Also in the letter:

■ Data centre certification push

■ Festivities to fuel lending

■ Google’s Australia blow

Taxman floats crypto code, quizzes industry

India’s top tax authority is testing the waters for a new legal framework for virtual digital assets (VDAs), raising the prospect of a reset in how crypto is regulated and taxed.

State of play: The Central Board of Direct Taxes (CBDT) has sent a detailed questionnaire to crypto platforms. It asks whether India needs a comprehensive VDA law, which agency— Securities and Exchange Board of India (Sebi), Reserve Bank of India (RBI), Ministry of Electronics and Information Technology (MeitY) or Financial Intelligence Unit – India (FIU-IND)—should oversee it, and how current tax rules are shaping trade.

- Crypto players were also asked if the 1% tax deducted at source (TDS) on every sale is excessive, what an equitable rate would be, and whether traders should be allowed to set off losses against profits.

- Other questions covered offshore migration of trading volumes, derivatives clarity, and readiness for the OECD’s crypto-asset reporting framework.

Zoom out: India currently taxes crypto gains at 30% and disallows loss offsets, unlike stocks. Many traders and platforms have shifted to Dubai, where policy is friendlier.

The big picture: Advocates say India may introduce a comprehensive VDA law this year, aligning with G20 commitments. The global trend is toward regulation, not prohibition, with China the lone exception.

Also Read: Perplexity offers users free access to Indian stock market and crypto data

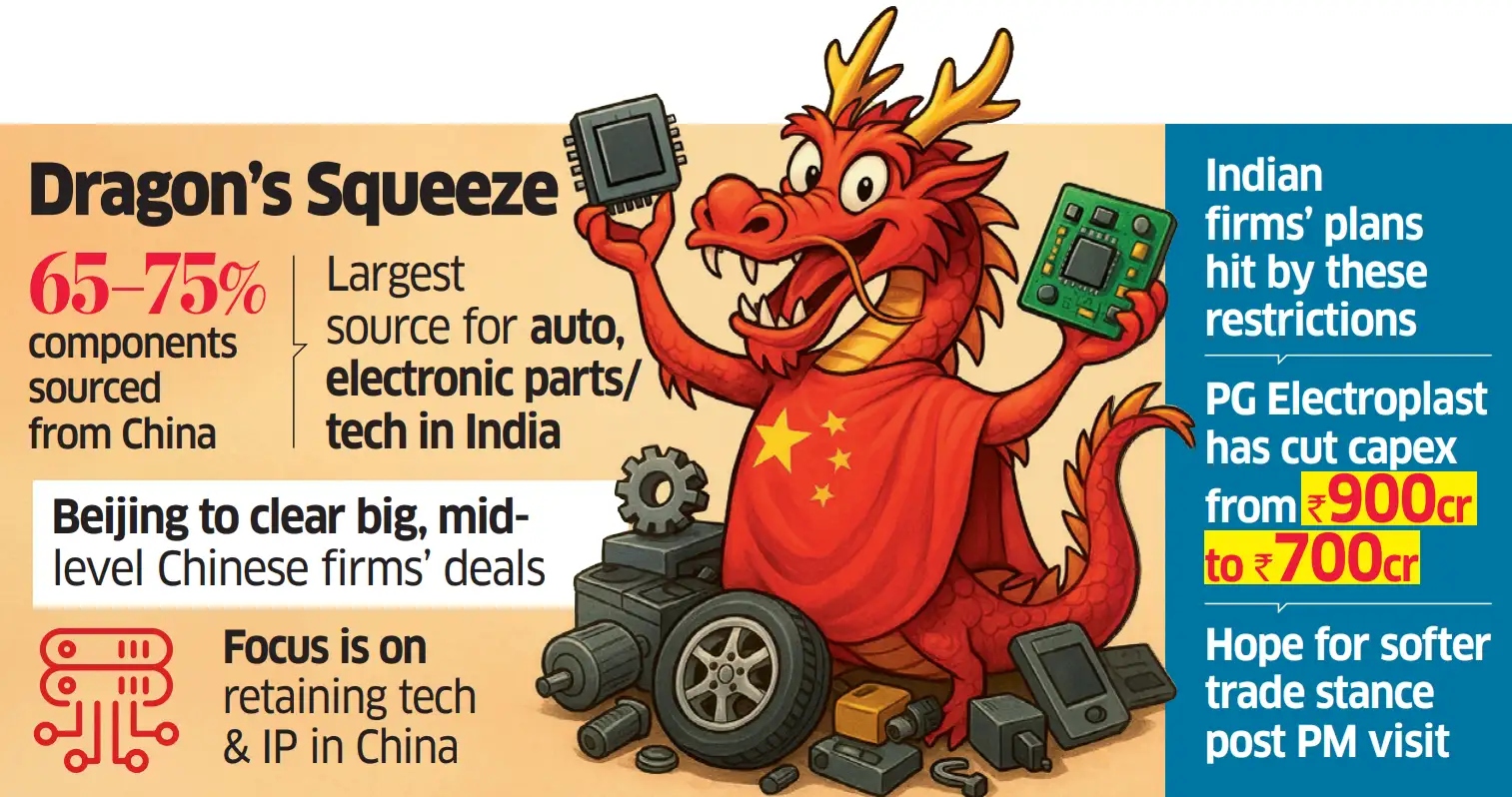

Beijing drags its feet on tech deals, holding back Indian JV plans

As Prime Minister Narendra Modi prepares to visit China for the first time in seven years, Indian companies are struggling with delays in securing approvals for technology partnerships.

Driving the news: Chinese authorities are taking longer to clear deals involving technology transfer, even when commercial terms are agreed.

- Haier’s plan to sell up to 50% of its India business to Bharti Group is delayed over the approval of transfer conditions.

- PG Electroplast’s compressor joint venture with China’s Highly Group is also stuck, pushing timelines for its new plant.

Why it matters: Indian electronics and auto parts makers rely heavily on Chinese technology. Delays could slow capex plans and dent India’s ambitions in EV and consumer durables manufacturing.

Between the lines: Industry insiders say Beijing has issued “verbal instructions” to scrutinise technology-transfer deals, especially in electric vehicles, to protect its lead.

What’s next: Analysts say China is treating tech with the same strategic lens it applies to rare earths. India, meanwhile, continues to vet Chinese investments under Press Note 3. Modi’s trip is expected to include trade talks on rare earths and critical inputs, but frictions remain.

AI moats and market makers: The ultimate soonicorn playbook drops in five days

Description: ET Soonicorns Summit 2025 is bringing India’s most ambitious AI and startup conversation to Bengaluru: From Research Labs to Revenue Models—The Billion-Dollar Blueprint for Scaling Indian AI Startups.

Power sessions:

- From the horse’s mouth! Know how to build an Indigenous Tech Stack in the AI Age with Mohit Saxena, the man who founded a unicorn when unicorns barely existed. This fireside chat features the Co-founder and CTO of InMobi and Glance, in conversation with Deepak Ajwani, Editor, EconomicTimes.com.

- Unravelling AI Moats for Market Leadership! An AI-focused panel featuring unicorn founders Piyush Shah, President & COO, Glance and Co-founder, InMobi, and Saahil Goel, Managing Director & CEO, Shiprocket.

- The grand finale fireside chat—‘The Mindset of Market Makers: Lessons from Building India’s First Scaled Meat Brand’. Listen to Samidha Sharma, Editor, ETTech, in conversation with Abhay Hanjura and Vivek Gupta, Founders of Licious, on leadership lessons from the trenches.

What are you waiting for then? Register now before the seats are filled!

Govt pushes ahead with national data centre certification

The Indian government is pressing ahead with plans to roll out a national certification framework for data centres, despite industry concerns over duplication with global standards.

Driving the news: Officials told ET that the Ministry of Electronics and IT (MeitY), along with Trai, TEC, and BIS, are working to establish India-specific norms for construction, operations, and security of data centres.

- The Standardisation Testing and Quality Certification (STQC) directorate is drafting the certification scheme, covering land use, power consumption, and security measures.

- Back in 2022, Trai had already recommended national-level standards, pushing BIS, TEC, and STQC to collaborate.

Why it matters: Data centres are becoming critical infrastructure for AI, fintech, and cloud services. Officials argue national standards are essential for security and resilience.

Between the lines: Industry players question the need for India-specific certification when international frameworks already exist. They worry that additional compliance could raise costs and slow rollout.

What’s next: The government is likely to finalise guidelines this fiscal. MeitY and other agencies see certification as a foundation for attracting investment, even as companies lobby for lighter-touch norms.

Fintechs bet on festive revival of unsecured lending after slowdown

After a year-long regulatory squeeze, fintechs and NBFCs are preparing for a rebound in unsecured lending, with the festive season expected to spark fresh demand.

State of play: RBI’s 2023 move to raise risk weights on unsecured loans forced banks and NBFCs to tighten credit, hitting fintechs dependent on consumer and merchant loans.

- BharatPe is scaling consumer lending through its NBFC, Trillionloans, and says it is ready to ramp up disbursals during festivals.

- Paytm reported strong Q1 growth in its lending business and expects more monetisation over the next 6–12 months.

- NBFCs such as L&T Finance and Poonawalla Fincorp are also seeing recovery signs in microfinance and unsecured segments.

Zoom out: Credit rating agency Icra projects Rs 19–20.5 lakh crore in incremental credit expansion this fiscal, up 10.8% year-on-year. Fintechs are eyeing a significant share.

The big picture: Executives believe the worst of the stress is over but caution that recovery will be gradual. Rate cuts will take time to flow through, and lenders remain wary. H2 FY26, especially Q4, is expected to be strong. Festive spending will be a critical test of whether the unsecured lending cycle has truly turned.

Google slapped with $36 million fine in Australia

Google has agreed to pay AU$55 million ($36 million) after Australia’s competition regulator accused it of signing anticompetitive deals with Telstra and Optus.

Driving the news: The deals, in place from late 2019 to March 2021, required the telcos to exclusively pre-install Google Search on Android devices, shutting out rivals.

- In exchange, Telstra and Optus got a share of Google’s ad revenues.

- Regulators said the contracts “substantially lessened competition,” reducing consumer choice.

- Google admitted the agreements were anticompetitive and pledged to adjust its contracts.

Why it matters: The ruling highlights how Big Tech leverages default settings to cement dominance — an issue under scrutiny globally, including in the US and EU.

Also Read: Meta says will appeal ‘unlawful’ EU fine

Between the lines: The fine comes as AI-driven search reshapes competition. Regulators argue that limiting search options at a time of disruption could stifle innovation.

Also Read: Apple takes fight against $587 million EU antitrust fine to court

What’s next: Google must comply with enforceable undertakings to remove restrictions from contracts with telcos and device makers. The case sets a precedent for how regulators may treat similar deals in other markets.

Recent Big tech fines: The European Commission recently imposed fines under the Digital Markets Act earlier this year: €500 million on Apple for preventing app developers from steering users to cheaper options outside the App Store, and €200 million on Meta for forcing users to choose between personalized ads or paying for ad-free access. Both companies are challenging the rulings.