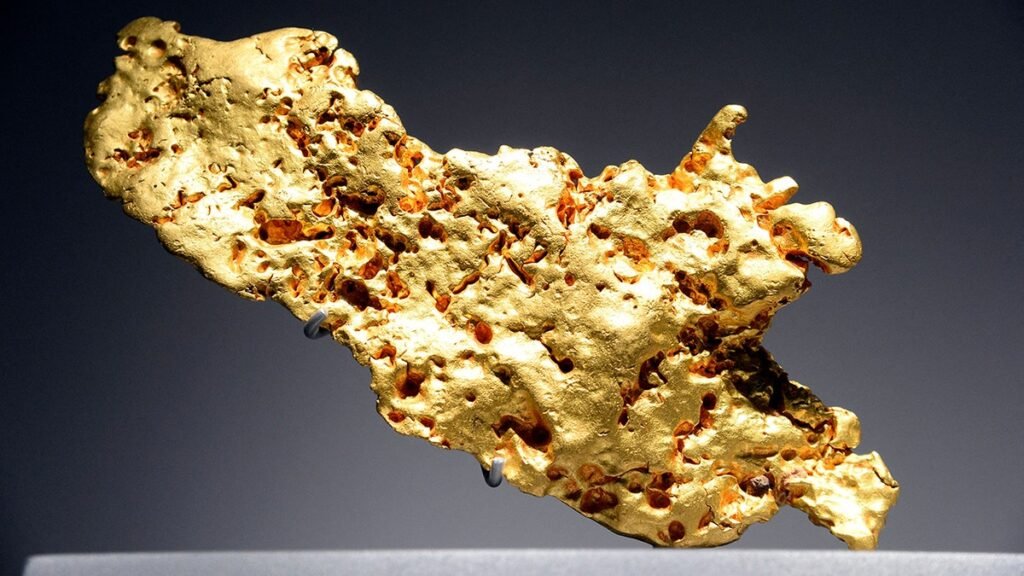

China has emerged as a critical force propelling gold prices to record highs in 2025, according to one of the most influential analysts on Wall Street. Torsten Slok, Apollo Global Management’s chief economist who is renowned for his pithy, incisive daily email The Daily Spark, highlighted on Tuesday that China’s impact goes beyond central bank buying; it also involves arbitrage trading, robust household demand, and safe-haven investment behavior, and he produces convincing data backing these claims. Against a backdrop of macroeconomic uncertainty, Slok notes that at this rate, global central banks will soon hold more gold than U.S. dollars, the world’s reserve currency.

“China is playing a key role in the ongoing rise in gold prices because of central bank buying, arbitrage trading, and increased speculative and safe-haven demand among Chinese households,” Slok wrote in his Tuesday Daily Spark, including four charts that prove his point. He included a fifth showing that “higher business uncertainty in the U.S. is also pushing gold prices up.”

Gold’s 50% jump in 2025 marked a seminal moment: it crossed the $4,000 an ounce threshold after President Donald Trump enacted a 100% tariff on China, severely disrupting global trade and eroding confidence in the greenback. As the dollar depreciates and U.S. stocks slump, gold shines brighter as a safe asset. Veteran analyst Ed Yardeni forecasts a price of $5,000 for 2026 and as much as $10,000 by 2028 if current trends persist—citing the “debasement trade” that favors gold and bitcoin when fiat currencies risk inflation and systemic instability.

Other reporting adds evidence to Slok’s findings. The People’s Bank of China has been a relentless purchaser of gold, marking its 11th consecutive monthly buy this September, per commodities news site Kitco. China’s officially reported reserves reached 2,264 tonnes by mid-2025, but industry consensus suggests that real holdings may be even greater due to underreporting—a tactic often employed for strategic advantage. This central bank buying is not just a statistical curiosity; it establishes a price floor that signals institutional and private investors to follow suit, reinforcing demand cycles.

Beyond official reserves, Chinese consumers are fueling the rally. Gold withdrawals from the Shanghai Gold Exchange surged in September, hitting a monthly tally of 118 tonnes, up both month-over-month and year-over-year. Chinese gold ETFs saw net inflows in September, and gold futures trading volumes have spiked notably—indicating a powerful combination of household safe-haven demand and speculative trading within China itself. This growing involvement of retail investors magnifies China’s effect on global gold pricing.

Slok cites the China Futures Exchange in reporting that the gold stock level in China has soared throughout 2025, and Bloomberg data shows that household demand for gold exchange-traded funds (ETFs) is also surging. This indicates that far beyond whatever the People’s Bank of China is doing, Chinese households are driving significant activity, as the China-U.S. trade war rumbles on. Presidents Xi Jinping and Donald Trump are due to meet soon with Xi imposing new restrictions on rare earths access and Trump threatening 100% new tariffs in response—before seeming to back off.

Global Ripple Effects: U.S. Uncertainty and Beyond

While Chinese buying is the dominant catalyst, increased business uncertainty in the U.S. has added fuel to the fire. As economic volatility and geopolitical risk rise—exacerbated by US-China trade tensions, dollar depreciation, and interest rate cuts—American investors have joined the move into gold, driving up prices even further. Leading institutions, including Goldman Sachs, have raised forecasts for gold, projecting prices as high as $4,900 per ounce for December 2026, well above current record levels. When analysts combine these factors with Torsten Slok’s data, the result is a compelling case: China’s gold moves are the linchpin, but the effect is global.

Slok’s analysis echoes observations from Goldman Sachs commodities strategist Lina Thomas and Canadian businessman and legendary gold investor Pierre Lassonde, who pointed out earlier this month that today’s gold rally is grounded in fundamentals, not hype. Thomas emphasized that economic instability—especially tariff-induced uncertainty and dollar depreciation—has driven gold up 65% in 2025, reaching a stunning $4,242 per ounce. With the U.S. and China locked in a trade standoff, both central banks and private investors are diversifying away from the dollar, further supercharging gold demand.

Thomas and Lassonde drew explicit parallels to the 1970s, when Nixon’s shock termination of the gold standard and subsequent fiscal turmoil sent gold prices accelerating by over 2,300% across the decade. Lassonde describes the current moment as “the equivalent year 1976 right now of that four-year bull market,” suggesting that the rally could have years left to run.

Even traditional gold skeptics have joined the rush. JPMorgan Chase CEO Jamie Dimon, long unconvinced of gold’s merit, admitted in conversation with Fortune editor-in-chief Alyson Shontell that “This is one of the few times in my life it’s semi-rational to have some in your portfolio”—a marked change driven by the kind of global uncertainty and market breakdown also evident in Slok’s analysis.

Citadel CEO Ken Griffin, the billionaire hedge fund founder, is sounding a similar note to Dimon but he’s not happy about it. “I now view gold as a safe harbor asset in a way that the dollar used to be viewed. That’s what’s really concerning to me,” Griffin told Bloomberg earlier this month.

Another hedge fund billionaire, Bridgewater founder Ray Dalio, said earlier this month that investors should put 15% of their portfolio into gold, calling it “a very excellent diversifier.” China seems to agree.