This week, Chinese leadership officially raised the curtain on the country’s fifteenth five-year plan, which outlines its broad economic, political, social, and military goals into the next decade. The bottom line is more of the same. For the economy, that means more money to high-tech industries and scientific development and more support for the export industries that have kept the Chinese economy afloat through the past five years of real estate and local-government debt crises. It also means little more than lip service to the daily struggles of hundreds of millions of consumers.

All of this was telegraphed over the past few months as the Chinese Communist Party prepared for this week’s fourth plenum of its Central Committee. While the initial headlines in foreign coverage from the meeting focused on the purge of several senior military and provincial officials, the communiqué, true to form, focused on the achievements of the last five-year plan and the party’s vision for the next half decade. It was, as is typical, short on details of how the blueprint will be implemented or funded. Those policies supposedly will be elaborated in legislation to be presented to the National People’s Congress at its annual gathering in early 2026. But overall, the “key tasks” in the document were remarkably similar to those outlined in 2021, at the beginning of the last five-year plan, as Gerard DiPippo of the RAND Corporation outlines in a table comparing the two.

All of this is good news for sectors of the Chinese economy that are at the heart of the government’s focus on “high-quality development” and “self-reliance and self-strengthening in science and technology.” This policy has driven China’s very successful drive to global leadership in green technologies, such as solar power and electric vehicles, and its dominance of strategically important rare-earth supply chains. Now Beijing will aim to extend those achievements into such fields as advanced semiconductors, biotechnology, and quantum computing.

The reality is that China’s people increasingly find themselves left out in the cold when it comes to Beijing’s spending priorities.

It is also good news for a vast range of Chinese manufacturers that have helped power China’s rise into an export powerhouse over the past generation but are now worried about their place in an economy facing massive industrial overcapacity, slackening domestic demand, falling producer prices, and anemic profits. The plenum demonstrates that Beijing’s ambitions now extend beyond cutting-edge industries to those threatened with decline. It is necessary to “maintain a reasonable proportion of manufacturing,” the plenum communiqué declares. “It is necessary to optimize and upgrade traditional industries.” Reading between the lines, the leadership is signaling to struggling manufacturers—and local governments that often support them—that it has their backs.

That support was highlighted by a front-page article during the plenum in the People’s Daily, the government’s mouthpiece, that highlighted visits that Chinese President Xi Jinping has made to “traditional” manufacturers in recent months to inspect their upgrading efforts. “The real economy cannot be lost,” Xi is said to have declared during one factory visit.

Such high-level support can only mean bad news for China’s trading partners, because they now will bear the impact of an increasing reliance on exports. That prospect will add greater weight to next week’s scheduled meeting in South Korea between US President Donald Trump and Xi.

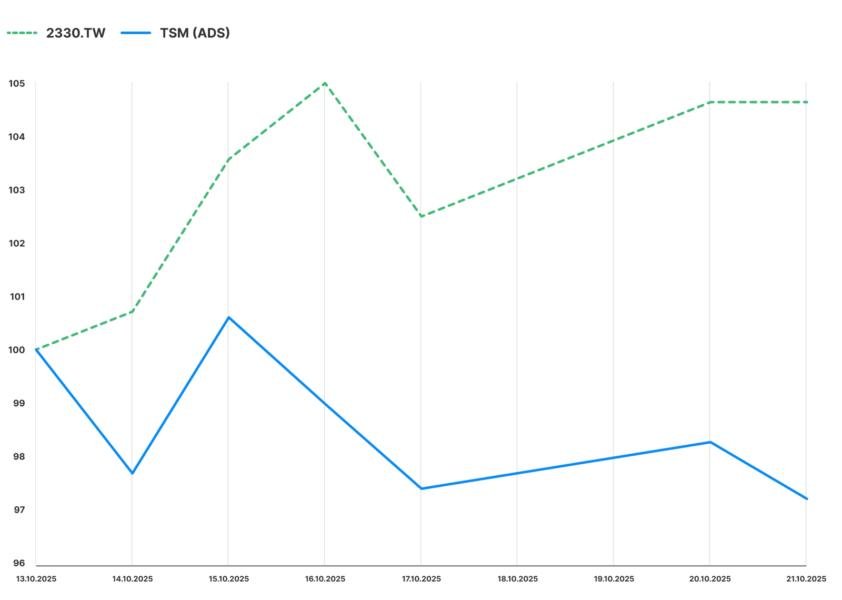

As China’s economy has slowed over the past few years, its exports have surged to the point that its global trade surplus may hit a record $1.2 trillion this year, nearly double its $676 billion surplus in 2021. This flood of exports has come at a moment when US demand for Chinese goods has dropped sharply because of trade tensions and Trump administration tariffs—all of which translates into sharp increases in shipments to other countries. As a result, many governments are feeling pressure from their own manufacturers to take action against Chinese exports, with Mexico threatening to impose automobile tariffs. A continuing Chinese export surge—powered by increased government support—could be devastating to manufacturers in countries lower down the development ladder that have been trying to occupy market niches that uncompetitive Chinese companies might be forced to abandon.

The other loser from the plenum would appear to be the Chinese consumer, whose struggles have been mounting since the COVID-19 pandemic hit China in 2020 and government policies pulled the rug out from under the property market in 2021. The government’s harsh lockdowns during the pandemic undermined consumer confidence, and the collapse of the property bubble wiped out considerable household wealth. Joblessness—especially among millions of recent college graduates—has mounted, and many working- and middle-class people have struggled to make ends meet. The communiqué this week states that the government “must promote high-quality and full employment, improve the income distribution system, provide education that satisfies the people, strengthen the social security system, promote high-quality development of the real estate industry, accelerate the development of a Healthy China, promote high-quality population development, and steadily advance equalization of basic public services.”

But similar promises are included in most public statements from high-level meetings these days. The reality is that China’s people increasingly find themselves left out in the cold when it comes to Beijing’s spending priorities. Moreover, with local governments already under severe fiscal constraint after years of profligate borrowing and unpaid bills, many grassroots officials will undoubtedly see that the plenum document continues to give pride of place to Xi’s emphasis on industrial development—and not to the kinds of reforms that might improve the lives of China’s citizens in the near future.

Jeremy Mark is a nonresident senior fellow with the Atlantic Council’s GeoEconomics Center. He previously worked for the International Monetary Fund and the Asian Wall Street Journal.

Further reading

Thu, Oct 23, 2025

The CRINK: Inside the new bloc supporting Russia’s war against Ukraine

Issue Brief

By

Angela Stent

The latest report in the Atlantic Council’s Russia Tomorrow series details how Russia’s war against Ukraine has brought together a new set of partners–united not by shared values, but by shared grievances–on the international stage: China, Russia, Iran, and North Korea.

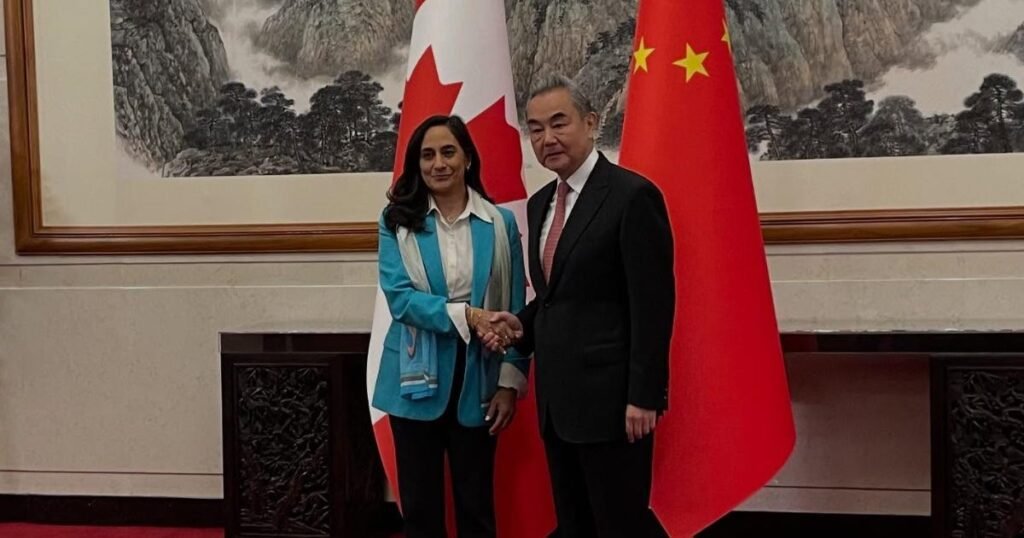

Image: Wang Wentao (left to right), Minister of Commerce of China, sits next to Zheng Shanjie, Chairman of the National Reform and Development Commission of China, Jiang Jinquan, Director of the Policy Research Office of the Central Committee of the People’s Congress of China, Han Wenxiu, Deputy Director of the Office of the Central Commission for Financial and Economic Affairs of China and Yin Hejun, Minister of Science and Technology of China. The Chinese Communist Party had previously concluded its Fourth Plenum, a meeting lasting several days at which the upcoming five-year plan was discussed this year. (Johannes Neudecker/dpa via Reuters Connect)