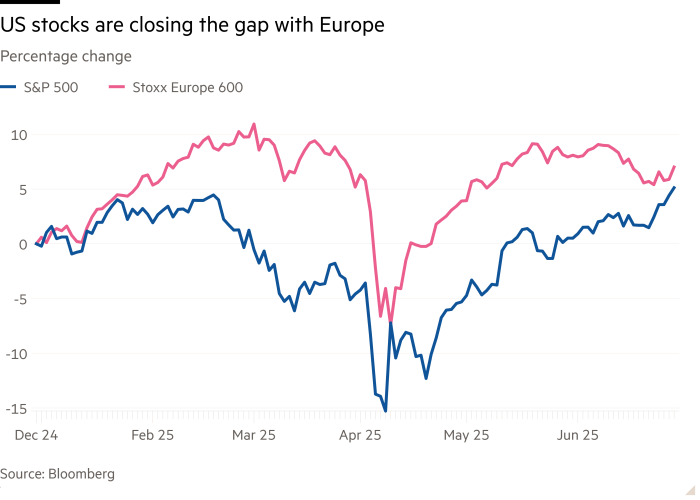

Asian shares climbed on Monday, powered by unrelenting demand for technology stocks as S&P 500 futures soared to another record high, while the US dollar remained under pressure ahead of key labour market data.

The bullish momentum in Wall Street’s tech sector driven by megacaps like Nvidia, Alphabet and Amazon, sent Nasdaq futures up 0.3%, and S&P 500 e-minis 0.2% higher. Japan’s Nikkei gained 1.0%, South Korea’s market added 0.5%, while the MSCI Asia-Pacific index excluding Japan edged up 0.1%.

The dollar weakened as investors braced for a softer US nonfarm payrolls report, expected a day earlier due to Friday’s holiday. Economists forecast a 110,000 job increase in June with unemployment ticking up to 4.3%, potentially reinforcing expectations of a July rate cut by the Federal Reserve.

Michael Feroli, JPMorgan’s head of US economics, noted continued job market softening. “The unemployment rate in June should tick up to 4.3%, with a significant risk of reaching 4.4%,” he said.

Markets are currently pricing in 63 basis points of rate cuts this year, with the odds of a July easing standing at 18%—numbers likely to shift on any labour data disappointment.

Meanwhile, attention also turned to the slow progress of a US tax and spending bill, with the Congressional Budget Office warning it could add US$3.3 trillion to national debt, raising concerns about foreign appetite for US Treasuries.

Despite debt jitters, 10-year Treasury yields held steady at 3.27%, cushioned by the growing prospect of Fed rate cuts.

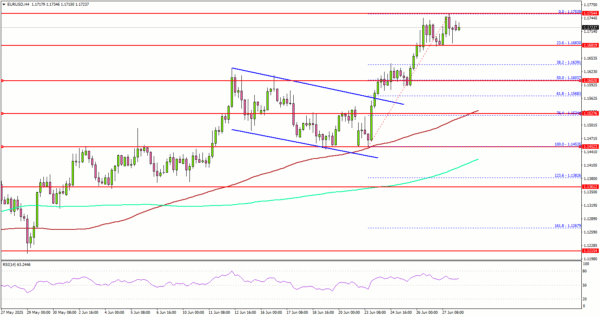

The dollar index dipped to 97.163, as the euro rose to $1.1731, its highest since September 2021 and sterling hovered near $1.3719. Against the yen, the dollar slipped to 144.48 after a 1% weekly loss.

James Reilly of Capital Economics highlighted a historic trend. “The dollar has fallen more so far this year than in any other since 1973,” he said, suggesting further weakness could become self-reinforcing.

Fed Chair Jerome Powell is expected to speak at the ECB’s Sintra forum on Tuesday, where markets will look for more signals on US monetary policy.

In commodities, gold retreated to US$3,266 an ounce, sliding further from April’s record US$3,500, while oil prices extended losses. Brent crude fell 55 cents to US$67.22, and US crude dropped 68 cents to US$64.84, amid concern over OPEC+ output plans.

Reuters