Celestial stock has likely flown under the radar of many U.S. investors because the company is based in Canada. But it’s easily bought on the New York Stock Exchange.

There is great reason to invest in artificial intelligence (AI) stocks. The global AI market will soar from $189 billion in 2023 to $4.8 trillion by 2033 — a 25-fold increase in a decade — according to an estimate by the United Nations Conference on Trade and Development.

Nvidia (NVDA 3.90%), the leading supplier of AI chips and related technology, has been garnering rockstar-like attention for its phenomenal stock performance. It deserves its accolades and I remain very bullish on the stock.

But there’s a large-cap AI stock that’s walloped Nvidia stock in 2025 to date, over the last year, over 3 years, and even over 5 years: electronic manufacturing services (EMS) provider Celestica (CLS 0.73%).

Celestica — which is well-established and profitable — deserves much more attention. I believe that the U.S. financial press doesn’t give it much coverage largely because it is based in Canada — Toronto, to be exact — rather than in the U.S. But Celestica stock trades on the New York Stock Exchange, as well as the Toronto Stock Exchange, so it can be easily bought by U.S. investors.

If you’re an AI stock or tech stock investor, Celestica is worth considering buying.

Image source: Getty Images.

Celestica stock’s performance

| Stock | YTD 2025 Return | 1-Year Return | 3-Year Return | 5-Year Return | 10-Year Return |

|---|---|---|---|---|---|

| Celestica | 174% | 409% | 2,570% | 3,190% | 1,860% |

| Nvidia | 31.6% | 49.9% | 1,220% | 1,350% | 31,110% |

| Palantir | 141% | 395% | 2,220% | 1,820%* | N/A |

| S&P 500 Index | 14.4% | 18.2% | 78.7% | 116% | 306% |

Data sources: Yahoo finance and finviz.com. YTD = year to date. Data to Friday, Sept. 19, 2025 except as noted. *Palantir went public Sept. 30, 2020, so its 5-year return shown is for 7 market days less than 5 years.

Celestica stock has trounced Nvidia stock in every period up to 5 years. Nvidia is the big winner over the 10-year period. Both Nvidia and Celestica have crushed the S&P 500 index (a proxy for the overall market) in every period shown.

Celestica has also beaten another AI darling — Palantir Technologies (PLTR -1.65%) — over every period the AI-powered software-as-a-service (SaaS) company has traded.

Celestica’s business: Good corporate DNA

Celestica is a leading electronic manufacturing services (EMS) provider. It provides design, manufacturing, hardware platform, and supply chain solutions for many of the world’s largest companies across technology and other sectors. It has over 40 manufacturing and design centers worldwide.

I described Celestica as having good corporate DNA because it’s essentially a spin-off from tech giant IBM. In 1996, Big Blue sold Celestica to an investors group, and in 1998, Celestica held its initial public offering (IPO).

The company’s financial performance — and hence, its stock performance — started soaring in 2023, driven by powerful demand for its services and hardware platform solutions from companies heavily involved in AI.

Celestica has two reportable segments: advanced technology solutions (ATS) and connectivity & cloud solutions (CCS). ATS includes its aerospace and defense, industrial, health tech, and capital equipment businesses. CCS consists of its communications and enterprise (servers and storage) markets.

Notably, the company “does business with the top five hyperscalers,” CFO Mandeep Chawla said in January on Celestica’s Q4 2024 earnings call. These are generally considered to be Amazon, Microsoft, Alphabet, Meta Platforms, and likely Apple. Hyperscalers are companies that operate massive AI-focused data centers, often (but not always) to support their cloud computing services.

Celestica’s key financial and stock stats

| Company | Market Cap | Forward P/E | Wall Street’s Estimated Annualized 5-Year EPS Growth |

|---|---|---|---|

| Celestica | $29.1 billion | 37.6 | 27.3% |

Data sources: Finviz.com. P/E = price-to-earnings ratio. EPS= earnings per share. Data to Sept. 19, 2025.

In the first half of 2025, Celestica’s revenue rose 20% year over year to $5.54 billion. On an adjusted basis, its net income surged 46% to $301.3 million, which translated to earnings per share (EPS) soaring 50% to $2.59. Cash flows were solid, and debt load is reasonable with a 0.55 long-term-debt-to-equity ratio.

The company’s connectivity & cloud solutions (CCS) segment is driving its growth. In the second quarter, total revenue rose 21% year over year to $2.89 billion. CCS revenue jumped 28% to $2.07 billion, while the ATS segment’s revenue increased 7%. Within the CCS segment, hardware platform solutions revenue rocketed 82% year over year to $1.2 billion.

In July, citing the “strengthening demand outlook from our CCS customers,” management raised its full-year 2025 guidance as follows:

- Revenue of $11.55 billion, up from $10.85 billion. This equates to annual growth of 20%.

- Adjusted EPS of $5.50, up from $5.00. This equates to annual growth of 42%.

- Free cash flow of $400 million, up from $350 million. This equates to annual growth of 31%.

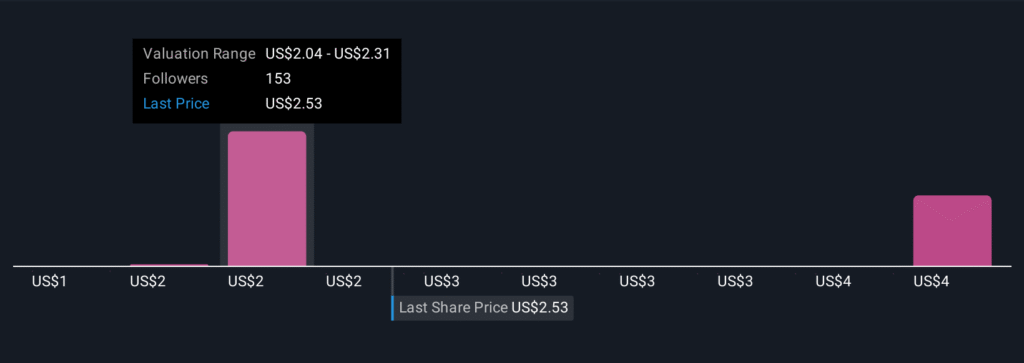

Moving to the stock’s valuation. Celestica stock is priced at 37.6 times Wall Street’s estimated one-year forward EPS growth. This is a little pricey for a stock of a company that’s expected to grow EPS at an average annual pace of 27.3% over the next 5 years.

However, investors should expect to pay up for quality. Moreover, the stock will turn out to be less highly valued than it now seems if Celestica continues to beat Wall Street’s earnings estimates. Over the last four quarters, the company has exceeded the analyst consensus estimate in every quarter and by an average of 9.1%.

In addition, using the same valuation metrics, Celestica’s valuation is much, much more reasonable than Palantir’s. And it’s anywhere from slightly to significantly more reasonably valued than every “Magnificent Seven” stock except for Nvidia. (That includes Microsoft, Amazon, Alphabet, Meta Platforms, Apple, and Tesla.)

Celestica expects no material impact on 2025 earnings from tariffs

When it raised its 2025 guidance, Celestica addressed tariffs: “Substantially all tariffs paid by Celestica are expected to be recovered from our customers, and are not expected to materially impact our … [adjusted] net earnings dollars.”

In short, if you’re a growth stock investor, Celestica stock is worth considering buying — or at least putting on your watchlist.

Celestica is scheduled to release its third-quarter results after the market close on Monday, Oct. 27.