The Trump administration’s AI Action Plan underscores a strategic pivot to tighten control over advanced artificial intelligence technologies, particularly in curbing the export of sophisticated AI chips to China. The plan, unveiled amid intensifying U.S.-China tech competition, outlines broad goals of maintaining American leadership in AI while addressing the dual-use nature of AI technologies that could bolster national security threats. Central to the strategy is the reinforcement of export controls on critical components, including advanced semiconductors, to prevent adversaries from accessing cutting-edge innovations. However, the plan’s practical implementation remains vague, with critics noting that the lack of detailed mechanisms for enforcement could hinder effectiveness [1].

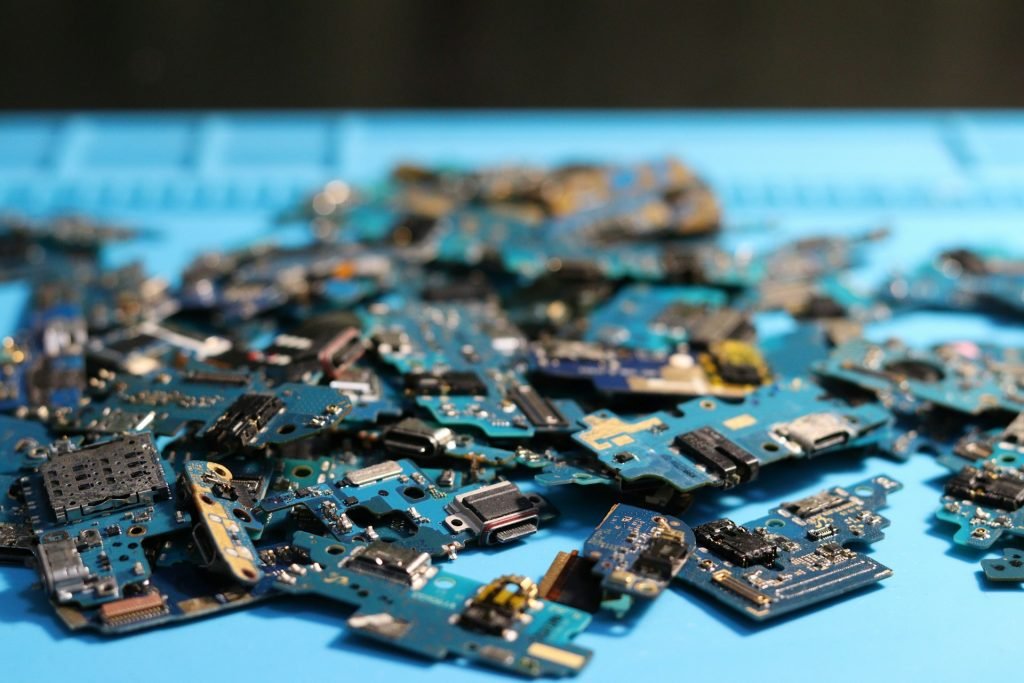

The administration’s focus on “chip location verification” and “component sub-systems” highlights an attempt to address vulnerabilities in the global semiconductor supply chain. By collaborating with industry stakeholders, the U.S. aims to develop features ensuring exported chips are not diverted to unauthorized users. Simultaneously, the plan seeks to expand export restrictions to sub-systems—smaller but vital parts of chip manufacturing—that are currently less regulated. This shift reflects an understanding of the intricate, globalized nature of semiconductor production, where a single chip’s creation involves multiple countries and suppliers [2].

A critical element of the strategy is securing global alignment with allies. The administration warns of potential economic penalties, such as secondary tariffs, for nations that fail to adopt U.S. export control standards. The Foreign Direct Product Rule (FDPR), a tool allowing the U.S. to restrict foreign-produced goods reliant on American technology, is positioned as a lever to enforce compliance. However, achieving consensus among allies remains a significant hurdle, as conflicting economic interests and geopolitical priorities complicate coordinated action. The plan’s reliance on diplomatic persuasion underscores the administration’s recognition that unilateral measures may be circumvented without international buy-in [3].

The semiconductor industry’s complexity further complicates enforcement. Advanced AI chips are inherently dual-use, applicable to both commercial and military applications, making it challenging to distinguish between legitimate and illicit use. The globalized supply chain—spanning design in the U.S., fabrication in China Taiwan, and assembly in Malaysia—adds layers of logistical and regulatory challenges. The administration’s emphasis on targeting supply chain choke points, while innovative, requires unprecedented coordination across nations and companies, a feat that remains unproven [4].

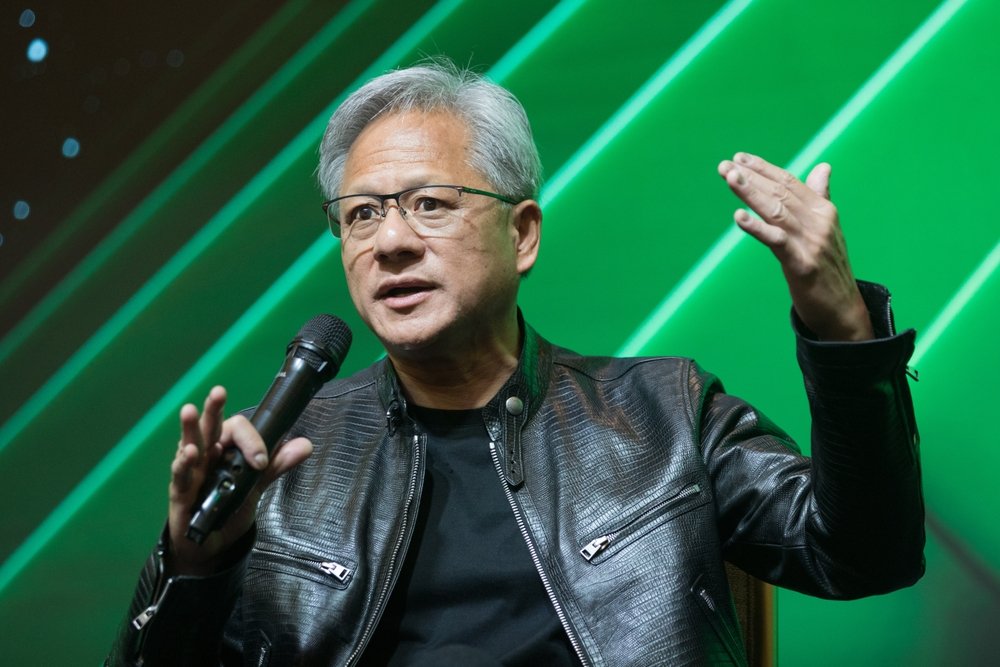

Past policy inconsistencies have raised concerns about the plan’s feasibility. Recent reversals, such as sudden approvals for Nvidia and AMD to sell AI chips to China after prior restrictions, illustrate the volatility of the regulatory landscape. These shifts create uncertainty for businesses, which must navigate rapidly changing rules that impact investment decisions and long-term planning. The rescission of the Biden-era AI Diffusion Rule further highlights the administration’s fluid approach, raising questions about policy continuity and the clarity of its strategic vision [5].

While the plan sets ambitious goals, it lacks granular details on implementing global alliances or coordinating with domestic companies. Instead, it serves as a foundational framework for future policies, with concrete actions likely delayed. The administration’s July 23 executive orders are expected to prioritize convening stakeholders rather than imposing immediate restrictions. This incremental approach acknowledges the technical and diplomatic intricacies involved, though it risks prolonging the development of effective controls [6].

The economic implications of these policies could be far-reaching. U.S. semiconductor companies may face revenue losses from restricted access to Chinese markets, even as they benefit from domestic investment incentives. Meanwhile, global trade friction could fragment the tech ecosystem, slowing innovation as companies adapt to disparate regulations. For sectors like cryptocurrencies, supply chain disruptions or heightened geopolitical tensions might introduce market volatility, affecting investor confidence and infrastructure development [7].

In navigating these challenges, the administration’s success hinges on balancing national security with innovation. Strengthening domestic semiconductor resilience and fostering international collaboration are potential opportunities, yet the path remains fraught with enforcement difficulties and diplomatic tensions. The AI Action Plan’s ultimate impact will depend on its ability to translate broad objectives into actionable, sustainable policies that withstand the complexities of a globalized tech landscape.

Source: [1][2][3][4][5][6][7]

[1] [title1] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

[2] [title2] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

[3] [title3] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

[4] [title4] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

[5] [title5] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

[6] [title6] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

[7] [title7] [https://coinmarketcap.com/community/articles/6881312c439cf10408b23c65/]

![[News] Samsung Reportedly Weighs Carbon Fiber in Next-Gen Foldable Amid China Supply Risks](https://koala-by.com/wp-content/uploads/2025/07/Samsung-Galaxy-Z-Fold-7-20250724-624x351.jpg)