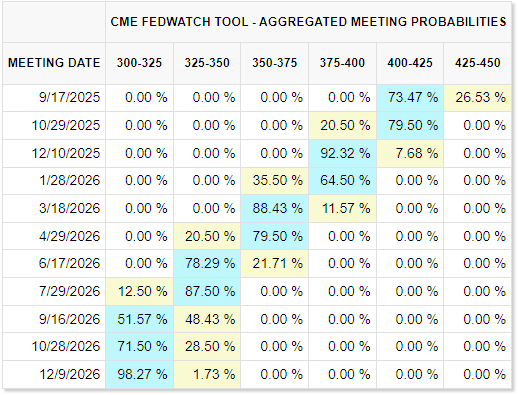

The U.S. Treasury market witnessed a widespread decline on Thursday, as hawkish remarks from Federal Reserve officials influenced investor sentiment. The initial values of indicators measuring August’s business activity exceeded expectations, leading to a sell-off in the market. The Cleveland Fed President stated that the current economic data does not support a rate cut in September, further driving down Treasury yields.

By around 3 PM New York time, yields on the longer end of the curve had risen by nearly 3 basis points, while shorter-term bond yields increased by over 4 basis points, both retreating from their intraday highs. The S&P Global’s initial values for August’s manufacturing, services, and composite PMI indices all surpassed economist forecasts, triggering a morning sell-off in the U.S. Earlier, the increase in initial jobless claims exceeded expectations, causing a brief dip in yields.

Investors are awaiting Federal Reserve Chair Powell’s speech on Friday morning at the Jackson Hole annual symposium to gain clearer insights into the prospects of a rate cut. While signs of weakness in the labor market had previously boosted rate cut bets, inflation remains above the Fed’s target, and financial conditions are generally accommodative.

The Cleveland Fed President noted that if a policy decision were to be made the next day, they would not support lowering interest rates due to elevated inflation levels that have been rising over the past year. This comment pushed U.S. Treasury yields to their intraday highs.

The 30-year TIPS reopening auction saw a strong demand, with the stop-out yield lower than the pre-auction trading level, and other demand indicators also performed well, leading to a narrowing of the decline in Treasury yields.