Traders work on the floor of the American Stock Exchange.

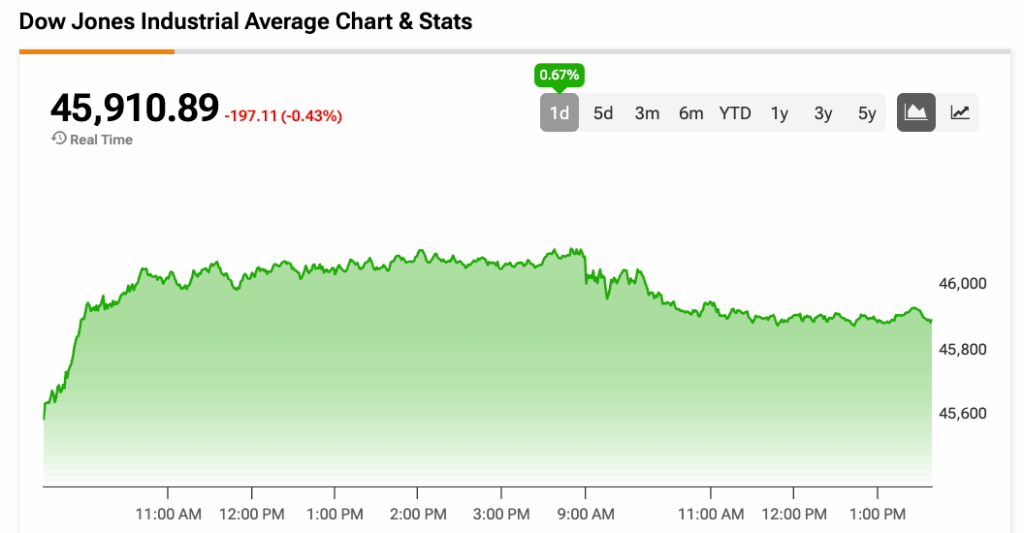

(Bloomberg) — A $14 trillion rally that has taken stocks to record highs is heading for an inflection point next week, with investors expecting the Federal Reserve to resume cutting interest rates at its long-awaited monetary policy meeting.

Most Read from Bloomberg

The S&P 500 Index is up 32% from its April lows, buoyed by bets that the Fed will lower borrowing costs several times this year, and a 25-basis point reduction on Wednesday is seen as a lock. Bullish traders may have history on their side: The index has been 15% higher, on average, a year after cuts resumed following a pause of six months or more, data from Ned Davis Research going back to the 1970s show. That compares to a 12% gain in the same period after the first cut of an ordinary cycle.

The worry is whether the Fed has acted quickly enough to head off an economic hard-landing that would undercut the case for stocks to rise further. Though growth remains relatively strong and corporate profits are healthy, ominous signs have cropped up in recent data, including a jobs report that showed unemployment at its highest level since 2021. Investors are employing a range of strategies to take advantage of an expected shift, from buying shares of smaller companies to sticking with the megacap names that have led markets higher.

“We’re in a unique moment,” said Sevasti Balafas, chief executive officer of GoalVest Advisory. “The big unknown for investors is how much is the economy slowing and by how much will the Fed need to cut rates. It’s tricky.”

With the Fed’s post-meeting statement set to be released at 2 p.m. on Wednesday, investors will look for changes in the latest quarterly rates projections, known as the dot plot, and pore over Chair Jerome Powell’s remarks a half-hour later.

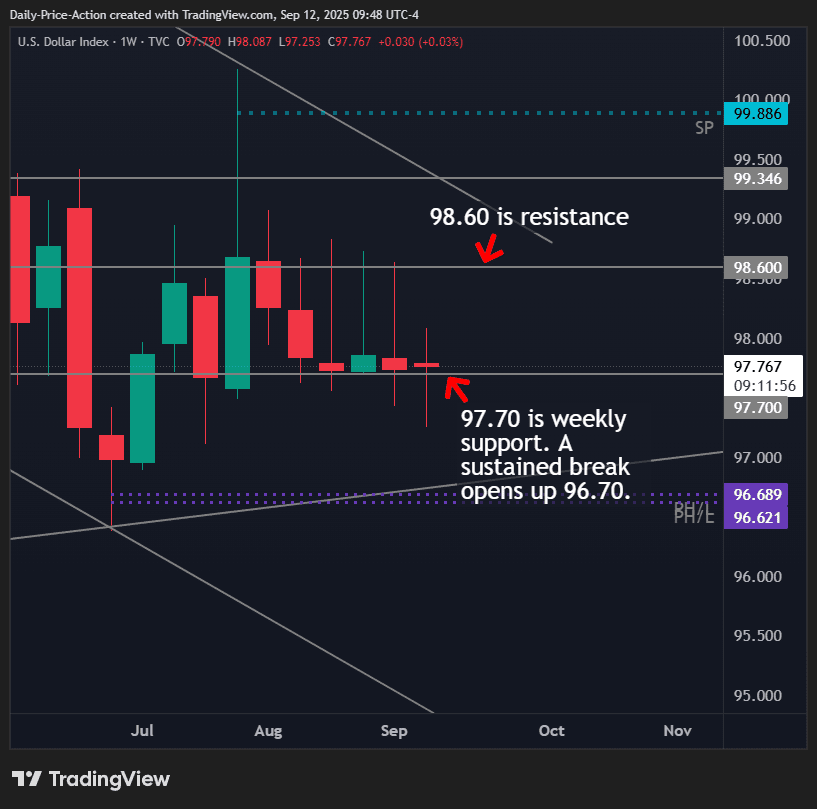

Swaps contracts are fully pricing in at least a quarter-point reduction, with policymakers expected to restart an easing cycle they halted in December. Roughly 150 basis points of cuts are priced in over the next year. An outlook from the Fed echoing that view would be an encouraging sign for stock bulls, who have largely banked on a gradual easing path that keeps the economy from sliding into a recession.

More broadly, “how inflation and economic trends play out in the rest of 2025 and next year will be crucial in determining how the Fed’s easing cycle will progress and how the stock market will fare,” said Andrew Almeida, director of investments at financial planning platform XY Planning Network.

Stock Sectors

The strength of the economy and pace at which the Fed reduces borrowing costs could dictate equity investors’ sector preference, if history is any guide.

In the four cycles where the Fed delivered only one or two cuts after pausing, the economy was generally strong and cyclical sectors like financials and industrials outperformed, according to data compiled by Rob Anderson, US sector strategist at Ned Davis Research. However, in cycles where four or more cuts were needed, the economy tended to be weaker and investors leaned more defensive, with health care and staples delivering the highest median returns.

“This market hinges on three factors: how quickly the Fed cuts rates and by how much, whether the AI trade continues to drive growth and if tariffs risk sparking higher inflation,” said Stuart Katz, chief investment officer at Robertson Stephens, a wealth management firm.

To Katz, an unexpected fall in producer prices seen in August’s data has helped ease worries that sticky inflation would prevent the Fed from cutting rates too deeply in the months ahead. He has been buying shares of small-capitalization companies, which tend to be highly indebted and benefit from lower rates. The small-cap focused Russell 2000 Index is up around 7.5% this year, compared with the S&P 500’s nearly 12% gain.

Investors with similar hopes have looked to comments from Powell, who last month said inflation effects from President Donald Trump’s trade war will be “relatively short-lived” and expects a “one-time shift in the price level.”

Others have been eyeing less-traveled areas of the market. Almeida, of XY Planning Network, is betting on mid-cap stocks: though the category has been often overlooked, it has typically trounced both large and small caps a year after rate cuts start, he said. Almeida also favors shares of companies in the financial and industrial sectors that could benefit from lower borrowing costs.

Balafas, of GoalVest Advisory, owns shares of Nvidia Corp., Amazon.com Inc. and Alphabet Inc., a bet that a gradual economic slowdown is unlikely to upend corporate profit growth.

That said, signs that the economy is cooling faster than anticipated could see equity investors ditch those bets in favor of plays that are more defensive. The S&P 500’s healthcare and consumer staples sectors, for example, have both returned an average of around 20% during cycles when the Fed needed to cut rates deeply, data from Ned Davis Research showed.

“If growth slows, the Fed will cut rates, but if the economy stalls too much, recession risks will rise,” said Katz, of Robertson Stephens. “So just how comfortable are investors with the economy slowing? Time will tell.”

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.