In the past decade, retail forex trading has transformed from a niche activity into a global phenomenon. What was once dominated by institutional players and seasoned professionals has now become a playground for millions of individual traders, many of whom operate with limited understanding of the risks involved. Today, retail forex participation accounts for nearly 19% of all trading activity on platforms like eToro, a 100% increase from 2022. This surge has brought both unprecedented opportunities and systemic vulnerabilities, particularly as high leverage and speculative behavior reshape market dynamics.

The Double-Edged Sword of High Leverage

At the heart of retail forex’s appeal lies leverage—a tool that allows traders to control large positions with minimal capital. Brokers once offered leverage ratios as high as 1:500, effectively enabling traders to multiply their returns (and losses) by a factor of 500. For example, a $100 investment with 1:500 leverage could control a $50,000 position in EUR/USD. While this model attracted retail traders with promises of exponential gains, it also created a fragile ecosystem.

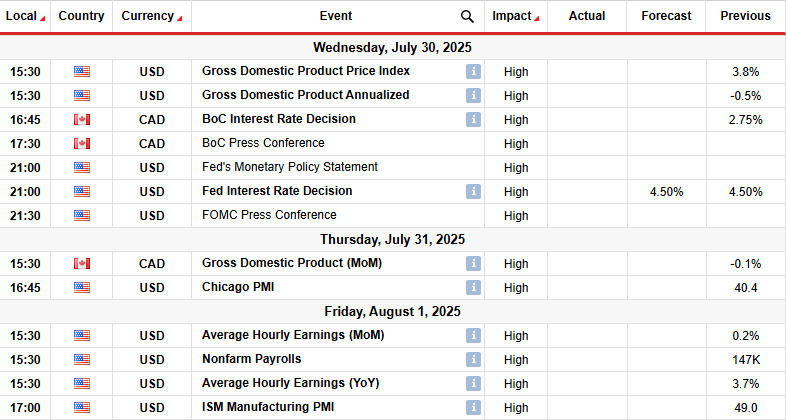

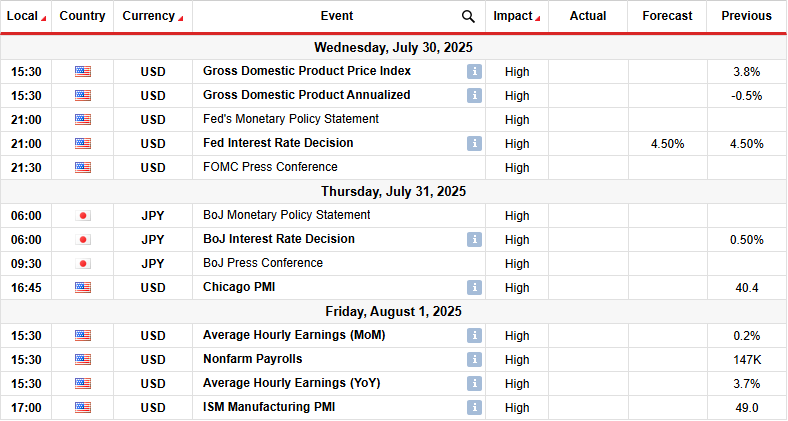

The fallout became evident during periods of heightened volatility, such as the 2023–2024 interest rate hikes by the Federal Reserve and the European Central Bank. Sudden market swings wiped out leveraged positions en masse. According to regulatory reports, 63% of retail forex traders either lost money or lacked the experience to navigate such volatility. The result? A wave of liquidations that not only destabilized individual accounts but also contributed to broader market instability.

Regulatory Interventions and a Cultural Shift

In response to these risks, regulators have tightened leverage caps. The European Securities and Markets Authority (ESMA) pioneered restrictions limiting retail traders to 1:30 leverage on major currency pairs. This model has since spread globally, with platforms like eToro and MetaTrader 4 defaulting to 1:30 or 1:50 for new accounts. While offshore brokers still offer higher leverage, they often lack the safeguards of regulated environments, exposing traders to additional risks.

Beyond regulation, a cultural shift is underway. Traders are increasingly adopting conservative strategies: limiting risk to 1–2% per trade, using trailing stop-loss orders, and prioritizing capital preservation over aggressive growth. This shift is supported by tools like risk calculators and lot size apps, which help traders quantify exposure. For instance, a $10,000 account risking 2% per trade would limit losses to $200 per trade—a stark contrast to the all-or-nothing bets of the past.

Systemic Risks and Market Resilience

The systemic risks posed by retail forex trading extend beyond individual losses. High leverage creates a feedback loop: during market downturns, mass liquidations can exacerbate volatility, leading to liquidity crunches and further price swings. In 2024, a single geopolitical event caused a 10% drop in the USD/JPY pair, triggering $2 billion in leveraged losses within hours. Such events highlight the interconnectedness of retail behavior and macroeconomic stability.

However, this volatility also presents opportunities. The increased caution among traders has led to more disciplined market participation. Brokers now promote sustainable trading habits, and platforms like FTMO (Funded Traders) have emerged as alternatives, offering traders access to institutional-grade capital without personal risk. Additionally, the decline of ultra-high leverage has forced traders to focus on fundamentals, such as economic indicators and geopolitical trends, fostering a more informed investor base.

Investment Advice for Retail Traders

For those navigating this evolving landscape, three principles are critical:

1. Cap Leverage Exposure: Stick to regulated platforms with 1:30 or lower leverage. Avoid offshore brokers unless you fully understand the risks.

2. Prioritize Risk Management: Use tools like stop-loss orders and risk calculators. Never risk more than 1–2% of your capital per trade.

3. Diversify Beyond FX: Consider spreading investments across asset classes like commodities, indices, or ETFs to mitigate forex-specific volatility.

Conclusion

Retail-driven forex trading is at a crossroads. The dangers of high leverage and speculative behavior have been starkly exposed, but so too have the opportunities for a more resilient and educated trading community. As regulators and traders adapt to this new reality, the key to success lies in balancing ambition with prudence. For investors, the lesson is clear: in forex, survival often trumps speed.