One of these stocks could still be a good buy today thanks to an improving growth rate and a long history of strong financial results.

If you buy a stock that goes up 20% in a year, I’d say you made a good investment. After all, the S&P 500 (^GSPC 0.51%) returns somewhere around 10% annually on average. Doubling that return in a single month, therefore, is a good deal.

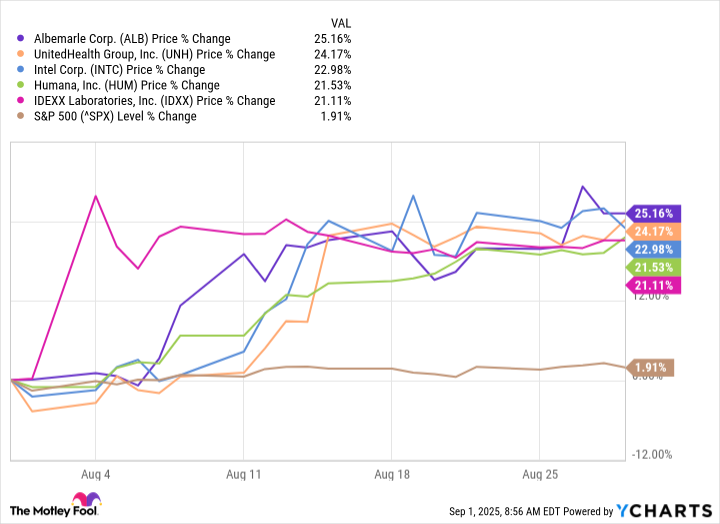

The five top-performing S&P 500 stocks all returned better than 20% in August. These top stocks were an eclectic mix of Albemarle (ALB 0.60%), UnitedHealth Group (UNH -0.51%), Intel (INTC -0.93%), Humana (HUM 0.70%), and Idexx Laboratories (IDXX -0.92%).

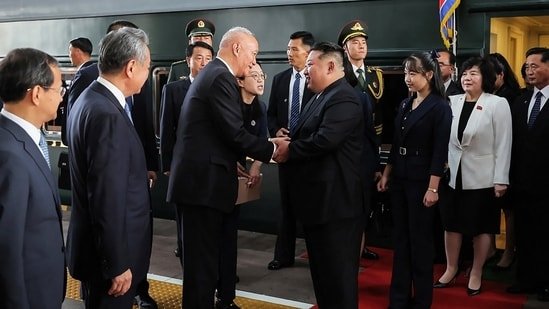

Image source: Getty Images.

Here’s why these five were up, and which could be the best buy now.

A big month for these five stocks

As the chart shows, these five stocks jumped between 21% and 25% during August, easily running past the 2% return for the S&P 500.

Data by YCharts.

Considering these stocks jumped at different times of the month, and most of these companies do business in different sectors, it goes without saying that all five of these top performers have a unique story:

Albemarle

This is one of the top suppliers of lithium in the world. In August, another top lithium company, Contemporary Amperex Technology, stopped output at a major mine. Investors believe this could improve lithium prices, to the benefit of Albemarle and peers, which is why the stock jumped.

UnitedHealth Group

Before August, UnitedHealth stock was trading down more than 50% in 2025 and hitting five-year lows due to a variety of legitimate concerns. The company’s profits are taking a hit due to higher costs, its CEO abruptly resigned, and it’s being investigated by the Department of Justice. But on Aug. 14, Warren Buffett’s Berkshire Hathaway disclosed a $1.6 billion stake in UnitedHealth stock, rekindling investors’ optimism.

Intel

The giant computer processor company was the recipient of not one, but two large investments during August. On Aug. 18, it got a $2 billion investment from SoftBank, and on Aug. 22, it got an $8.9 billion investment from the United States government. The investments are intended to help the company grow its semiconductor production infrastructure.

Humana

This healthcare company reported quarterly financial results at the end of July. And in August, professional stock analysts routinely upgraded their outlooks for the business. There weren’t any big daily jumps for Humana stock, but rather a steady, consistent increase throughout the month.

Idexx Laboratories

On Aug. 4, veterinary health technology company Idexx reported financial results for the second quarter of 2025, which were better than what investors expected, which led management to raise its guidance for the rest of the year.

As one can see, these stocks were all moving for different reasons. But it’s important to keep in mind that stock performances are somewhat fickle over the short term. And measuring performance over a single month is indeed short-term thinking.

The real question is, which of these five stocks will perform best over the next three to five years? While it’s just my opinion, allow me to venture a prediction.

Why I would buy Idexx Laboratories stock here

Allow me to preface this by saying I’m not a big fan of healthcare stocks today. There’s a lot of dissatisfaction from consumers with their providers, and the political environment seems ripe for change. Predicting the headwinds for UnitedHealth or Humana is beyond my skill level.

Albemarle is tempting because lithium is important with the electrification-of-everything trend — the world will likely need more batteries than ever. But the business does have struggles, and the stock only got a boost because of a decision from a competitor. I don’t believe the mining decision from Contemporary Amperex Technology will improve Albemarle’s economics dramatically.

Intel is likewise tempting. The business has put up lackluster results for years. But the stock is cheap, and management is changing the business model and getting major financial backing to do it. That could powerfully improve the long-term outlook.

However, I’m ultimately most comfortable with Idexx Laboratories stock here, and here’s why.

Providing better healthcare for pets is an unstoppable trend, in my opinion. It seems like pet owners increasingly believe they have a duty to treat pets like members of the family. This provides Idexx and its pet diagnostic services a strong tailwind.

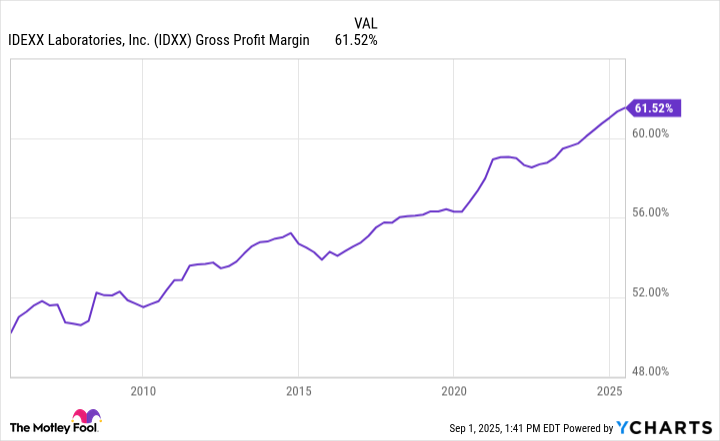

Idexx’s management believes that it can routinely grow by 10% or better, and its long history of growth backs this up. Moreover, I believe it’s worth noting that the company’s gross margin has consistently increased over the last two decades, which suggests that it has a competitive moat — competitors haven’t cut into its pricing.

Data by YCharts.

Given its history of growth and strong business economics, I wouldn’t bet against the long-term performance of Idexx Laboratories. It’s worth noting that its Q2 growth picked up after a couple of years of slower growth. So perhaps now is a good time to give Idexx stock a fresh look.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway and Intel. The Motley Fool recommends Idexx Laboratories and UnitedHealth Group and recommends the following options: short August 2025 $24 calls on Intel and short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.