Stock futures are lower ahead of market open on Friday, September 12.

getty

Stock prices rose in trading Thursday after the latest inflation report confirmed higher prices in August.

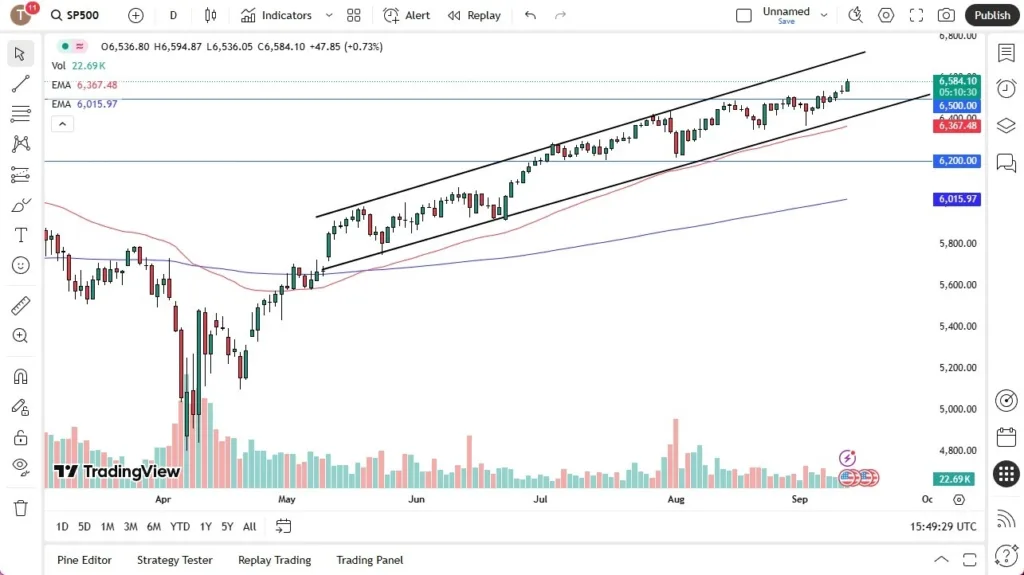

The large-cap S&P 500 index rose 0.5% while the technology-focused Nasdaq Composite rose 0.3%. The Dow Jones Industrial Average, focused on blue-chip stocks, rose 1.16%.

The Bureau of Labor Statistics reported Thursday that the Consumer Price Index, an inflation measure, rose 2.9% over the past year, after increasing 2.7% in the July. Prices on food rose 3.2%, while electricity and gas utilities combined rose 7.7%.

Higher prices strain on household budgets and could prompt a consumer spending decline. Meanwhile, recent unemployment data shows a weakening U.S. jobs market. The U.S. central bank is likely to reduce interest rates next week to stimulate jobs, but a rate cut could also drive higher prices.

Stock futures are down ahead of the market open on Friday. Futures tracking the S&P 500 fell 0.13%. Contracts tied to the technology-focused Nasdaq 100 fell 0.02%. And Dow Jones futures fell 0.21%.

ForbesHow To Take Investing Advice From Social Media: Experts Weigh InBy Catherine Brock

Investing News To Watch Today

Friday is typically a light day for economic news and earnings reports. But the latest consumer sentiment reporting is on the calendar for September 12.

The University of Michigan reports consumer sentiment measures monthly. The preliminary September report is expected to show a slight sentiment decline to 58.1 from 58.2. In August, this number was down 14.3% for the year.

Declining sentiment is concerning because it is thought to signal a slowdown in consumer spending. Consumer spending is a primary economic driver—accounting for about 70% of the U.S. economy.

The link between sentiment and spending, however, is not clearcut. A recent report from the Kansas City Fed concludes that consumer sentiment declines don’t necessarily change the spending outlook.

Today’s Trading Lesson

ForbesStudy Reveals 4 Secrets To DIY Investing SuccessBy Catherine Brock

When do you need the cash? Investing requires you to give up some cash temporarily. You put that cash into a stock or fund with the goal of increasing its value. While you wait, you don’t have the cash available to shop, pay bills or reinvest.

This points to an essential issue investors must manage: liquidity, which can mean two things:

- How easily an asset, like a stock, can be converted to cash without affecting its market value

- How easily a person or company can meet obligations with money or assets on hand

These concepts are related. If your investments cannot be sold quickly or without incurring losses, they are illiquid. If you only have illiquid assets on hand, you personally face a liquidity crisis. That can have various outcomes. A minor liquidity crunch can mean you don’t get to do the things you want, like buy a home or take a nice vacation. A deep and lingering liquidity problem can lead to unpaid bills and, eventually, bankruptcy.

Manage Liquidity To Avoid Unnecessary Losses

ForbesUnderstanding Risk Vs. Reward: What Every New Investor Should KnowBy Catherine Brock

If you have the option, you will probably sell your investments at a loss to remedy a liquidity problem before you go bankrupt. While that approach makes sense, it undermines your investment returns. In hindsight, you might have been better off not investing at all—which is why it’s essential to manage your liquidity carefully from the start.

You can manage your liquidity proactively in two ways:

- Having an emergency cash fund in place before you start investing

- Investing according to when you think you’ll need the cash

Ideally, you will invest money you won’t need for decades. That approach allows ample time for your investments to increase in value, despite any market corrections that may occur. Once that happens, if you need to sell, you can realize gains instead of losses.

If your timeline is shorter than 10 years, choose conservative assets like high-quality fixed-income funds.

Forbes5 Best Stocks To Buy For September 2025By Catherine BrockForbesHow To Retire On Dividends And How Much You NeedBy Catherine BrockForbes10 Key Financial Ratios Every Investor Should KnowBy John Dobosz