Source: Leverage Shares analysis

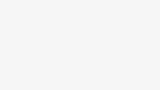

While the Taiwan-listed ticker soared before moderating in the present week, the U.S.-listed ticker (wherein each ADS comprises of 5 ordinary shares) showed a distinctly bearish flavour. The factors behind this are directly related to the outlook on AI chip buy-ins as well as the ongoing U.S.-China trade tensions. Trend Analysis

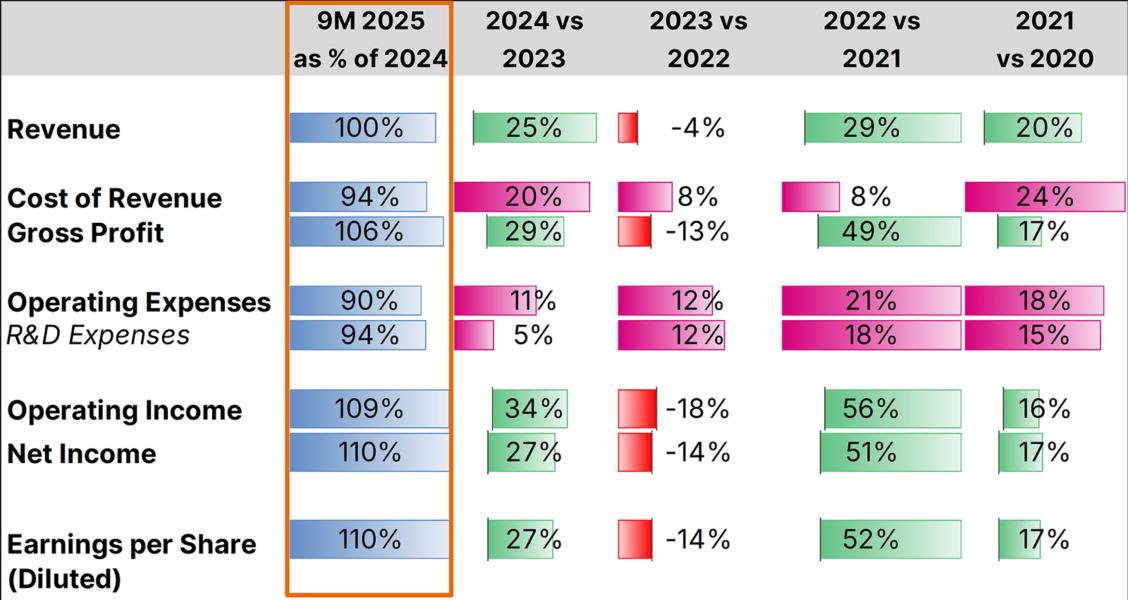

Taiwanese investors weren’t entirely unjustified, as trends in the year till date indicate relative to the previous FY. As of the first nine months (“9M”) of the current FY, revenues already equal that made in FY 2024.

Source: Company Information; Leverage Shares analysis

Meanwhile, cost of revenue – as well as research and development (R&D) expenses – is running at a slight discount relative to previous FY.

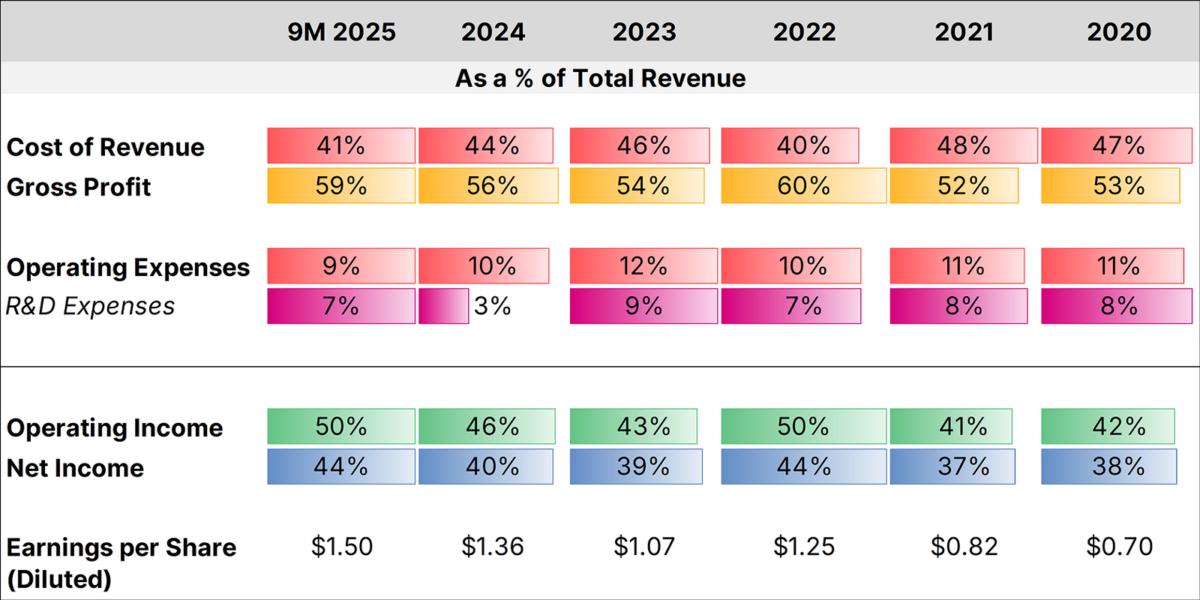

However, this isn’t exactly a repeat of the previous FY’s performance. If current trends continue, earnings per share is trending towards a 13-14% increase over the previous FY while revenue would be 33-35% higher. In the previous FY, a lower growth in revenue had resulted in a higher unlocking of earnings.

This was likely one factor behind the U.S.-listed ticker that is generally considered to be a “high-conviction” name in the midst of the ongoing AI Hype enveloping major tech stocks. Without a high rate of growth in the bottom line evident in trends, some of this conviction is likely faltering among many U.S.-based investors.

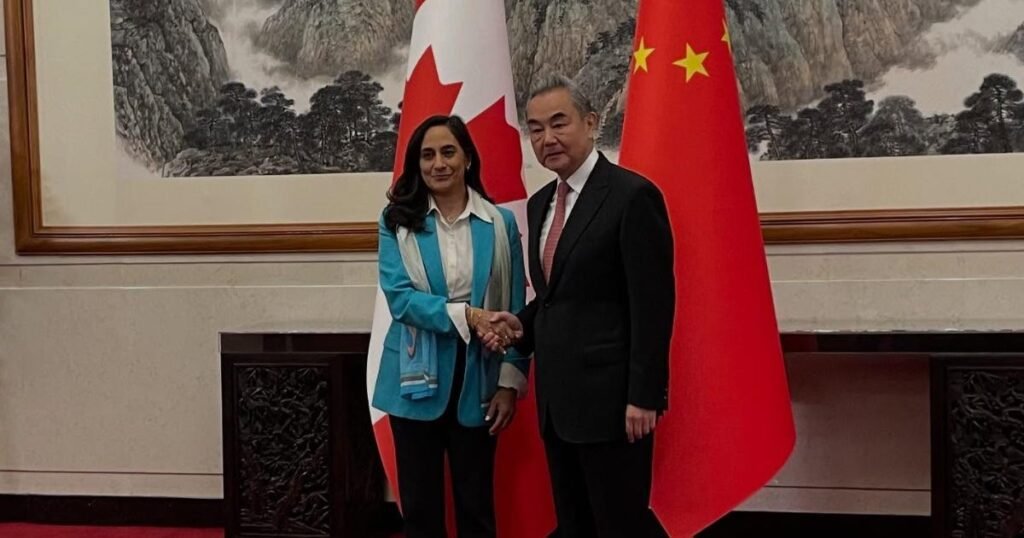

The second factor is the ongoing China-U.S. trade dispute. TSMC’s China Exposure

The ongoing dispute over trade between the U.S. and China is another layer on top of long-standing allegations made over the years in the U.S. legislature on a bipartisan basis over Chinese firms essentially stealing U.S.-developed technology. This has led to restrictions on both the export of advanced chips as well as advanced chipmaking technology for a number of years.

While the likes of American chipmaker Nvidia and Dutch chipmaking tool manufacturer ASML adapted to the restrictions by selling less advanced technology to Chinese clients, this year has seen a ratcheting up of pressure to restrict exports even more. Earlier in the month, the Dutch government seized control1 of Nexperia, a Chinese-owned chipmaker based in the Netherlands on grounds of “serious governance shortcomings”. China-based Wingtech – Nexperia’s parent company – has been on the U.S. government’s watchlist as a “national security concern” since December 2024.

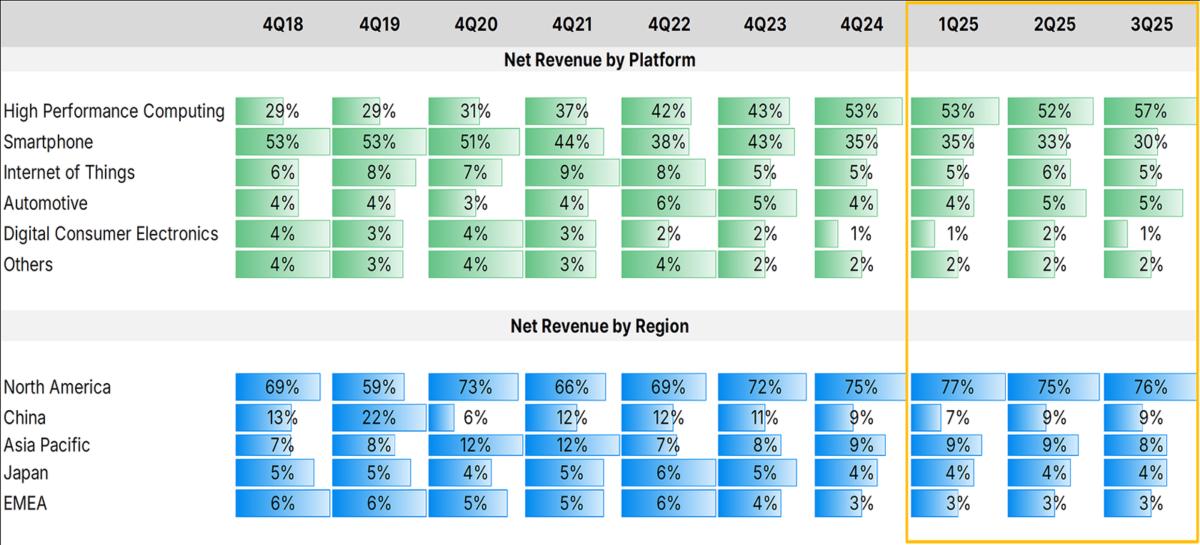

The restriction of technology exports to China forms the crux of a key conundrum from TSMC. From Q4 2018 through Q3 2025, smartphones have gone down from 53% to 30% of the company’s revenue. The company stated in its earnings that advanced technologies – denoting the company’s current 3-nanometer, 5-nanometer and 7-nanometer process nodes – typically used in AI-relevant computing and datacenter applications now accounted for 74% of its total revenue.

Source: Company Information; Leverage Shares analysis

Juxtaposing this with the fact that high performance computing is marked as accounting for 57% of revenue suggests that advanced technologies are also employed in a fair portion of smartphone-related products.

From Q4 2018 through Q3 2025, China and Asia-Pacific has stayed nearly the same at around a net 19-20% share of revenue. The current trade and technology tensions brings to the fore products from Nvidia – a major client of the company and the possibility of restrictions being circumvented through re-exports. Earlier this month, U.S. and Singaporean authorities have opened a probe2 into Megaspeed, a Singapore-headquartered cloud provider that was spun out of a China-based gaming company in 2023, bought nearly $2 billion worth of Nvidia’s most advanced products (likely manufactured by TSMC) through its Malaysian subsidiary. Despite Nvidia stating that its inspections found nothing out of place within Megaspeed, authorities reportedly suspect that this might have been an attempt to circumvent the ban on exports to China.

The export ban brings to the fore another potential concern for the company. In an interview with Citadel Securities on the 14th of October, Nvidia CEO Jensen Huang stated3 that U.S. technology export restrictions took Nvidia’s position in the AI infrastructure market in China from a 95% market share to 0%. Meanwhile, China-based Huawei’s Ascend 910C and 920 are designed and being positioned as direct competitors and substitutes for Nvidia’s H100 and H20 chips respectively. Reports suggest4 that the 910C uses components from TSMC, Samsung and SK Hynix sourced at an earlier date and put together by Chinese companies like SMIC. Details are still cloudy on the provenance of the newer 920 chips.

If China’s new chips require components sourced from TSMC, this is a potential red flag for TSMC. While the company’s foundries producing components being used by Huawei and SMIC are likely based in Taiwan, TSMC has also received $11.6 billion in U.S. government funding5 for its $65 billion buildout of chipmaking facilities in Arizona. Like Nvidia, TSMC lies square in the crosshairs of both belligerents in the U.S.-China dispute.

This dispute also foretells substantial risks worldwide that would potentially affect the conviction behind the stock.Upending Global Convictions

Over the past week, a significant amount of media attention was brought to bear on the news that TSMC’s Arizona facilities have begun production6 of the wafers for Nvidia’s Blackwell AI chips and likely promoted the idea among commentators that the global dominance of American manufacturing is within grasp. However, this may not be the case. In 2022, Morris Chang – the 92-year-old MIT “triple-graduate” founder of TSMC who retired as the company’s chairman in 2018 – flatly stated7 that America’s attempt to grow its domestic chip production will be “a wasteful, expensive exercise in futility” and that the company has the data to prove it, thanks to 25 years of manufacturing experience from its plant in Oregon. Manufacturing in the US have been proven to be simply prohibitive – with multiple arrangements of American and foreign employees to staff its Oregon plant, but without much reduction in costs. He explained that the decision to build the Arizona facility was done at the urging of the U.S. government. However, given the high per-unit cost increase relative to production elsewhere, it will be hard for U.S. chip manufacturers to compete internationally.

Currently, the company’s cost of revenue and net income as a proportion of revenue is respectively at the lowest and highest levels seen since 2020:

Source: Company Information; Leverage Shares analysis

By relying on subsidies, TSMC might be able to offset the cost of manufacturing in the U.S. to meet some portion of domestic demand for some time. But it would need to continue to manufacture in volume and at high cost efficiencies elsewhere to pay off the debt it has raised to establish and operate the U.S. facilities (and which weren’t covered by U.S. grants and subsidies).

One key factor of consideration among investors as to whether a company can be “high-conviction” is their potential for maintain high growth rates. Since no single region can be expected to be in perpetual growth, this necessitates that the company have global exposure, i.e. be able to sell in different markets around the world. Trump’s Season 2 in the U.S. political arena effectively upends this narrative.

While the administration’s near-daily remonstrations over trade imbalances might be politically useful for Trump’s base in the electorate, it conveniently denies the fact that the current state of trade historically played a large hand in easing access to goods and services at reasonable prices for that very same electorate (and other citizens). Meanwhile, U.S.-based companies had substantial allowances granted for entering markets all over the world. The administration’s tariff tantrums provide a precedent for behaviour by subsequent administrations: today, it’s China and Russia, tomorrow might be India and the European Union’s turn. The day after, it might be Japan and South Korea. Then, it might be Taiwan and Canada’s turn. And after that might be Latin America and the ASEAN economies, and so forth.

For these other members of the global marketplace, there is now enormous incentive to shoulder the high cost of decoupling when previously there was none. Given the near centrality of semiconductors to the modern economy, a dozen TSMCs and Nvidia’s as well as a half-dozen ASMLs could (or will) soon begin to bloom all over the world.

For the denizens of the world outside of the U.S., a diversity of choices will be the best outcome in the geopolitical sense. But for the long-term outlook for the stock of the likes of TSMC, it isn’t – despite the best efforts of TSMC’s C.C. Wei and Morris Chang as well as even Nvidia’s Jensen Huang. The fact remains that TSMC (and, for that matter, Nvidia) is increasingly and more inextricably linked to the fortunes of the U.S., which doesn’t necessarily bode well for its position in the world at large and for the global conviction its stock enjoys.

Footnotes:

- “Dutch government takes control of China-owned chip firm”, BBC News, 14 October 2025

- “Singapore police probe Nvidia customer Megaspeed over alleged China export violations”, CNBC, 10 October 2025

- “Jensen Huang says Nvidia went from 95% market share in China to 0%—‘I can’t imagine any policymaker thinking that that’s a good idea”, Forbes, 19 October 2025

- “Huawei Used TSMC, Samsung, SK Hynix Components in Top AI Chips”, Bloomberg, 3 October 2025

- “TSMC Gets $11.6 Billion in US Grants, Loans for Chip Plants”, Bloomberg, 8 April 2024

- “The Engines of American-Made Intelligence: NVIDIA and TSMC Celebrate First NVIDIA Blackwell Wafer Produced in the US”, Nvidia Newsroom, 17 October 2025

- “Growing US chip output an ‘expensive exercise in futility’, warns TSMC founder”, The Register, 20 April 2022