Federal Reserve Chair Jerome Powell’s cautious stance on further easing overnight, caused the greenback to surge from its lowest point in nearly a week on Wednesday.

•

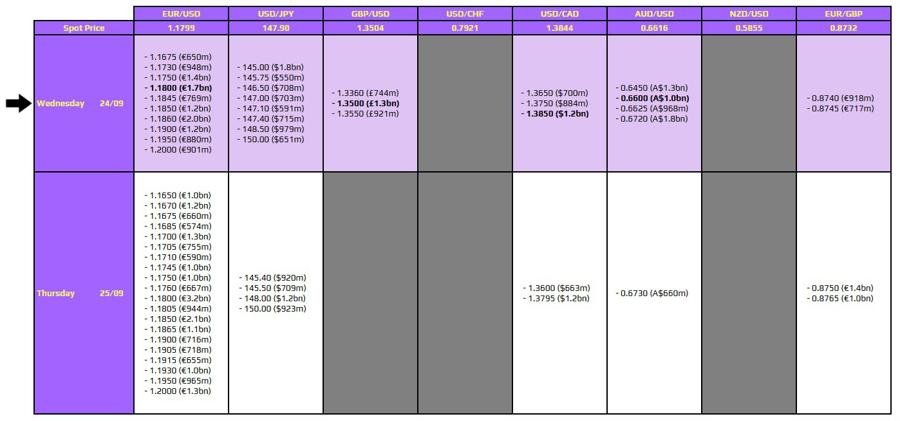

Last updated: Wednesday, September 24, 2025

Quick overview

- Federal Reserve Chair Jerome Powell’s cautious approach to further easing led to a rebound in the US dollar.

- The US dollar index rose 0.1 percent to 97.361 after hitting a low of 97.198.

- Markets are anticipating quarter-point rate cuts at the remaining Fed meetings this year and another in early 2026.

- Powell emphasized the need to balance high inflation risks with a weakening labor market in future policy decisions.

Federal Reserve Chair Jerome Powell’s cautious stance on further easing overnight, caused the greenback to surge from its lowest point in nearly a week on Wednesday.

The US dollar index, which compares the currency to six major rivals, increased 0.1 percent to 97.361 in an effort to regain some ground following two consecutive losing sessions that saw the currency hit its lowest level since Thursday at 97.198 overnight.

The markets are pricing in quarter-point rate cuts at the two Fed policy meetings remaining this year. In the first quarter of 2026, another cut is anticipated, which roughly corresponds with Fed officials’ projections after a quarter-point cut on Wednesday of last week.

Powell reiterated last week’s remarks on Tuesday, saying the central bank must continue to balance the conflicting risks of high inflation and a faltering labor market in future policy decisions. He described the policy conundrum as “a difficult circumstance.”.

Powell admitted that there were no risk-free policy options, cautioning that much monetary restriction could unnecessarily harm job prospects and that much easing could further entrench inflation.

Olumide Adesina

Financial Market Writer

Olumide Adesina is a French-born Nigerian financial writer. He tracks the financial markets with over 15 years of working experience in investment trading.