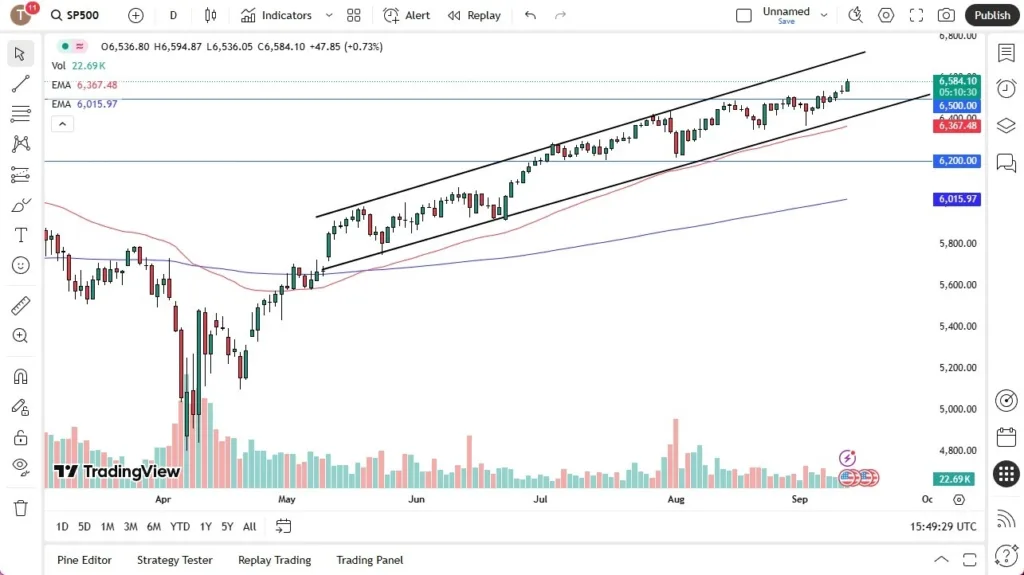

U.S. stocks finished mixed on Friday as investors looked ahead to next week’s Federal Reserve decision on interest rates.

The Dow Jones Industrial Average fell 0.59 percent to 45,834.22. The Standard and Poor’s 500 slipped 0.05 percent to 6,584.29. The Nasdaq Composite Index rose 0.44 percent to 22,141.1, marking its fifth consecutive record close.

Seven of the 11 primary Standard and Poor’s 500 sectors ended lower, with health care and materials leading the declines, down 1.13 percent and 0.97 percent, respectively. Consumer discretionary and utilities were the best performers, rising 0.57 percent and 0.56 percent.

The University of Michigan’s preliminary survey showed consumer sentiment fell more than expected in September, while long-run inflation expectations rose to 3.9 percent as households expressed concern about tariffs.

Even so, investors remained confident that the Fed would cut rates at its Sept. 17 policy meeting. Futures markets point to a quarter-point reduction with near certainty, according to the CME FedWatch tool.

On the corporate front, Microsoft climbed 1.77 percent after striking a deal with OpenAI that would allow the artificial intelligence company to shift from a nonprofit to a for-profit model.

Tesla gained 7.36 percent, Apple added 1.76 percent, and Nvidia, Alphabet, Meta Platforms and Broadcom posted modest advances. Amazon was the sole large-cap tech laggard, slipping 0.78 percent.

U.S. stocks close mixed ahead of Fed decision on interest rates

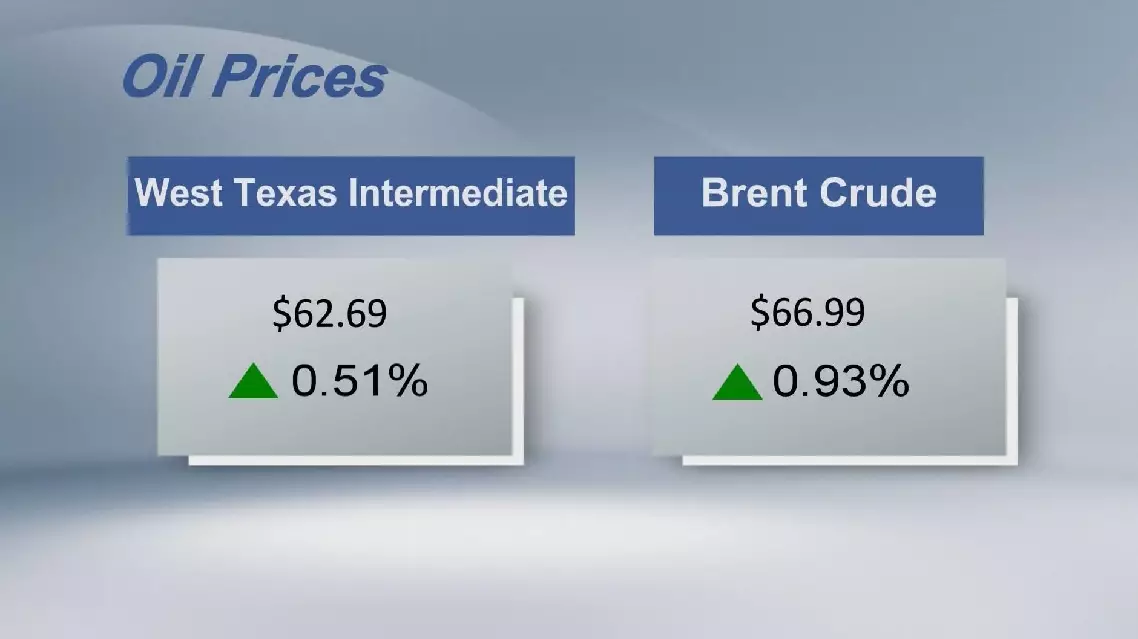

Oil prices rose on Friday.

The West Texas Intermediate for October delivery added 32 cents, or 0.51 percent, to settle at 62.69 U.S. dollars a barrel on the New York Mercantile Exchange. Brent crude for November delivery gained 62 cents, or 0.93 percent, to settle at 66.99 dollars a barrel on the London ICE Futures Exchange.

Crude futures settle higher