These innovative businesses could deliver explosive returns.

Spending on artificial intelligence (AI) is expected to reach as much as $4 trillion by 2030. This forecast has put a lot of attention on big tech giants that are spending big on data center infrastructure. But if you dig deeper, you can find small- to mid-cap stocks that could also benefit and deliver explosive returns. Here are two smaller AI stocks that are flying under Wall Street’s radar.

Image source: Getty Images.

1. SoundHound AI

SoundHound AI (SOUN 6.62%) emerged as a leader in conversational AI, allowing people to interact with devices as easily as talking to another person. The stock soared 400% over the last three years, yet this company is only followed by five Wall Street analysts.

Low coverage on Wall Street is typical of small- to mid-cap stocks, and that’s why it’s possible to find hidden gems that crush the return of the major indexes. SoundHound stock could be on the verge of a massive bull run over the next five years. Small caps in general have underperformed large caps in recent years, making stocks like SoundHound, which currently has a market cap of about $6 billion, overdue for a major rally in the stock market.

SoundHound’s business is expanding rapidly. Revenue surged 217% year over year in Q2, and the few analysts that cover the company expect revenue to be up 96% for the full year.

This is not a fly-by-night business. SoundHound has been investing in this technology for 20 years. Its voice AI solutions have been widely adopted by leading restaurant brands for customer ordering. Importantly for investors, SoundHound is expanding its addressable market to other industries like retail and healthcare, which could lead to significant growth over time.

It just hit an important milestone last quarter, where SoundHound’s voice AI surpassed 1 billion queries per month on its platform. This indicates a scalable platform, which spells significant profit potential. Over time, SoundHound is aiming to monetize its platform through subscriptions, royalties, and other revenue-sharing agreements with third parties.

The robust growth it is experiencing and the leadership it is gaining in this important area of AI make SoundHound AI a promising stock to appreciate significantly over the next decade.

Image source: Getty Images.

2. Innodata

With the world’s largest companies exploring ways to use AI in their operations, there’s a growing need for quality data. This is a big opportunity for Innodata (INOD 2.71%), yet only two analysts on Wall Street follow this company. Innodata specializes in data annotation, developing models, and providing customized AI solutions for enterprise.

Innodata has customers across several industries that are implementing AI for a variety of use cases. It is listed as a Google Cloud Build and Services partner, indicating Innodata’s competitive advantage in data engineering technology.

Revenue has gone parabolic over the last few years. In Q2, Innodata reported a 79% year-over-year increase in revenue excluding the impact of acquisitions. Its trailing-12-month revenue has nearly tripled over the last three years, while growing earnings per share shows the company’s ability to profitably scale its AI services.

Innodata continues to win major deals with big tech customers. Management noted that these large tech companies are in an arms race to achieve super-intelligent autonomy with AI, and the fact that they are turning to Innodata for help spells tremendous growth potential.

Importantly, Innodata is positioned to benefit from new AI advancements. For example, management believes the progress in agentic AI will create a “ChatGPT moment for robotics.” The company plans to invest to benefit from multiple new applications of AI in the coming years.

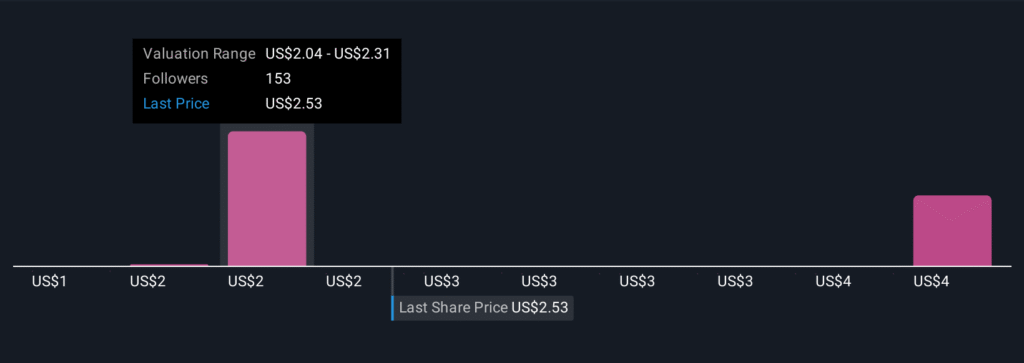

The stock has rocketed 3,000% over the last five years, but it still has a market cap of just over $2 billion. With AI spending expected to reach into the trillions by the end of the decade, Innodata should see explosive growth that easily delivers market-beating returns for investors.

John Ballard has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.