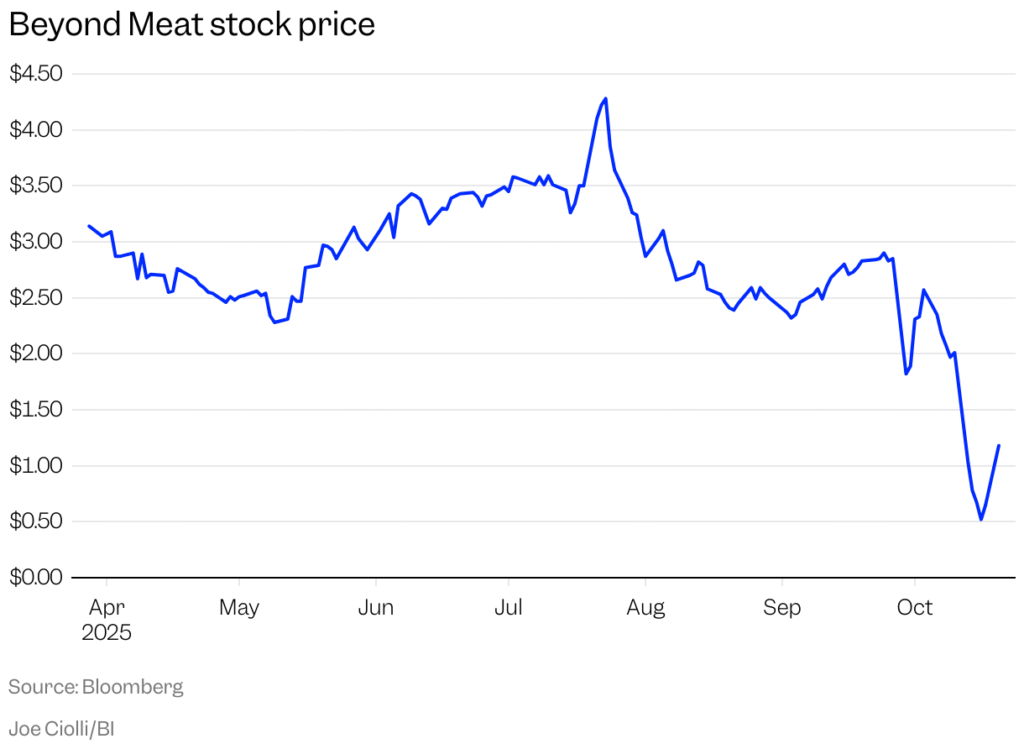

This time, it was Beyond Meat (BYND 127.70%) ripping higher on a short squeeze. As of 2:01 p.m. ET, the stock had more than doubled, up as much as 137% during the session.

The plant-based-meat company has been one of the worst performers on the stock market over the past five years. In fact, even with today’s drop, the stock was still down more than 99% over the last five years.

Image source: Beyond Meat.

What’s happening with Beyond Meat

Beyond Meat jumped in premarket trading and continued to rally in the regular session on an organized short squeeze that began on social media sites like Reddit and X. Investors responded to posts arguing that it was the most shorted stock in the U.S., making it ripe for a short squeeze. As of Sept. 30, 54% of the float was sold short.

By the afternoon, trading volume had topped 700 million, compared to an average of less than 20 million.

The news that helped spark the short squeeze was a tender offer from Beyond Meat last Monday to exchange shares for convertible senior notes, an event that created 316,150,176 new shares, increasing its shares outstanding by more than 4 times. The stock plunged on that news, falling nearly 75% from Oct. 10 to Oct. 16 as it reflected the company’s rapidly weakening financial position.

However, the lock-up restrictions expired at 5 p.m. ET on Oct. 16, last Thursday, giving the former convertible note holders the opportunity to sell those shares. The stock jumped 23% last Friday, and is surging today as meme investors are capitalizing on the new liquidity to create a short squeeze.

Even with the jump in share count, the average share has changed hands nearly twice today.

Can Beyond Meat keep gaining?

Today’s jump has nothing to do with Beyond Meat’s fundamentals. In fact, the tender offer looks like a desperate move, as the company would have almost certainly been unable to repay those notes, which were due in 2027.

Converting them to stock eliminates that debt and gives lenders something, rather than the pennies on the dollar they likely would’ve gotten in a bankruptcy.

Revenue at the company is falling, and it’s deeply unprofitable. As of the end of the second quarter, the $1.14 billion in convertible notes exceeded the $691.7 million it had in assets, a clear problem.

From that perspective, the tender offer was a smart move, but it does little to change the company’s growth prospects or profitability, though it could give it breathing room to raise more cash.

At this point, anything can happen to Beyond Meat in the near term, as we saw previously with stocks like GameStop, AMC Entertainment, and, more recently, Opendoor Technologies. However, over the longer term, this still looks like a broken company headed for bankruptcy. Investors are best off staying away.

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.