These companies are thriving today and have robust long-term opportunities.

Warren Buffett will be at the helm of Berkshire Hathaway for just a few more months, but his wisdom and guidance will continue to inspire investors to make sound decisions and stay in the market through volatility.

If you’re looking for some excellent Buffett stocks to add to your portfolio today, and you have $1,000 available to invest, consider Amazon (AMZN -0.61%) and American Express (AXP 7.21%).

Image source: American Express.

1. Amazon: Leading with AI

Buffett has said that buying Amazon stock wasn’t his idea, and that one of his investing managers made the call. However, he has professed admiration for Jeff Bezos and admitted that he missed the boat by not considering it earlier; Berkshire Hathaway only added it to the equity portfolio in 2019.

At that time, artificial intelligence (AI) was a nebulous term to many investors, even though Amazon has been using it in some form throughout its e-commerce empire for decades. When generative AI had a major breakthrough in 2022, Amazon became an immediate player, offering a wide assortment of tools and services for its Amazon Web Services (AWS) cloud-computing clients.

It’s hard to overstate the opportunity here. As CEO Andy Jassy put it, “How often do you have an opportunity that’s $123 billion of annual revenue run rate where you say it’s still early?” Amazon is investing hundreds of millions of dollars in the AI business, more than any competitor in its field, as it expands with more high-level chips and data centers, as it has more demand than capacity right now — even with its $100 billion run rate, it can’t keep up.

And that’s just AI, which isn’t even its biggest business today. That title, of course, goes to e-commerce, and Amazon controls around 40% of the U.S. e-commerce market, which itself is still growing. As Amazon improves its value proposition with more products and faster shipping speeds, it’s poised to keep its dominant position and grab greater market share.

For a company as large as Amazon to report double-digit sales growth is quite a feat, and with Amazon’s sales up 13% year over year in the 2025 second quarter, investors can be confident in Amazon’s abilities to perform, as well as its incredible long-term opportunity.

2. American Express: A distinctive payments platform

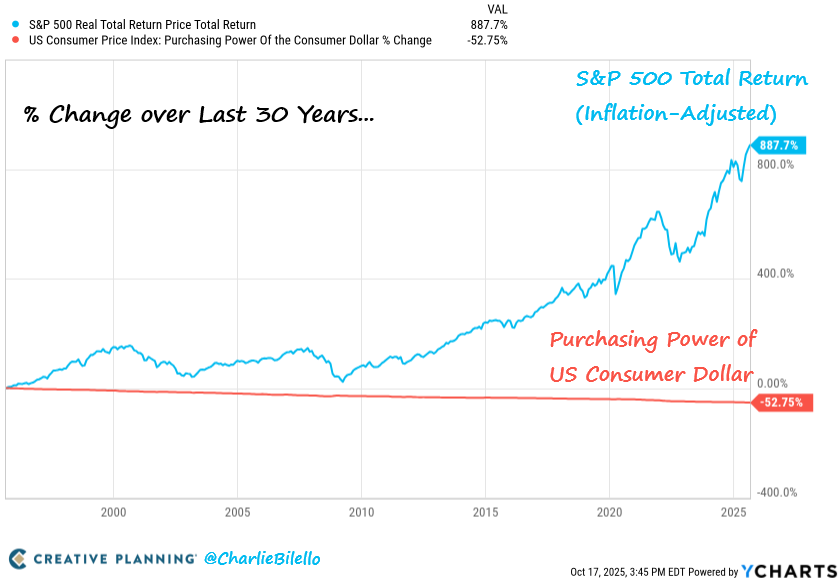

American Express is the quintessential Buffett stock, and it’s been a part of Berkshire Hathaway’s portfolio for almost 30 years.

There are many reasons Buffett loves Amex. It has a distinctive, closed-loop payments model that brings in a lot of cash through the banking segment, making money on interest in the credit card segment, and its focus on an affluent client base provides resilience and reliable spending on its credit cards.

It operates a membership model where it charges annual fees for most of its credit cards and provides an attractive rewards program with many premium perks that feed into its premium consumer base’s interests. The annual fees are a reliable revenue stream that typically grow in the high teens and go straight to the bottom line, padding the company’s profits.

American Express also pays a growing dividend that demonstrates a strong commitment to creating shareholder wealth, and in Buffett’s case, presents a huge cash flow that benefits the entire company.

The company has been performing well despite inflation, and its cards are resonating with a younger cadre of customers who are driving growth today and will continue to into the future.

In some ways, American Express is the opposite of Amazon, as a company more than a century old that has shape-shifted many times to offer value to new generations of consumers. It’s still a financial powerhouse, and investors can count on it to continue fueling spending and financial management for new cohorts of customers.

American Express is an advertising partner of Motley Fool Money. Jennifer Saibil has positions in American Express. The Motley Fool has positions in and recommends Amazon and Berkshire Hathaway. The Motley Fool has a disclosure policy.