New York

CNN

—

US stocks are floating near all-time highs as Wall Street maintains cautious optimism that Washington might ink more trade deals, avoiding a worst-case scenario of extraordinarily high tariffs and enabling the resilient economy to continue chugging along.

Stocks were higher on Friday. The Dow rose 70 points, or 0.15%. The broader S&P 500 gained 0.25% and the tech-heavy Nasdaq Composite rose 0.2%.

The Dow is less than 300 points away from hitting an all-time high. The blue-chip index needs to finish the day with a gain of 0.72% to hit a fresh record, which would be its first this year.

President Donald Trump late Tuesday announced a trade deal with Japan, signaling that the United States might be open to further negotiations with other trading partners. The S&P 500 has notched four consecutive records this week as global markets have welcomed progress on trade ahead of Trump’s self-imposed August 1 deadline.

The deal with Japan includes a 15% tariff on imports from the nation, which is less than the previously threatened 25% levy. A 15% tariff is still relatively high, but investors were relieved to see that level compared to previous threats, Eric Freedman, CIO at US Bank Asset Management Group, said.

As stocks grind higher, markets are adjusting to the prospect of Trump’s tariffs staying in place, Freedman said. But a surprisingly high levy on a major trading partner like the European Union could send a jolt through markets that triggers a downturn.

“The key is will we see that effective tariff rate hover around the 15 to 17% level, or will it be north of 20%?” he said.

“Markets are not priced for major trading partner effective tariff rates north of 20%,” he said. “The European negotiations remain paramount. That’s something that markets are very, very fixated on right now.”

Stocks earlier this month dropped lower after Trump announced plans for a 35% tariff on Canada, highlighting how markets could react negatively to high tariff rates.

Trump on Friday said that there’s a “50-50 chance” he will strike a trade deal with the European Union ahead of a deadline for imposing hefty tariffs on the US’ close economic partner.

“I would say that we have a 50-50 chance, maybe less than that,” Trump said at the White House. “But they want to make a deal very badly.”

Trump has vowed to impose 30% tariffs on the EU on August 1 should the two sides fail to reach an agreement.

The Dow on Wednesday posted its best daily gain in one month. The Nasdaq this week closed above 21,000 points for the first time ever. The S&P 500 has notched 10 record highs in the past month.

Stocks have marched higher, supported by a de-escalation in global trade tensions, better-than-expected economic data and healthy corporate earnings.

About 34% of companies in the S&P 500 have reported earnings results for the second quarter, with 80% posting earnings that beat expectations, according to FactSet data.

“Trump’s Tariff Turmoil appears to be subsiding,” Ed Yardeni, president of Yardeni Research, said in a note.

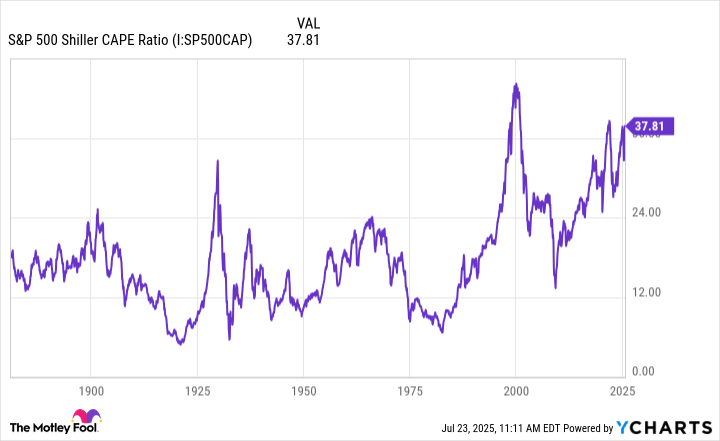

But stocks are historically expensive, and markets are vulnerable to a negative trade surprise.

Wall Street in April was caught off-guard by Trump’s enormous “Liberation Day” tariffs, which sent stocks plunging. Investors are optimistic that the August 1 deadline will provide more clarity and less concern, though there’s room for miscalculation.

The S&P 500 hasn’t posted a daily gain or loss of more than 1% in one month, which is a sign that momentum is slowing down.

“We had hoped that much of the tariff uncertainty would have been resolved by now,” David Lefkowitz, head of US Equities at UBS Global Wealth Management, said in a note.

“Plus, we can’t rule out that the president will continue to escalate his tariff rhetoric until the markets send a signal that he is going too far,” he said.

The Dow this week has flirted with closing at a record high, which would be its first since December. “Extreme greed” was the sentiment driving markets on Friday, according to CNN’s Fear and Greed index.

US stocks have rallied in recent days despite underlying uncertainties related to tariffs on major trade partners including Mexico, the European Union and India. That’s because Wall Street has welcomed progress on the trade front with Indonesia, the Philippines and Japan, including tariffs ranging from 15 to 19% and more clarity about where average tariff rates might land.

“While still negative from the macro point of view, the world can live with these levels of tariffs,” Mohit Kumar, chief strategist and economist for Europe at Jefferies, said in a note.

“We have been in the relative sanguine camp for tariffs and our view remains,” Kumar said. “With trade deals likely with all the trading partners, markets can move from the uncertainty surrounding tariffs.”

Wall Street’s fear gauge, the CBOE Volatility Index, or VIX, traded at its lowest level since February, signaling relative calm in markets. It’s a major shift from early April, when the VIX had spiked above 50 points as volatility gripped markets after Trump’s tariff announcements.

“The administration pushed a critical trade deal across the finish line with Japan which unlocks new possibilities,” Sarah Bianchi, chief strategist of international political affairs at Evercore ISI, said in a note.

However, Bianchi said she is cautioning investors that Trump is still pushing forward with an average tariff rate “far above anything the United States has seen in recent history.”

“Looking ahead to the August 1 deadline, these successes will increase momentum to ink more deals,” Bianchi said. “However, it could also embolden Trump even more to punish the countries who do not land a deal by August 1.”

While economic data has been encouraging, a campaign of massive tariffs could cause a resurgence in inflation, creating additional headwinds for businesses and complicating the Federal Reserve’s rate-cutting path.