(Bloomberg) — As Donald Trump’s trade policies deal a punishing blow to steelmakers across the world, countries including Mexico, Brazil and Canada are fighting back — but the US isn’t their only target.

While the three nations are each seeking to negotiate with the Trump administration to reduce the tariffs of as much as 50% imposed in June on steel imported into the US, they’re also focused on boosting local demand to offset the drop in exports. That means blocking the rising tide of cheap Chinese supply that threatens to push local producers out of their home markets.

Most Read from Bloomberg

Mexico announced a plan this month to raise tariffs on products from China, including steel, to as much as 50%. Canada has also implemented protectionist measures, and in Brazil, steel producers are calling on the government to impose further trade barriers to foreign supply. Together, the three countries accounted for 38% of US imports of the alloy in July and about half last year.

“We need swift and effective trade defense measures,” Marco Polo de Mello Lopes, the head of industry group Instituto Aco Brasil, said at a conference last month. Chinese steel now accounts for 65% of the Brazilian import market, he added. “The big challenge is to win back the one-third of the market we lost to predatory imports.”

China began a trade and investment barrier investigation into Mexico’s measures on Thursday, according to a statement from China’s Ministry of Commerce. The probe is expected to end within six months, although it can be extended for up to three months.

The moves to halt Chinese steel imports could help the three countries’ negotiating position with the US. Trump’s tariffs on US neighbors in the Americas come as his administration wages a broader trade war against the world’s second-largest economy, aimed in part at stemming the flow of inexpensive Chinese goods to countries around the world. Chinese steel accounted for more than half of the global steel market last year, according to data from the World Steel Association.

But the shift toward more protectionism in the Americas — a reversal from decades of globalization and close cross-border ties in the region — may not convince Trump to budge. While some countries have won tariff cuts and exemptions for certain goods, the US president has cast duties on steel as key to protecting national security and boosting domestic production of the alloy. His trade policies are bolstering the steel industry in the US while pummeling producers abroad, reshaping supply chains as companies scramble to avoid hefty levies on inputs and exports.

A spokesperson for the Office of the US Trade Representative didn’t respond to requests for comment.

Since Trump announced the steel tariffs, volumes sent from Canada and Brazil to the US have plunged. US imports from the countries tumbled 45% and 27%, respectively, in July versus a year earlier, US Census Bureau data show. Mexico has yet to feel the full impact of the levies due to inventories, with steel shipped to the US rising 50% in July.

Still, the damage across industries in Mexico, Canada and Brazil has already been widespread.

Algoma Steel Group Inc., which operates a large mill in Ontario, is halting steel shipments to the US, the company’s top executive told Bloomberg News. Rail operator Canadian Pacific Kansas City Ltd. has also been forced to stop its cross-border steel shipments, accounting for 41% of its revenue in metals, minerals and consumer products. And Brazil’s Gerdau SA canceled its plans to invest some $600 million in a new steel mill in Mexico.

While some US steel consumers are tapping into inventories to soften the blow of reduced supply or have been protected under contracts signed prior to tariffs, next year could prove more difficult as stored product is depleted and foreign steel becomes too expensive.

In the first half of the year, nearly $750 million in projects were canceled by Mexico’s seven largest steel companies, and at least 4,000 direct jobs were lost, said a person with knowledge of the matter, requesting anonymity because the information isn’t public. Mexico’s steel demand dropped 8.1% over that period, data from the National Chamber of the Iron and Steel Industry, known as Canacero, shows.

The steel association welcomed efforts by the Mexican government to curb Chinese steel with higher tariffs. “It is essential to have measures that defend Mexican production, promote competitiveness, and protect employment,” Canacero said in a September statement.

Although the headline tariff on steel is 50%, countries actually have a lower effective rate. For iron and steel in July, it’s below 30% for Canada, Mexico and Brazil, according to data compiled by Bloomberg, which is calculated to include negotiated exemptions. Mexico and Canada are relatively shielded thanks to a carve-out for metal that is “melted and poured” in the US, as well as exemptions from other tariffs on the non-metal content of these products, according to Bloomberg Economics.

The US remains a net steel importer, and it will need to keep buying foreign steel unless the domestic industry expands on a massive scale. The ultimate fate of Trump’s tariffs, meanwhile, remains uncertain after the Supreme Court agreed to hear arguments on whether the duties are legal.

But in the near term, protectionist measures aimed at China are proliferating as steelmakers in the Americas reel from Trump’s levies.

In addition to Mexico’s tariff hikes on Chinese steel, its government is investigating phantom steel mills, operations that exist only on paper in Asia and serve as a cover for foreign imports as the owners seek to evade tariffs or sanctions. The government has already stopped imports from more than a thousand of these fake steel mills, of which 40% were linked to China, 10% to India and 6% to Iran, Luis Rosendo Gutiérrez Romano, Mexico’s deputy economy minister for trade, said in an August interview.

Canada has placed 25% tariffs on Chinese steel and in July tightened its tariff-rate quotas — which impose higher duties on amounts above a certain level — to further limit imports from non-US partner countries. The government also added a 25% surtax on steel products from any country, except for the US, that contain steel melted and poured in China.

Companies contracting with the Canadian government will also be required to source steel from domestic producers as the country boosts its military, infrastructure and housing spending. Still, many Canadian steelmakers will have to pivot to new manufacturing areas — Canada isn’t a beam producer, for example, while it has too much capacity in steel coils used in variety of products such as cars.

The Canadian government has put forward financial support such as a C$1 billion ($727 million) initiative to help steelmakers with investment projects, and Canada is examining additional measures, Industry Minister Melanie Joly told Bloomberg News last month. She also highlighted the deal between Sweden’s Swebor Stal Svenska AB and Canadian armored vehicle maker Roshel Inc. to produce ballistic-grade steel at a new facility.

Brazil, meanwhile, is investigating whether anti-dumping tariffs are needed on imports of 25 types of steel products from China. The government has implemented a tariff-rate quota system to limit imports of some steel products and support local steel mills — a measure that the industry considers ineffective.

In a speech in late July, Zhao Minge, the chairman of the China Iron & Steel Association, warned of potential protectionist measures from countries inundated with Chinese steel. The large-scale export of “low value-added primary steel products” doesn’t align with China’s export policies, he said.

If major steel importers to the US find “their shipments to the US are blocked, then to balance their own domestic steel supply and demand, they will reduce imports from China,” he said.

But protectionist moves may not be enough to move the needle for steelmakers in the Americas, some analysts and industry executives say. In Canada, the cross-border steel trade has effectively stopped and the industry said it had cut close to 1,000 jobs.

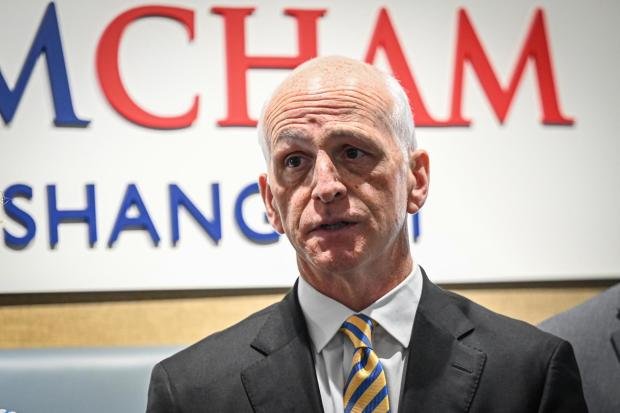

Algoma, one of Canada’s largest steel producers, is jettisoning its US business on the assumption that Trump’s tariffs are going to be in place for the near- to medium-term, Chief Executive Officer Michael Garcia said in an interview earlier this month. The company is in “very advanced discussions” with the Canadian government for a C$500 million federal loan to curb mounting losses, he added.

“We’ve found it impossible to hold on to our US business,” which is about 60% of Algoma’s book, he said.

The Canadian market is facing a glut of foreign supply, which accounts for about 65% of the steel sold in the country, Garcia said. Algoma is trying to replace as much of the US business as possible “with domestic business, but we’re finding it very, very challenging given the dynamics of the Canadian market,” he said.

Brazil, too, is under significant pressure as US tariffs prompt China to redirect its supplies. Luxembourg-based multinational steel manufacturer ArcelorMittal SA could delay its plans for a newly planned plant in Brazil, according to the head of its Brazil operations, Jorge Oliveira. “Investment risk exists, and if imports keep rising we may delay,” he said in an interview late last month.

The global trade reshuffle has also forced ArcelorMittal to halt exports of 400,000 tons of steel slabs made in Brazil to Canada, which is now unable to re-export to the US, Oliveira said.

Gerdau Chairman Andre Gerdau Johannpeter warned at a conference in Sao Paulo in August that Brazil’s steel sector is nearing a breaking point, with any additional drop in capacity from its current 66% likely to threaten jobs. “The big question is where the jobs will be — in China or in Brazil?” he said.

A political clash between Brazil and Trump over the treatment of his ally Jair Bolsonaro has dealt a blow to Brazil’s bid for a bilateral deal on steel tariffs. Since Trump slapped 50% levies on Brazilian goods, diplomatic channels between the two countries have gone silent — and talks will only resume once tensions ease, said Lopes, the head of Instituto Aco Brasil.

Barry Zekelman, the billionaire CEO of Zekelman Industries Inc., said in an interview last month that Canadian steel mills won’t survive unless US trade policies change. His company, a Chicago-based steel pipe and tube maker, has a pipe factory in Ontario and owns a stake in Algoma.

Canadian mills “cannot survive with the duties they’re paying,” he said. “They’re going to go out of business if this continues.”

–With assistance from Joe Deaux, Laura Dhillon Kane, Brian Platt, Derek Decloet, Ari Altstedter and Alfred Cang.

(Updates with China investigation in fifth paragraph)

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.