President Donald Trump and Chinese President Xi Jinping spoke Thursday and agreed on a meeting between the two countries, signaling the two nations are resuming recently halted negotiations while the trade war rattles the U.S. and global economies.

In a post to Truth Social, Trump said the 90-minute call “resulted in a very positive conclusion for both Countries.” Trump also said Xi invited him and first lady Melania Trump to China, an invitation Trump returned.

“As Presidents of two Great Nations, this is something that we both look forward to doing,” Trump wrote on social media. He added that the U.S. team would include Treasury Secretary Scott Bessent, Commerce Secretary Howard Lutnick and Jamieson Greer, the United States Trade Representative, with the location and date of the meeting yet to be determined.

Trump also said that imports of rare earth minerals from China would resume shortly, although a readout from Chinese authorities did not mention rare earth minerals.

“The Chinese always keep promises and turn actions into results. Since a consensus has been reached, both sides should abide by it … The U.S. side should look realistically at the progress made and withdraw negative measures taken against China,” Xi told Trump, according to Chinese state broadcaster CCTV.

Chinese state media also claimed that Trump told Xi that Chinese students are welcome to study in the United States.

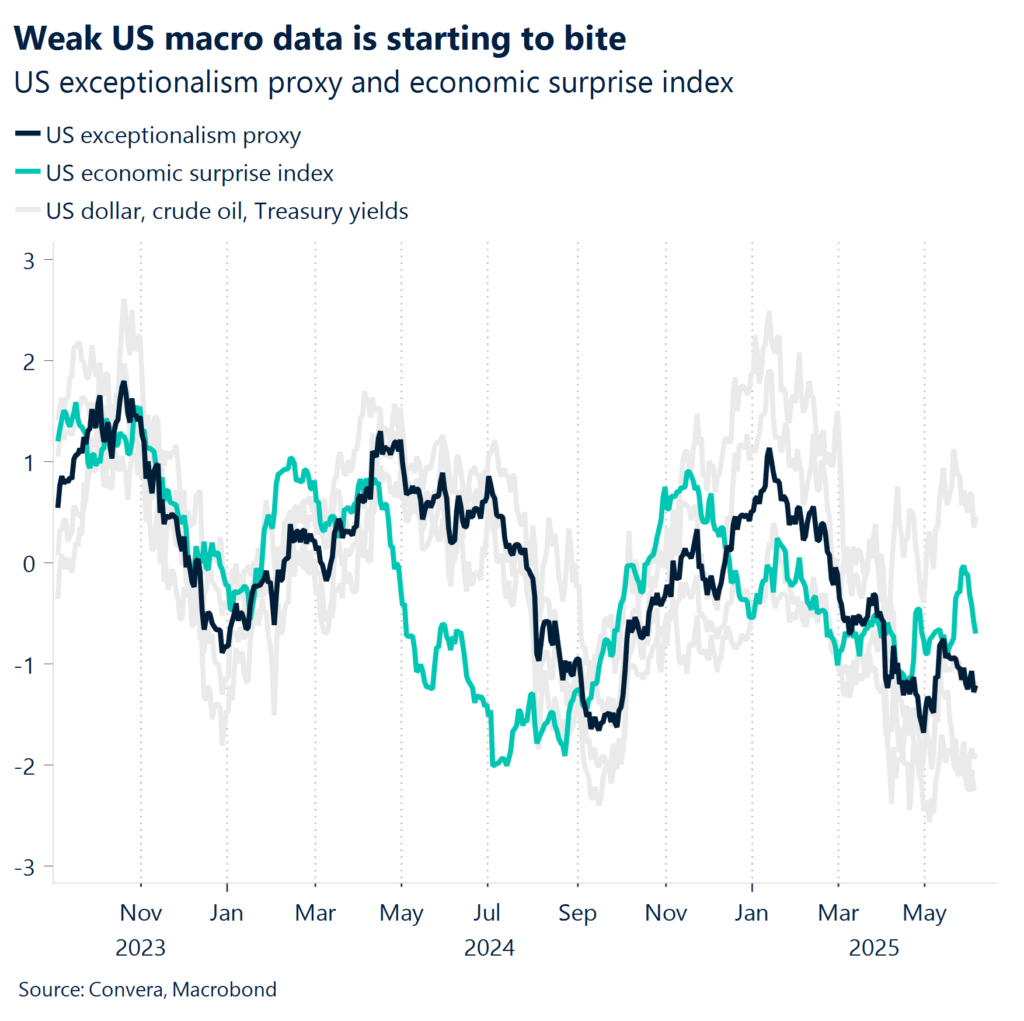

News of the call – first reported by Chinese state media – came as fresh Census data showed the U.S. trade deficit narrowed sharply in April to its lowest level since 2023, as imports plunged and exports ticked up. A 16.3 percent drop in imports, driven by a steep decline in shipments from China, more than offset a modest 3 percent rise in exports to shrink the gap. Imports from China fell to $25.4 billion, the lowest since March 2020, when the pandemic first upended global trade.

U.S. exports to China also tumbled, hitting $8.2 billion – the weakest showing in more than four years.

The overall snapshot reflects how businesses rushed to buy foreign goods in the weeks before sweeping tariffs took hold April 2 but have since halted orders amid so much uncertainty. A 90-day pause was announced in early May, but that move came too late to influence April’s data.

Stocks recovered slightly after Trump’s social media post, with all three major indexes flashing green after a morning of losses. Households, businesses and the nation’s economy are shouldering high tariffs, rising costs and little ability to plan for the future. On Wednesday, tariffs on steel and aluminum doubled to 50 percent. A handful of court decisions have thwarted the White House’s aggressive approach to resetting global trade. And tariff policies – among the hallmarks of Trump’s agenda – often change on a dime.

The White House did not immediately respond to a request for a comment.

Trump and Xi’s call came after Washington and Beijing agreed to lower triple-digit tariffs for 90 days last month, signaling a diplomatic breakthrough and giving the global economy a sigh of relief. The decision lowered U.S. tariffs on many Chinese goods from at least 145 percent to a still-high range of around 40 percent to 60 percent.

But it isn’t guaranteed that the agreement will hold. While there are also ongoing trade negotiations with dozens of other nations that have seen some of their tariffs paused, negotiations with China have proven difficult. Earlier this week, China said the United States had “seriously damaged” terms of a trade agreement through restrictions on Chinese microchips and student visas. That came after Trump repeatedly accused China of violating the agreement, and after Greer took to CNBC to say China had not resumed some exports of rare-earth materials, which are used to make military drones, consumer electronics, battery-powered vehicles and more.

Negotiations appeared to unravel after the Trump administration announced an aggressive clampdown on student visa holders from China, imperiling hundreds of thousands of college students. Trump’s social media post did not weigh in on the student visas and said “the conversation was focused almost entirely on TRADE. Nothing was discussed concerning Russia/Ukraine, or Iran.”

Separately, Xi also warned Trump to be “cautious” in managing the issue of Taiwan, the self-governing island democracy Beijing claims as its territory, and not to allow “Taiwan independence” forces to “drag U.S.-China relations into a dangerous situation of conflict and confrontation,” according to the read out Xi provided Chinese state media.