If there is any mystery over America’s historic agreement to partner with Australia this week on the supply of critical minerals, it is why it took so long.

On April 4, just two days after Donald Trump’s much-touted Liberation Day tariffs panicked investors and sent markets into a tailspin, Beijing retaliated with its own ferocious hit to the American economy.

It imposed restrictions on the export of seven rare earth minerals to America, vital ingredients in the manufacture of everything from household appliances to the most sophisticated weapons systems.

Since then, the trade battle between Washington and Beijing has waxed and waned, in line with the US president’s capricious nature. And then, China’s President Xi Jinping decided to up the ante.

Loading…

A few weeks back, Beijing expanded the restrictions, this time including rare earths specifically used by the US defence sector.

If ever there was a catalyst for decisive action, that was it. For despite all the swagger and bluff about “a deal” with Ukraine over critical minerals or taking control of Greenland, the far more obvious destination to break China’s grip on critical minerals was always in full view.

Right here, in Australia.

This week’s historic partnership, involving joint investments in mining and processing critical minerals, including rare earths, builds on earlier investments under Joe Biden’s Inflation Reduction Act.

Beijing’s recent actions may have been the last straw. But it is not the first time it has wielded its muscle with minerals.

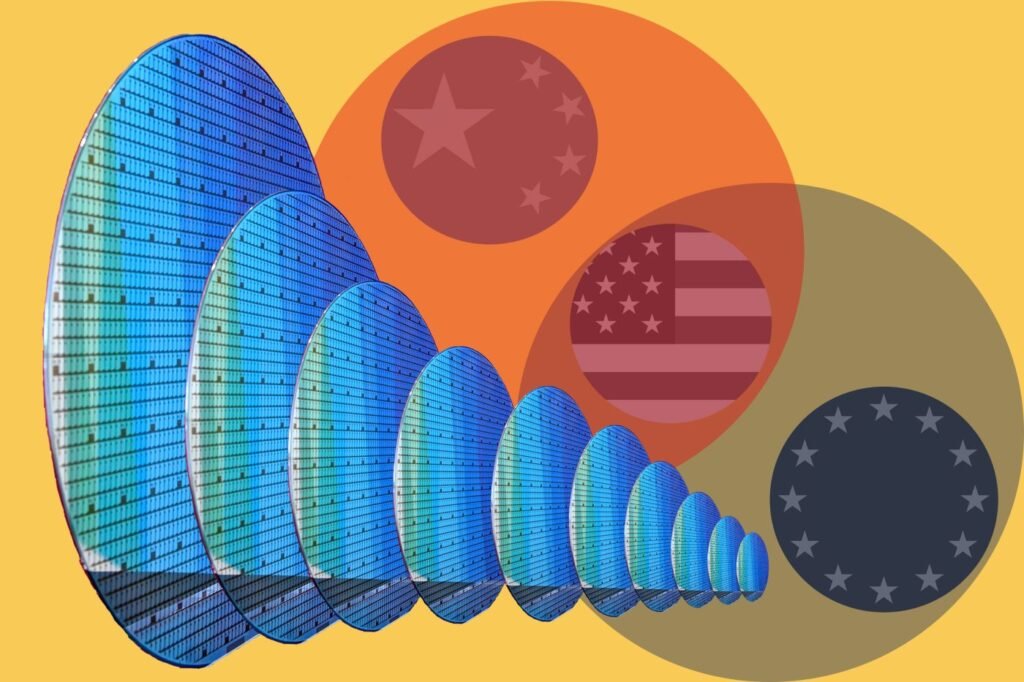

It restricted exports of gallium and germanium — key materials in the creation of microchips — in December after the Biden administration refused China access to the high-grade chips required for artificial intelligence.

But the power plays go back years. The Middle Kingdom has engaged in not-so-subtle and, occasionally, nefarious tactics to entrench its near-monopoly position on much of the global metal trade.

And it has never been afraid to use the power that a monopoly delivers to impose its will and punish nations it considers hostile.

Heavy metal but no music

America dominates the global financial system. The Middle East controls energy.

What is not generally known is that China, during the past 40 years, has created a vice-like grip on the mining, refining and production of global metals.

It is not just nickel, lithium, graphite and cobalt — the materials essential for battery production and the renewable energy age — where it holds the rest of the world in its palm.

It is also the world’s biggest producer of steel, dominates aluminium smelting and production, and has an outsized influence on copper.

Australian Strategic Policy Institute national security program director John Coyne points out that China currently controls production of 29 commodities, including 22 metals and seven industrial minerals.

That delivers it power on both sides of the demand and supply equation.

Commercial miners of many of these minerals have almost no option but to send their raw material to China for processing.

With such a stranglehold over the supply of refined material comes pricing power.

Australia and the US have formed a partnership to combat China on critical minerals. (AAP: Lukas Coch)

“Where China does not possess a near monopoly, it can control the market through ‘monopsony’, a market condition featuring one overbearingly and singularly important customer,” Dr Coyne said.

“While it does not produce the most essential battery materials — lithium, cobalt and graphite — it buys, refines and exports them to incomparable degrees.“

But when it comes to rare earths, China has no rival. Blessed with ample deposits, it deliberately embarked upon a plan for global domination as early as 1992 when Deng Xiaoping expressed a desire to mimic the Middle East’s stranglehold on energy.

Huge government investment and lax environmental concerns helped. But Beijing also nurtured expertise in refining with massive investments in research.

It then ventured into manufacturing, creating a near-monopoly around the production of “permanent magnets”, which are now essential components in everything from smartphones to robotics and missiles.

Rare earths refining is a difficult and dirty business. And it takes years to build into a profitable enterprise.

But it has now become hugely strategic from a national security perspective, which has shifted priorities within the West in an ever more hostile world.

Essentially, China has cornered the entire rare earths ecosystem from mining to manufacturing. And it has been utterly determined to maintain that.

Price manipulation and astroturfing

A little over 15 years ago, a Chinese fishing trawler collided with two Japanese coastguard vessels near the Senkaku Islands, a disputed territory in the South China Sea.

The trawler captain was arrested and the dispute quickly escalated into a major stand-off between Tokyo and Beijing.

Within little time, China dramatically raised the stakes by imposing an unofficial embargo on the supply of refined rare earths to Japan, much like the unofficial three-year trade ban on Australian imports during the pandemic.

Startled, Japanese officials began looking elsewhere for a more secure line of supply.

They opted for an Australian company, Lynas Rare Earths, which was extracting a range of high-end rare earths from its West Australian mine at Mount Weld, which sits in the plug of an ancient volcano.

But Japan needed fully processed and refined material. To achieve that, it backed Lynas with cheap loans to build a new facility in Malaysia.

And that is when things got ugly.

Chinese supplies suddenly flooded the market, sending prices crashing.

In Malaysia, meanwhile, a community backlash over the safety of the new plant gathered momentum.

That fuelled political opposition to the project despite a clean bill of health from the International Energy Agency.

The combination of the two sent the Lynas share price crashing as the company flirted with collapse.

Loading…

The game continues

Throw forward 12 years, to June 2022.

Lynas Rare Earths, funded by the US government under the Biden administration’s Inflation Reduction Act, had just won a $US120 million ($185 million) contract with the US Department of Defence to build a heavy rare earths separation facility in Texas.

Of the 17 rare earths, seven are classified as heavy rare earths. These are the minerals vital for the production of permanent magnets, which are in heavy demand by the US military, including for the construction of F-35 fighter jets.

Once again, without warning, a community backlash to the project suddenly gathered pace, this time driven by social media posts.

It was later revealed that the campaign was run by a Chinese group called Dragonbridge, using Facebook and Twitter accounts that claimed the new plant would “expose the area to irreversible environmental damage” and “radioactive contamination”.

Lynas said it had been “the subject of disinformation campaigns in Malaysia for some years, however, this is the first time we have seen evidence of direct links between fake social media accounts spreading disinformation and political agendas”.

Rare earths are dug up and processed into concentrate in Western Australia, then shipped to the Lynas plant in Malaysia. (Reuters: Sonali Paul)

Sudden surges in supply and price manipulation have gained momentum in recent years.

Iluka Resources, an Australian company on track to complete the first heavy rare earths separation facility outside of China within 18 months, long ago lost faith in global pricing to justify the company’s investment.

Managing director Tom O’Leary has a blunt message: China is manipulating the price of unprocessed rare earths to put rivals out of business.

Specifically, he claims that the prices published by the Asian Metal index — the key source of pricing for producers — are rigged.

“Linking prices to the Asian Metal index only further entrenches China’s market power,” he told the Australian Financial Review last year.

“It is this monopolistic production, combined with interference in pricing, that is resulting in market failure, and rare earths are among the very few metals where China has demonstrated a preparedness to weaponise its control.”

Loading

![[Latest] China Oil And Gas Market Strategic Importance](https://koala-by.com/wp-content/uploads/2025/10/La22291585_g.jpg)