Despite mounting speculation of a possible ‘AI bubble‘, a senior Silicon Valley investor has told City AM that some concerns may be overblown.

Anne Hoecker, Silicon Valley partner at Bain & Company and head of the company’s global tech practice, told City AM on Tuesday: “When people say a bubble, it feels like something that’s going away. But I don’t think it will go away as much as it could push out”.

“I don’t think there’s going to be a… pop”, she added.

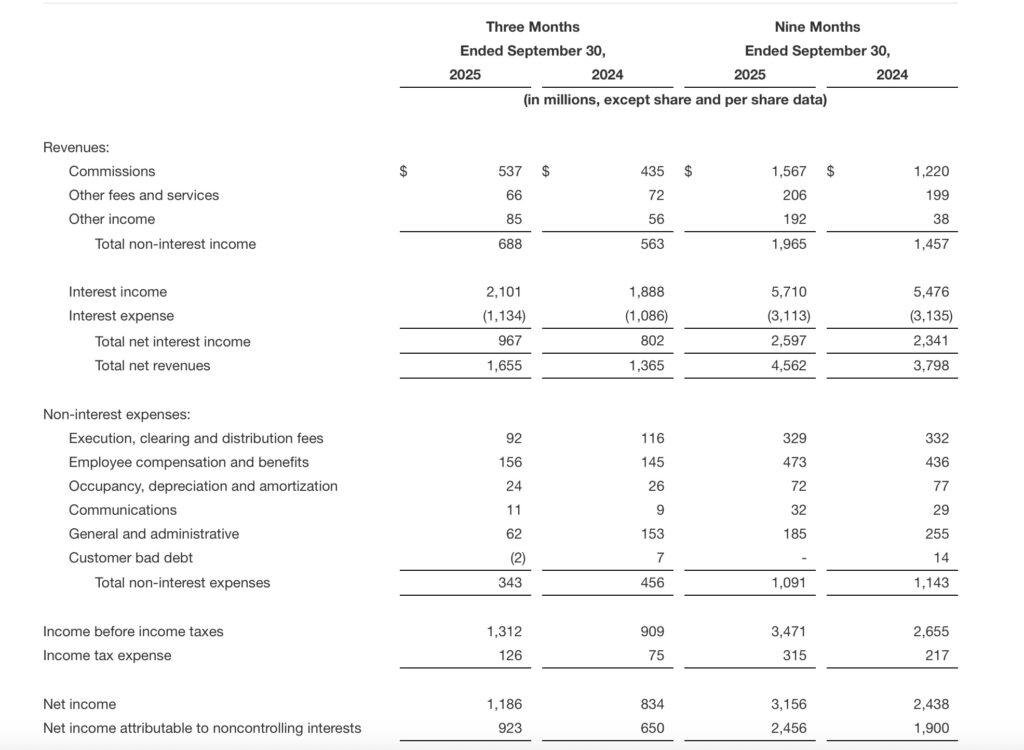

This comes as Bain released its sixth annual ‘global technology report’, highlighting the scale of investment needed to keep pace with AI’s growth.

The firm estimated that $2 trillion in annual revenue will be required by 2030 to fund the computing power needed for AI demand.

$2 trillion and counting…

According to Bain’s findings, the world will need around $2 trillion in annual revenue to fund the compute power required for AI by 2030.

But its research found that even if enterprises reinvest all AI-driven savings from sales, marketing, customer support, and R&D into new data centres, a shortfall of around $800bn remains.

“If the current scaling laws hold, AI will increasingly strain supply chains globally”, said David Crawford, chairman of Bain’s Global Technology Practice.

“By 2030, technology executives will be faced with the challenge of deploying about $500bn in capital expenditures and finding about $2tn in new revenue to profitably meet demand”.

The report estimated global incremental AI compute requirements could reach 200 gigawatts by 2030, with the US accounting for half of that power.

Hoecker explained that much of the investment will come from enterprise efficiency gains.

“Companies are embedding AI into products or helping people become more efficient. That covers more than half of the $2 trillion,” she told City AM when asked about the AI bubble.

The remainder, she predicted, will come from innovation-driven new business models: “That $800bn gap we think really will get closed by new business types, new innovation, things that we haven’t even thought of before”.

AI challenges vs opportunities

Data complexity and legacy systems remain the main barriers to enterprise adoption.

Hoecker told City AM: “Big organisations have very complex data. Governance, IP concerns, and behavioural change in employees are huge factors. To get real value from AI, you have to rethink your business processes”.

Power supply, she added, is the long-term bottleneck: “The short term is still chips, especially packaging. Long term, in a three-year perspective, it’s power”.

Bain forecasts that innovation in cooling, energy efficiency, and distributed power generation will be essential to keep pace with demand.

However, Hoecker argued that a degree of caution is warranted: “Scaling is hard. There is a risk of not scaling fast enough. Many companies get stuck in proof-of-concept mode, with hundreds of use cases that never deliver real value”.

Meanwhile, sovereign AI and global supply chains are emerging as strategic considerations, Hoecker added.

“Practicality will overrule purity. No country will have its own chips, memory, and models running entirely domestically. Businesses need to move boldly where confidence is high and prioritise flexibility where uncertainty rules”, she said.

“It’s disruptive, probably more than past tech innovations, and it will hit all parts of the economy”, she said. “It’s not a linear rise, but nor is it a bubble that will suddenly pop,” Hoecker concluded.