U.S. mHealth Apps Market Size & Trends

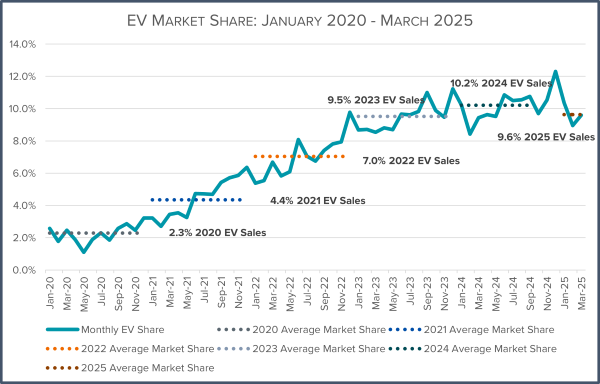

The U.S. mHealthapps market size was estimated at USD 12.33 billion in 2024 and is projected to reach USD 32.41 billion by 2033, growing at a CAGR of 11.16% from 2025 to 2033. The growing penetration of smartphones and internet connectivity, and the rising adoption of mHealth technologies by physicians and patients, drive segment growth. Furthermore, the growing adoption of fitness and medical apps to collect and track individuals’ health-related data and to improve the overall health of patients using smartphones is a major factor anticipated to drive market growth.

Increasing Smartphone Penetration Fuels Widespread Access to mHealth Solutions

Smartphone penetration in the U.S. is a foundational driver for mHealth app adoption. According to The Mobile Economy reports, smartphone penetration in the U.S. was approximately 76% in 2022 and is projected to reach 92% by 2030. This rapid growth means more consumers have the devices necessary to access mHealth apps anytime and anywhere. With over 6.8 billion smartphone users worldwide as of 2023, to grow to 7.34 billion by 2025, the scale of connectivity is unprecedented. This widespread smartphone ownership enables millions of Americans, 84 million people in the U.S. alone, to use healthcare apps, with 30% relying heavily on these apps for managing their health. Expanding network infrastructure and 5G technology support seamless app functionality and real-time health data exchange.

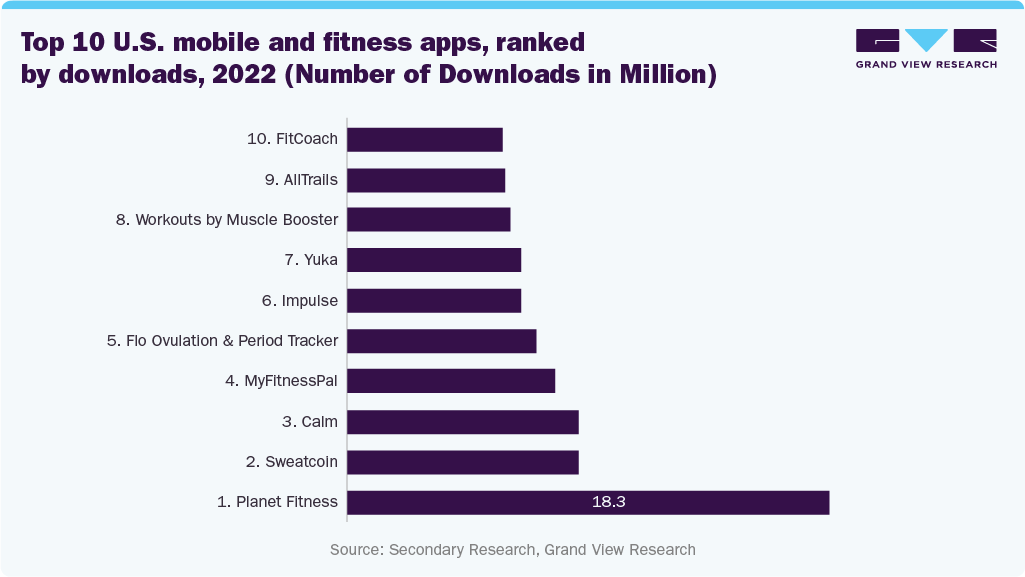

Most Popular mHealth Apps in the U.S.

-

MyChart is the most widely used, with 49% of American mHealth app users accessing it to securely view medical records and communicate with healthcare providers.

-

Doctor on Demand, offering virtual consultations with licensed healthcare professionals, is used by 21% of users.

-

Aetna Health follows closely with 20% usage.

-

Other notable apps include QuickMD (16%), Zocdoc (15%), and APPatient (12%), with additional users engaging with MyHealth and Kaiser Permanente apps among others

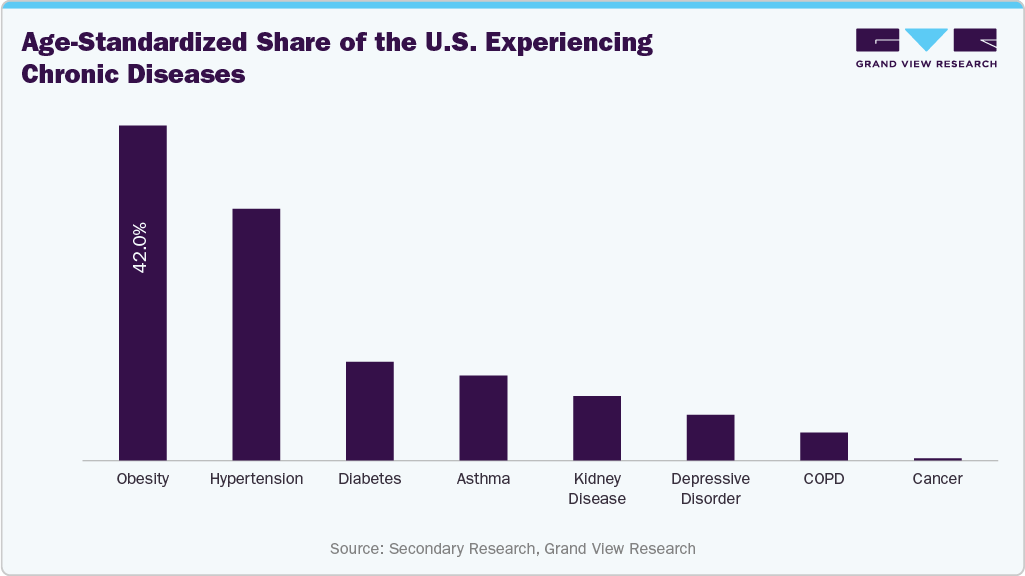

Rising Prevalence of Chronic Diseases is Driving Demand for Remote Health Management

The rising prevalence of chronic diseases such as diabetes, hypertension, and heart conditions in the U.S. is driving demand for remote health management. mHealth apps enable patients to track vital signs, medication, and symptoms, reducing hospital visits and improving outcomes. Remote monitoring has become essential, fueling growth in chronic disease management apps, one of the fastest-growing market segments. Integrating AI and personalized health insights further boosts their effectiveness in managing long-term conditions.

Top U.S. Chronic Care Apps

|

App Name

|

Key Features

|

|

Teladoc Health

|

Comprehensive telehealth with chronic care programs, 24/7 doctor access

|

|

Lark Health

|

AI-based coaching for diabetes, hypertension, weight loss, and wellness

|

|

WellDoc’s BlueStar

|

Clinically validated diabetes management app with real-time coaching

|

|

K Health

|

AI symptom checker, virtual primary care, and ongoing chronic condition support

|

|

ChronicCareIQ

|

Provider-focused platform for remote monitoring, EHR integration, and automation

|

Favorable Government Initiatives for Mobile Health Apps

Favorable government initiatives have significantly accelerated the growth of the U.S. mHealth apps market. For instance, the Centers for Medicare & Medicaid Services (CMS) have expanded telehealth coverage and reimbursement policies to include remote patient monitoring and digital health services. In addition, the ONC’s Cures Act Final Rule, released in the U.S., aimed to promote patient access to electronic health information, enhance interoperability, prevent information blocking, and drive innovation through standardized APIs, empowering individuals to access and manage their health data securely. Such initiatives have enhanced provider adoption, improved patient access to care, and boosted investor confidence in the mHealth sector.

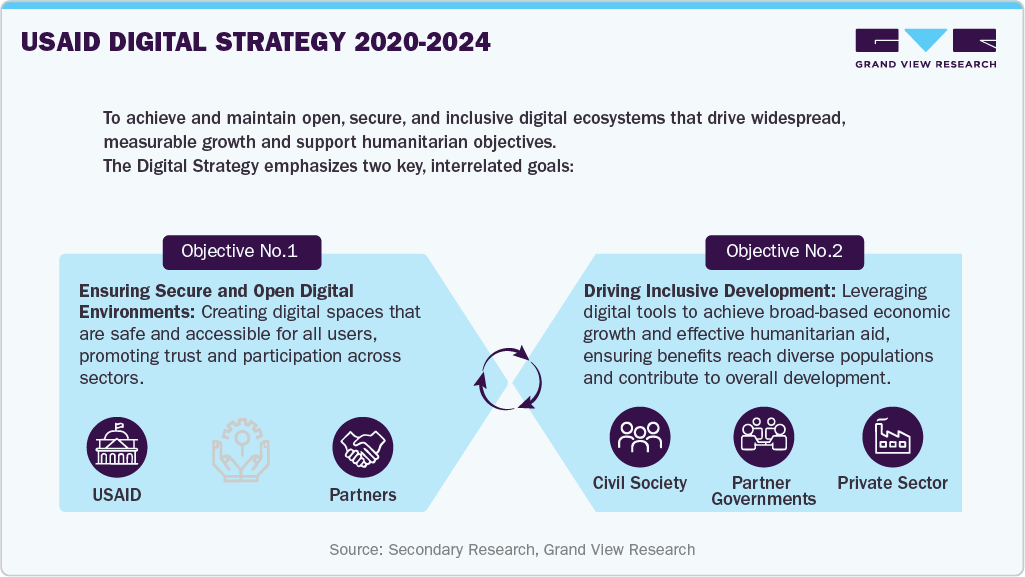

Furthermore, USAID’s Digital Strategy seeks to utilize digital technologies to advance development and provide humanitarian aid. Its goal is to establish open, secure, and inclusive digital ecosystems that facilitate significant progress & aid humanitarian missions.

Increasing Adoption Of Digital Healthcare

In the U.S., smartphones have evolved into tools for health monitoring and fitness tracking, supported by mobile apps that simplify daily healthcare tasks. Some companies are developing Chatbot services for one-time consultations or basic medical inquiries. With growing smartphone use and advanced technology, investors are backing innovative mobile healthcare solutions that offer convenience and high-quality care. Apps such as Practo and AssistRx allow patients to book appointments, track consultations and prescriptions, and manage health data through mobile platforms, phone calls, or messaging services.

Growing Investments by Players

Investment in the U.S. mHealth and digital health sectors has surged, driving market growth. Venture capital, private equity, and corporate funding fuel innovation, helping companies enhance technology, expand offerings, and scale efficiently. This has led to the launch of advanced, personalized health solutions tailored to specific needs. For instance, in August 2024, Zepp Health in the U.S. introduced the Wild.AI mini‑app on Amazfit Active smartwatches. It delivered hormone‑aware, cycle‑based readiness scores and personalized training, diet, and recovery guidance, supporting life stages from menstruation to menopause, backed by 450+ academic studies.

Top 10 Digital Health VC Deals in 2024

|

Company

|

Close Date

|

Segment

|

Category

|

Deal value (USD Million)

|

|

Flo Health

|

July 30

|

Digital Health

|

Women Health

|

200

|

|

Foodsmart

|

July 12

|

Digital Health

|

Nutrition & Weight Loss

|

200

|

|

Maven

|

Complete analysis will be included in the final deliverable

|

|||

|

Rula

|

||||

|

Alto Pharmacy

|

||||

|

Spring Health

|

||||

|

Headway

|

||||

|

Thyme Care

|

||||

|

K Health

|

||||

|

Huma

|

||||

Source: Secondary Research, Grand View Research

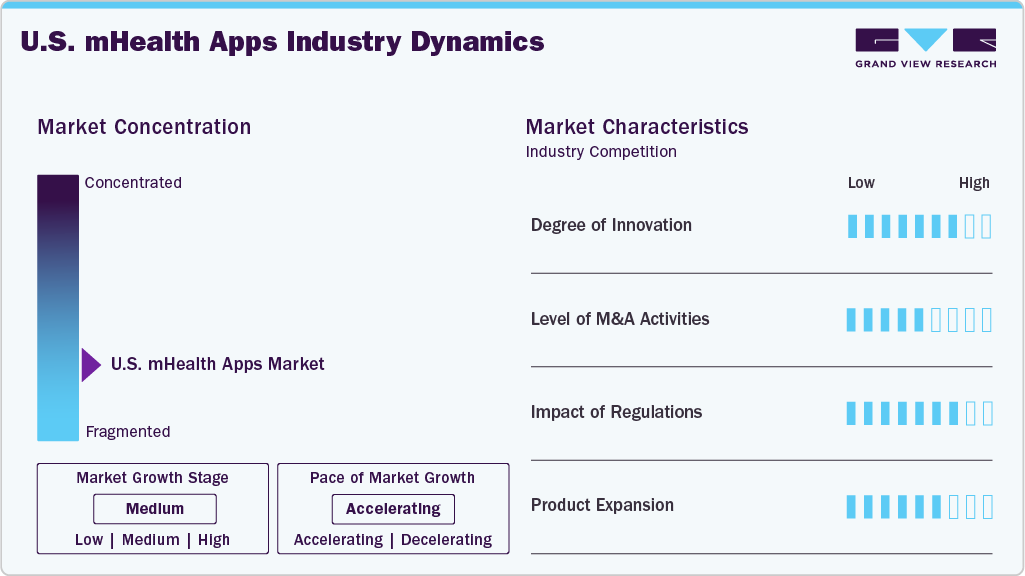

Market Concentration & Characteristics

The degree of innovation in the U.S. mHealth apps market is high, driven by rapid advancements in mobile technology, artificial intelligence, and data analytics. Developers are continuously introducing apps with enhanced features such as real-time health monitoring, personalized health recommendations, AI-powered diagnostics, and integration with electronic health records and wearable devices. For instance, in February 2025, Owens & Minor launched the ByramConnect digital health app in the U.S. to support patients with diabetes and other chronic conditions through personalized education, remote monitoring, and care coordination tools to improve health outcomes.

The level of mergers and acquisitions in the U.S. mHealth apps market is moderate as companies seek to strengthen their technological capabilities, expand user bases, and enter new healthcare segments. Larger digital health firms and tech giants are acquiring smaller, specialized startups to integrate niche solutions such as mental health support, chronic disease management, and AI-driven diagnostics into their platforms. These M&A activities are also driven by the need to offer end-to-end healthcare solutions that combine remote monitoring, telehealth, and digital therapeutics.

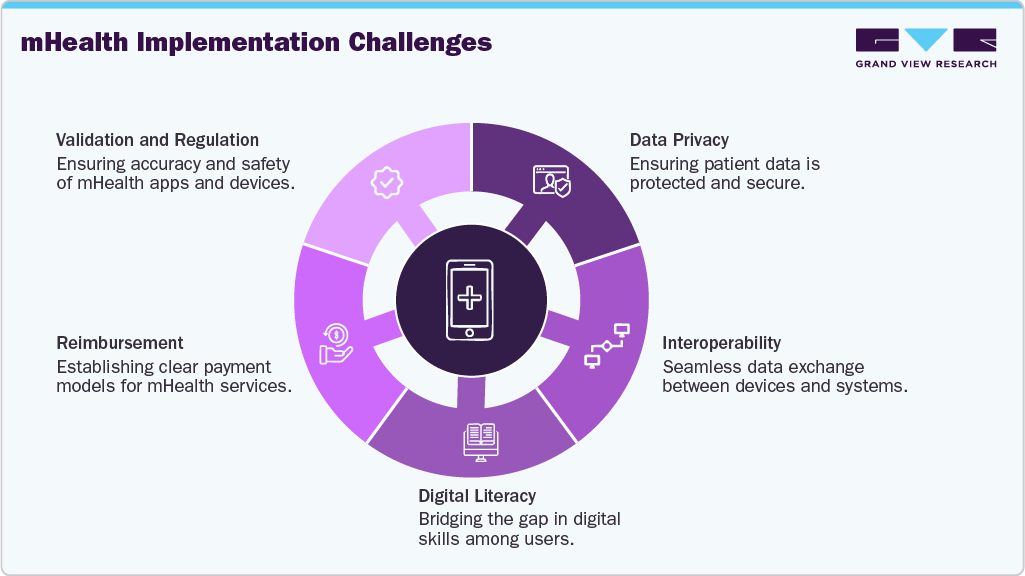

Regulatory frameworks in the U.S. have significantly shaped the mHealth apps market, both by encouraging growth and imposing necessary safeguards. Initiatives such as the 21st Century Cures Act and HIPAA compliance requirements have established standards for data privacy, interoperability, and secure information exchange. These regulations have increased consumer trust in mHealth solutions while ensuring patient safety and confidentiality.

Product expansion in the U.S. mHealth apps market is moderate as companies diversify their app portfolios to include a wider range of health services such as fitness tracking, mental wellness, medication reminders, chronic disease support, women’s health, and lifestyle coaching. This broadening of offerings helps companies cater to specific user needs and promote long-term user engagement. Integration with wearable devices, telehealth platforms, and AI-based analytics tools also enhances the value proposition of these apps. For instance, in April 2025, Olis Robotics launched its USD 499 Android-based diagnostic tool in the U.S., transforming smartphones and tablets into remote automation-cell gateways, offering real‑time video, telemetry, error‑recovery, and predictive maintenance without additional hardware.

Type Insights

Based on types, the medical apps segment dominated the market with a revenue share of 71.74% in 2024 and is expected to grow at a significant CAGR over the forecast period. This growth is attributed to the rising demand for remote patient monitoring, chronic disease management, and teleconsultation services, especially due to growing healthcare consumerism and physician shortages. Medical apps offering features such as symptom tracking, medication reminders, electronic health record access, and virtual doctor visits have become integral to modern care delivery. For instance, in April 2025, U.S.-based Trellis Health introduced a D2C pregnancy app aiding mothers during birth and beyond. The app enables users to access medical records, predictive symptom tracking, in-app nurse‑midwife chat, and appointment prep tools.

Moreover, the increasing integration of artificial intelligence, real-time analytics, and wearable connectivity within these apps has enhanced clinical decision-making and patient engagement. The growing focus on personalized, accessible, and preventive healthcare further supports the dominance of medical apps in the U.S. mHealth market.

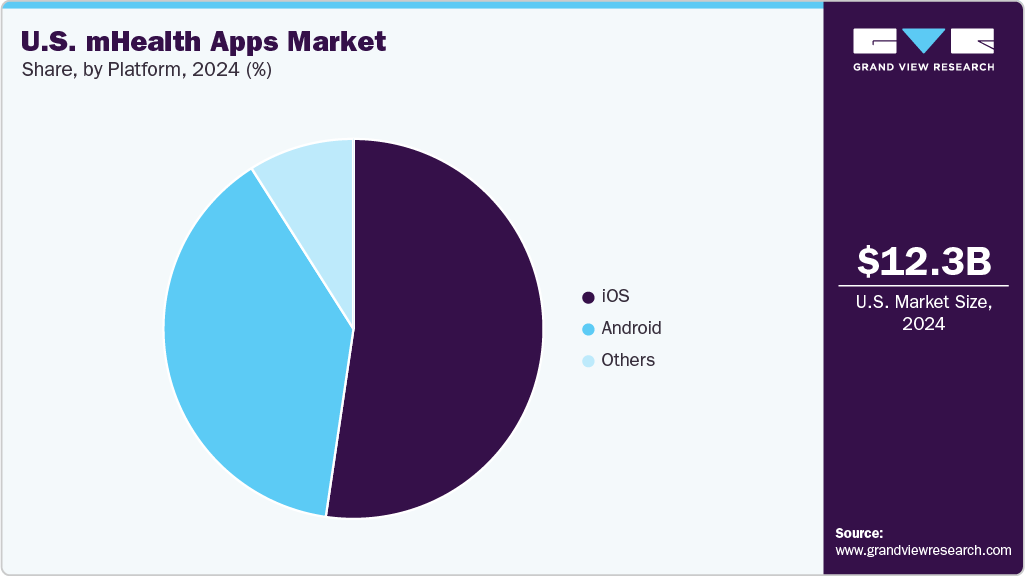

Platform Insights

Based on platform, the iOS segment dominated the market with a revenue share of 52.33% in 2024, owing to the strong penetration of iOS devices in the U.S. market and the high level of consumer trust in the security and reliability of the iOS ecosystem. Apple’s HealthKit and seamless integration with Apple Watch and other health-focused features have made the platform particularly appealing to users and developers. As of the first quarter 2024, approximately 54,546 health apps were available on the iOS App Store worldwide. Moreover, the iOS App Store maintains strict quality control and privacy standards, attracting premium health app developers and ensuring a consistent user experience. The platform’s widespread adoption among healthcare professionals and tech-savvy consumers has further contributed to its leadership in the mHealth apps market.

The Android segment is anticipated to grow at a significant CAGR over the forecast period. This growth is due to the widespread adoption of Android smartphones across diverse population groups, including cost-sensitive users, which expands the accessibility of mHealth apps. The open-source nature of the Android platform allows developers greater flexibility and faster innovation, leading to a broader range of health applications. In addition, increasing partnerships between Android-based device manufacturers and healthcare providers are driving the development of advanced features such as real-time monitoring, teleconsultation, and integration with wearable devices. As healthcare demand rises across all demographic segments, the scalability and affordability of Android devices position the platform for substantial growth in the U.S. mHealth market.

Key U.S. mHealth Apps Company Insights

Key players operating in the U.S. mHealth Apps Market are actively adopting strategic initiatives to enhance their market footprint and expand their service offerings across diverse healthcare segments. These initiatives include acquisitions, product innovations, and technology integrations to improve patient engagement, remote monitoring, and chronic disease management.

Key U.S. mHealth Apps Companies:

- Apple Inc.

- Google Inc.

- AirStrip Technologies, Inc.

- Veradigm LLC (Allscripts Healthcare Solutions)

- Qualcomm Technologies, Inc.

- AT&T

- Teladoc Health, Inc.

- Abbott

- Johnson & Johnson Services, Inc.

- Pfizer Inc.

- Headspace Health

- WellDoc, Inc.

Recent Developments

-

In June 2025, Apple announced plans to integrate an AI-powered “doctor” into its revamped Health app, offering virtual health coaching, personalized nutrition and fitness guidance, and food tracking.

“If you zoom out into the future, and you look back, and you ask the question, ‘What was Apple’s greatest contribution to mankind?’ it will be about health.”

-Tim Cook, CEO, Apple

-

In March 2025, U.S.-based Emagine Solutions Technology integrated its Journey Pregnancy App with Epic’s EHR system. The upgrade enabled patients to share real-time vitals, such as blood pressure, glucose, symptoms, and mood, with providers, enhancing maternal care coordination and safety.

“The US is facing a maternal health crisis. A reported 1 in 6 babies in maternity care deserts are not receiving adequate prenatal care, and our own studies show that women are abandoning pregnancy apps, frustrated by a lack of useful features. People need technologies to make pregnancy care safer and at a lower cost with improved outcomes. By integrating with EPIC, we will be able to further our mission to make pregnancy safer while bridging these untenable gaps in care.”

-Courtney Williams, Co-founder and CEO, Emagine Solutions Technology.

-

In June 2024, Cleveland Clinic and FitNow (US) launched the Cleveland Clinic Diet app, featuring fitness tracking, evidence-based coaching from doctors, nutritionists, and behavior specialists, plus AI-enhanced food logging, tailored BodyGuard or HeartSmart plans, and health education.

“We know that health is about far more than just weight. The goal of the Cleveland Clinic Diet app is to approach each individual’s health status and goals beyond the numbers on the scale. We aim to help individuals overcome barriers and support them in creating lasting improvements in their health. We consider their individual needs and preferences to both look and, importantly, feel their best.”

-Julia Zumpano, RD, LD, is a registered dietitian at the Cleveland Clinic’s Center for Human Nutrition.

U.S. mHealth Apps Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2033

|

USD 32.41 billion

|

|

Growth rate

|

CAGR of 11.16% from 2025 to 2033

|

|

Actual data

|

2021 – 2024

|

|

Forecast data

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Type, platform

|

|

Country scope

|

U.S.

|

|

Key companies profiled

|

Apple Inc.; Google Inc.; AirStrip Technologies, Inc.; Veradigm LLC (Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; AT&T; Teladoc Health, Inc.; Abbott; Johnson & Johnson Services, Inc.; Pfizer Inc.; Headspace Health; WellDoc, Inc.

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. mHealth Apps Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the U.S. mHealth apps market report on the basis of type, and platform:

-

Type Outlook (Revenue, USD Million, 2021 – 2033)

-

Medical Apps

-

Women’s Health

-

Chronic Disease Management Apps

-

Obesity Management Apps

-

Mental Health Management Apps

-

Diabetes Management Apps

-

Blood Pressure and ECG Monitoring Apps

-

Cancer Management Apps

-

Other Chronic Disease Management Apps

-

-

Personal Health Record Apps

-

Medication Management Apps

-

Diagnostic Apps

-

Remote Monitoring Apps

-

Others (Pill Reminder, Medical Reference, Professional Networking, Healthcare Education)

-

-

Fitness Apps

-

-

Platform Outlook (Revenue, USD Million, 2021 – 2033)

Frequently Asked Questions About This Report

b. The U.S. mHealth apps market size was estimated at USD 12.33 billion in 2024.

b. The U.S. mHealth apps market is expected to grow at a compound annual growth rate of 11.16% from 2025 to 2033 to reach USD 32.41 billion by 2033.

b. Based on types, the medical apps segment dominated the market with a revenue share of 71.74% in 2024, owing to the rising demand for remote patient monitoring, chronic disease management, and teleconsultation services, especially due to growing healthcare consumerism and physician shortages.

b. Some of the key players include Apple Inc.; Google Inc.; AirStrip Technologies, Inc.; Veradigm LLC (Allscripts Healthcare Solutions); Qualcomm Technologies, Inc.; AT&T; Teladoc Health, Inc.; Abbott; Johnson & Johnson Services, Inc.; Pfizer Inc.

b. The growing penetration of smartphones & internet connectivity and rising adoption of mHealth technologies by physicians & patients are factors driving segment growth.