CNN

—

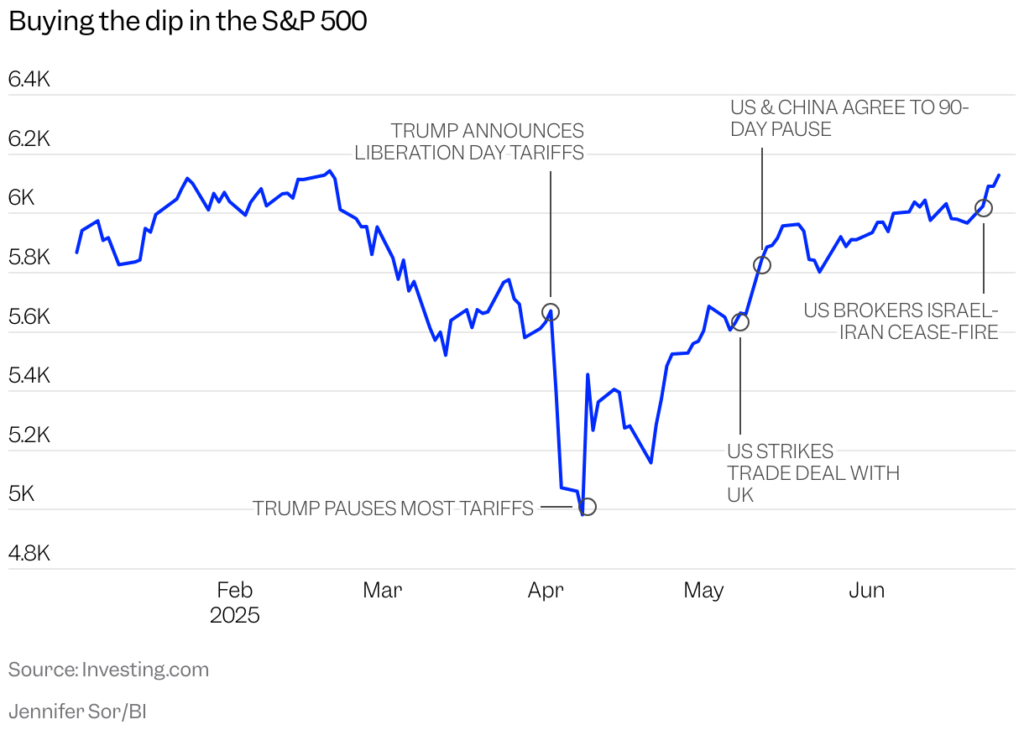

In the face of higher tariffs on virtually everything the United States imports, plus a Middle East crisis, the United States economy has, remarkably, held its ground. Inflation has mostly held steady, while the unemployment rate remains near historic lows. Stocks, meanwhile, hit fresh record highs last week.

That could soon change as crucial deadlines near.

The first is July 9, which marks the end of President Donald Trump’s 90-day pause on what he termed as “reciprocal” tariffs on dozens of America’s trading partners. Unless those countries reach trade deals with the US, they could potentially face much higher tariffs.

Then, just around the corner from that is the so-called X-date, when the government could default on its debt obligations. That will occur at some point in August, Treasury Secretary Scott Bessent said in a recent letter to congressional leaders. The consequences of the US defaulting on debt, which has never happened, are grave and would likely cause global economic upheaval. That’s why Bessent argued lawmakers need to raise the debt ceiling before Congress’ one-month recess starts on August 4.

The president has essentially pressured Congress to raise it by July 4. But complicating that effort is the fact that raising the nation’s borrowing limit is just one of several measures included in his “One Big, Beautiful Bill,” which is what he really wants to sign into law by then.

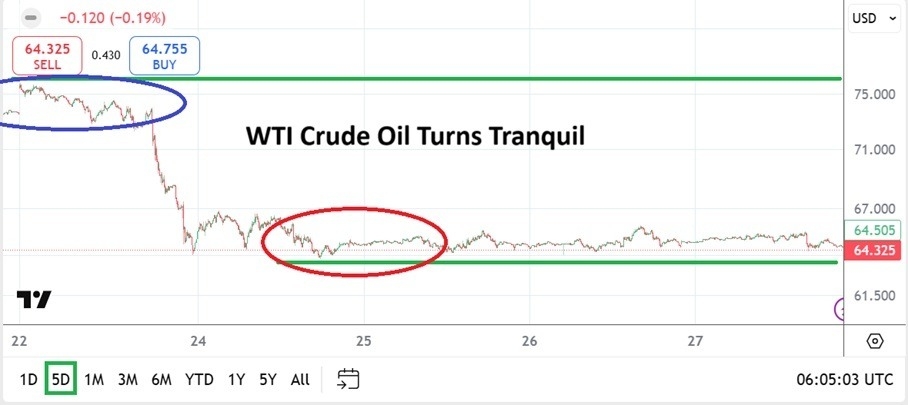

Another pressing situation that could overturn the current calm is the fragile ceasefire Trump brokered between Iran and Israel. It could quickly become undone and cause oil prices to surge at a time when inflation from his tariffs may already be picking up.

“We know it’s coming. There’s a lag between changes in tariffs and when they show up in prices you and I are paying,” said Ryan Sweet, chief US economist at Oxford Economics.

And there are other cracks in the economy that could rapidly evolve into fault lines, such as the number of people continuing to receive unemployment benefits hitting a four-year high and consumers reining in their spending.

Trump has demonstrated over the first few months that there’s no limit to how high he’ll raise tariffs — whether across a country’s goods or across all imports of a particular product. For instance, the US had taxed Chinese goods at a minimum 145% rate, but a deal that was reached on May 12 brought that rate down to 30%.

Other tariffs currently in place include 50% on steel and aluminum, 25% on cars and auto parts, and a 10% minimum tariff on virtually every country’s goods.

While Mexican and Canadian goods are exempt from certain tariffs if they comply with the terms of the United States-Mexico-Canada Agreement, Trump on Friday said he will levy new tariffs on Canadian goods over the country’s refusal to ditch a new tax set to take effect Monday.

In April, after his trade policy rocked markets, Trump announced a 90-day pause, ostensibly to buy more time to work on “bespoke” trade deals with impacted countries, he said. Since then, there have only been two trade deals inked, with the United Kingdom and China.

Trump noted Friday that it was unrealistic that 200 countries that have been aiming to ink trade deals with the US would have them finalized by July 9.

“At a certain point, over the next week and a half or so, or maybe before, we’re going to send out a letter. We talked to many of the countries, and we’re just going to tell them what they have to pay to do business in the United States,” he told reporters from the White House press briefing room.

“We have a lot of great things going, and we’re getting along with countries, but some will be disappointed because they’re going to have to pay tariffs,” Trump added.

Trump administration officials have floated potential extensions for countries “negotiating in good faith,” without specifying what that means or which countries that applies to.

Treasury Secretary Scott Bessent said Friday in a CNBC interview: “There are probably another 20 countries where they could go back to the reciprocal tariff (rate) of April 2 as we work on the deal. Or, if we think that they are negotiating in good faith, then they could stay at the 10% baseline.”

Commerce Secretary Howard Lutnick re-upped the possibility of a regional tariff strategy on Thursday, while also claiming that 10 trade deal announcements were imminent.

“You’ll have South American deals, African deals… We will put these people in their proper buckets on July 9,” he said in a Bloomberg TV interview.

That could mean some nations end up facing higher tariffs compared to the April levels just based on where they’re located. For instance, Vietnam was set to face 46% tariffs, while its neighbor Malaysia was going to face a 24% tariff.

Or, come July 9, tariff policy could just come down to picking a number out of a hat. As Bessent said, “It will all be up to President Trump.”

“Whether or not the July 9th deadline spells trouble for the economy depends on how the Trump administration handles trade policy,” Matthew Luzzetti, chief US economist at Deutsche Bank, told CNN.

“If he were to reinstate the historically elevated tariffs announced on ‘Liberation Day,’ (April 2) this would bring back fears of an economic slowdown that were prevalent in April,” he said, adding that it didn’t seem like a strong possibility. “More likely, we get a mix of extensions, trade deals and threats of increased tariffs on specific countries or sectors. If that is the outcome, it could leave the economy in its current holding pattern for a bit longer until uncertainty clears.”

Already, Luzzetti’s team of economists is anticipating higher prices in the coming months. Reinstituting more tariffs come July 9 could only add more fuel to that fire, he said.

Similarly, Olu Sonola, US head of economic research at Fitch Ratings, said, “Regardless of the outcome of these deadlines, we expect (Consumer Price Index) inflation to trend higher towards 4% at the end of the year. If ‘Liberation Day’ tariffs return, we’ll likely see inflation higher than 4%.” The latest CPI report from May showed prices rising at a 2.4% annual rate.

Another 11th-hour debt ceiling standoff?

Sweet says he expects lawmakers won’t allow the US to default on its debt and will ultimately raise the debt ceiling in the 11th hour. “This is essentially a very bad movie that we’ve seen before, so we know how it ends.”

He said there may be more time before the US defaults compared to Bessent’s estimates. (It’s incredibly difficult to make precise predictions on when that is.)

“But each passing week you naturally get a little bit more nervous, because you don’t want to imagine the unimaginable,” Sweet said. “I just don’t think that’s a very likely scenario, because I think lawmakers know that it would be political and economic suicide not to raise the debt limit.”