- Digital Turbine was recently selected to join the S&P MidCap 400 Index, replacing another company and highlighting the firm’s rising profile in the mobile advertising space.

- While the company’s mobile ad platform has drawn significant demand, management’s updated guidance signals a sharp slowdown from its earlier rapid growth trajectory, drawing attention to its shifting outlook.

- We’ll examine how Digital Turbine’s S&P MidCap 400 inclusion could influence its investment narrative, especially given the company’s growth outlook.

Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Digital Turbine Investment Narrative Recap

To be a shareholder in Digital Turbine, you need to believe its mobile ad platform can continue capitalizing on growing advertiser demand outside big tech “walled gardens,” while navigating a shifting growth outlook. The recent S&P MidCap 400 inclusion puts a spotlight on the company but is unlikely to materially shift the most important near-term catalyst, expanding partnerships with mobile carriers and OEMs, or the principal risk, which remains execution against slower projected growth.

Among key announcements, Digital Turbine’s exclusive partnership with Alcatel in India stands out, aiming to integrate its technology across new devices and further extend its international reach. Announcements like this align directly with the imperative to grow its global device footprint and shield revenue from saturation risks in more mature markets.

Yet, in contrast, execution risks in scaling new segments and sustaining operational efficiency remain areas investors should be aware of…

Read the full narrative on Digital Turbine (it’s free!)

Digital Turbine’s narrative projects $651.7 million in revenue and $85.3 million in earnings by 2028. This requires 9.0% yearly revenue growth and a $166.3 million increase in earnings from the current -$81.0 million.

Uncover how Digital Turbine’s forecasts yield a $6.75 fair value, a 25% upside to its current price.

Exploring Other Perspectives

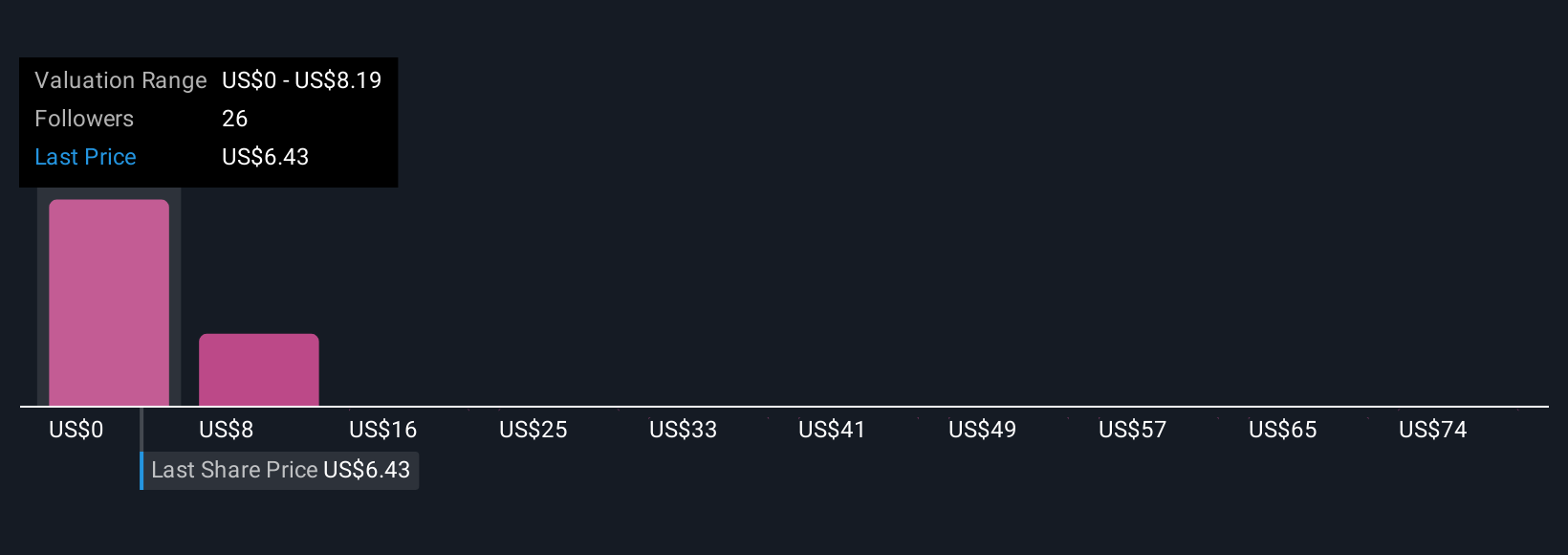

Seventeen Simply Wall St Community members estimate Digital Turbine’s fair value spans from US$8.19 to US$81.85 per share. While users express broad opinion, the company’s execution against slower guidance remains a key discussion for future performance and you are encouraged to review multiple viewpoints.

Explore 17 other fair value estimates on Digital Turbine – why the stock might be a potential multi-bagger!

Build Your Own Digital Turbine Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com