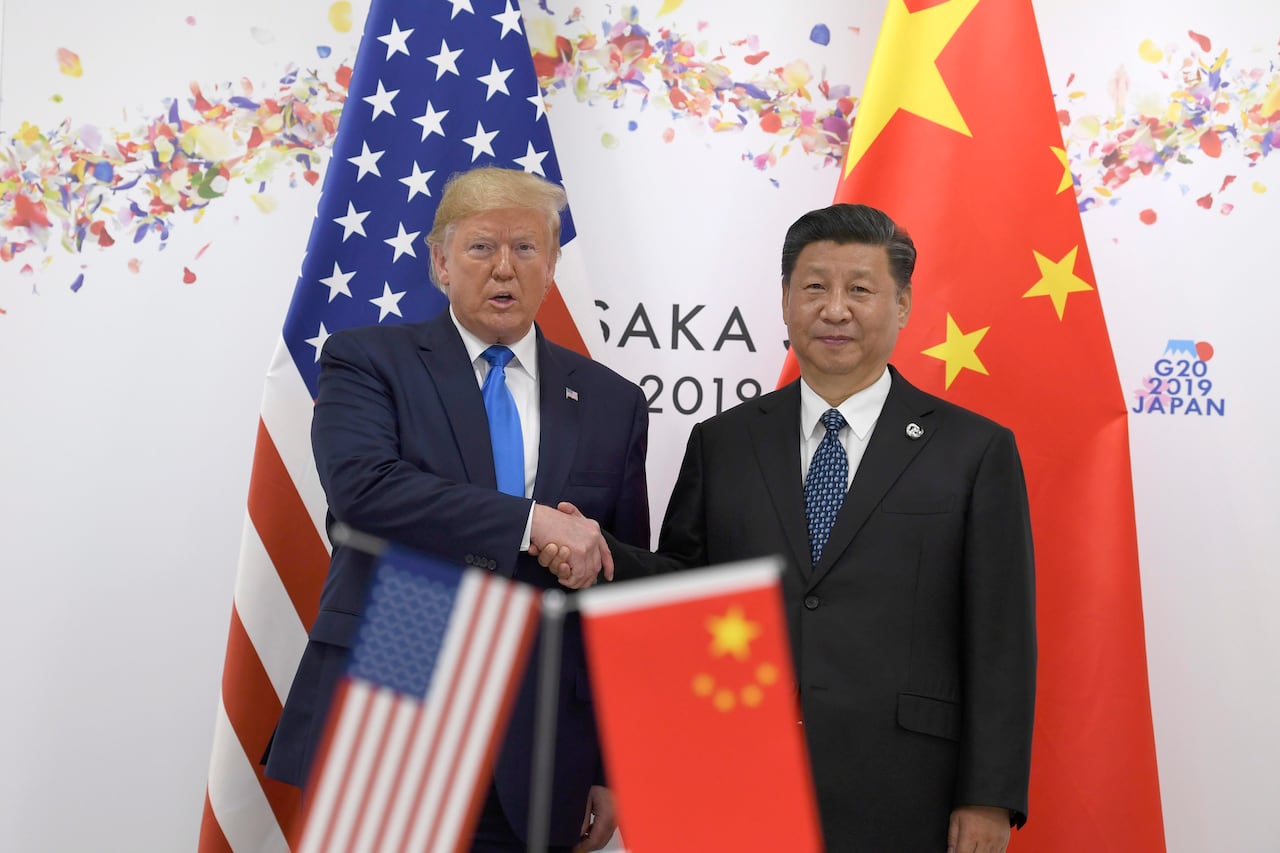

China still has substantial leverage over the U.S. in its dominance of the rare earth minerals market, despite the two countries agreeing to a framework trade deal days before a meeting between U.S. President Donald Trump and Chinese President Xi Jinping.

The meeting between the leaders, the first of Trump’s second term, is set to happen Thursday on the sidelines of the annual Asia-Pacific Economic Cooperation (APEC) summit in Gyeongju, South Korea.

It comes as the world’s two largest economies are embroiled in a trade war that has seen the countries levy tariffs higher than 100 per cent, threatening to rock the global economy — and revealing that China is willing to use its strengths as bargaining chips in the face of increasing economic threats from the White House.

New framework deal

There was, however, optimism that tariffs would be averted just days before Trump and Xi are slated to meet, after top officials from both countries announced a potential trade agreement following months of talks between officials, including in Geneva in May and Madrid in September.

“The tariffs will be averted,” stated U.S. Treasury Secretary Scott Bessent, who, alongside U.S. trade representative Jamieson Greer and Chinese Vice-Premier He Lifeng at the Association of Southeast Asian Nations summit in Kuala Lumpur announced a “substantial framework” for Xi and Trump’s meeting.

“I think we’re going to have a deal with China,” Trump said later.

However, the truce continues to be tenuous, considering the ebbs and flows of the U.S.-China relationship.

“There is a ceasefire going on. It doesn’t mean there’s disarmament,” said Mary Lovely, a senior fellow at the Peterson Institute for International Economics in Washington, D.C.

“These tools will still be available to both sides,” she said, referring to tariffs and using various domestic industries as leverage.

Although the details are still murky, Bessent said the agreement included a “final deal” to transfer TikTok’s U.S operations to new ownership or face a ban, something Trump has delayed several times.

Bessent also said China could resume buying soy beans from U.S. farmers after Chinese orders stopped completely in the trade war.

He suggested the 100 per cent tariff on Chinese imports Trump threatened would not take effect Nov. 1.

But perhaps most importantly, the deal would see China delay its export controls on rare earth minerals for a year — a major pain point for Washington.

U.S. trade war: How China is fighting Trump’s tariffs

China is hitting the U.S. in a vulnerable spot as the trade war escalates between the two. Then, Andrew Chang explains why the math used to determine President Donald Trump’s global reciprocal tariffs is misleading.

For some watchers, the agreement signals an important acknowledgement of the consequences of a blowout.

“It has become increasingly evident that the two top leaders continue to share a pragmatic desire to stabilize the world’s most consequential bilateral relationship,” said Beijing-based Zichen Wang, research fellow at the non-government think-tank Centre for China and Globalization.

He calls that desire a “vital safety valve amid deep structural rivalry.”

‘Room for mischief’

The agreement strikes a careful balance, says Jonathan Czin, the Michael H. Armacost Chair in foreign policy studies at the non-profit Brookings Institute in Washington, D.C.

“It allows both sides to declare victory or enough victory in the run-up to the meeting that you can justify a presidential encounter,” he said.

“There’s also enough ambiguity that leaves room for mischief and further measures.”

Many outstanding issues remain and likely won’t be tackled by Trump and Xi when they meet.

They include trade imbalances, China’s overcapacity, security in the South China Sea and competition in technology.

“I don’t think the U.S. has had the capacity and the bandwidth to negotiate a huge deal with China,” said Rorry Daniels, managing director of the New York-based Asia Society Policy Institute, adding that deals on “smaller” issues might be more likely.

“These are two countries that remain deeply mistrustful of each other,” she said.

‘A very strong leader’

Speculation about a potential face-to-face meeting between the two presidents heightened after Xi formally invited Trump to China during a phone call in June, then again in September.

Unlike his predecessors and the hawks in his administration, the U.S. president has repeatedly flattered his counterpart.

“I get along great with [Xi],” Trump said on Sunday Morning Futures on Fox News on Oct 19. “He’s a very strong leader.”

The last several weeks and months are telling of the current state of the relationship and just how strong a position Xi is in as the two gear up for their meeting.

Early on in Trump’s trade war, China was one of the few countries to threaten retaliatory tariffs — an indicator it thought its economy could withstand the pain.

Rare earth mineral exports

More recently, on Oct. 9, China expanded its export rules on rare earth minerals after months of relative calm in the trade war truce.

Not only did the country threaten to restrict exports, but it also said it would require foreign companies to apply for a licence from the Chinese government to ship magnets with even a trace of rare earths from China or those obtained using Chinese equipment or technology.

“Xi knew that doing this could have potentially jeopardized the [Trump-Xi] meeting, and it’s very telling that he was willing to take that risk,” said Czin with the Brookings Institute.

That’s possible because Beijing has a near-monopoly on the minerals, which are essential to everything from smartphones to medical devices, fighter jets and electric vehicles.

China currently controls roughly 70 per cent of mining and 90 per cent of the processing of these minerals, according to Natural Resources Canada, and the U.S. is just one of many countries heavily reliant on them.

“[China] utilizing its unique advantages in the global supply chain seems to have worked very well,” said Wang with the Centre for China and Globalization.

In response to the measures, Trump threatened an additional 100 per cent surtax on Chinese goods and export controls on software. He later admitted the tariff was “not sustainable” in an interview with Fox Business Network.

What’s also telling is attempts by the U.S. administration to play catch up with China’s dominance in the field.

On his whirlwind Asia tour, Trump signed two agreements with newly elected Japanese Prime Minister Sanae Takaichi, one of which focused on critical minerals mining and processing. According to the framework provided by the White House, the deal includes working together to “accelerate the secure supply of critical minerals and rare earths … by leveraging policy tools” including “financial support mechanisms” and “trade measures.”

On Sept. 8, U.S. Strategic Metals signed a $500 million agreement with the Pakistani military’s Frontier Works Organization, that country’s largest miner of critical minerals.

Earlier this month, Trump and Australian Prime Minister Anthony Albanese signed an agreement to invest $8.5 billion to boost rare earth and critical minerals supplies by expanding mining and processing.

However, that work is often measured in decades.

‘When the elephants fight’

A sense of the leaders’ positions heading into a meeting can also be gauged from their respective domestic politics.

Despite a slumping economy at home, Xi has just hosted the Chinese Communist Party’s annual plenum, where it vowed to speed up the country’s self-reliance in technology. During the four-day meeting, he highlighted his power by purging high-ranking members of the military.

Trump, meanwhile, is heading to South Korea as the U.S. government potentially faces its longest-ever shutdown.

Ultimately, there are billions of dollars riding on Trump and Xi working it out.

“Most countries don’t want to see China and the United States fight one another because [they are] the two largest economies and militaries in the world,” said Wang.

“When the elephants fight, it is the grass that suffers.”