Bullish view

- Buy the AUD/USD pair and set a take-profit at 0.6600.

- Add a stop-loss at 0.6400.

- Timeline: 1-2 days.

Bearish view

- Sell the AUD/USD pair and set a take-profit at 0.6400.

- Add a stop-loss at 0.6600.

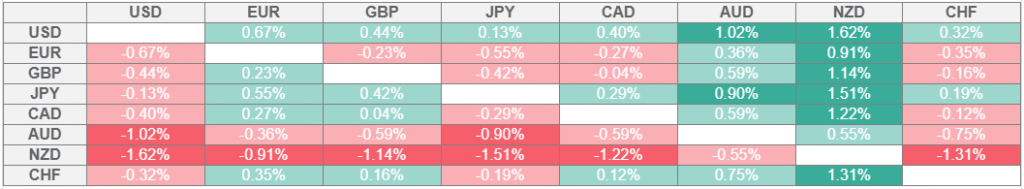

The AUD/USD exchange rate was stuck at a key support level after the latest Australian jobs and United States consumer and producer inflation data. It was trading at 0.6500, a few points below last week’s high of 0.6570.

Australia Jobs and US Inflation Data

The AUD/USD pair moved sideways after Australia published a mixed jobs report last week. In a statement, the Australian Bureau of Statistics (ABS) showed that the economy created 24.5k jobs in July after adding 1,000 in the previous month.

The closely watched unemployment rate improved to 4.2% from 4.3% in the previous month, while the participation rate remained at 67% for the month.

These numbers came a week after the Reserve Bank of Australia (RBA) slashed interest rates by 25 basis points. Officials hinted that they will continue to review labor and inflation data to determine when to cut rates.

The AUD/USD pair reacted to the latest US consumer and producer inflation data, which showed that tariffs were having an impact on prices.

The data showed that the headline consumer price index remained at 2.7% in July, while the core inflation rose to 3.1% as it moved further away from the Fed target of 2.0%.

Another report showed that inflation expectations continued rising, leading to concerns on whether the Federal Reserve will start cutting interest rates in September, as analysts were expecting.

There will be no major economic data from the United States and Australia this week. Therefore, market participants will focus on Jerome Powell’s speech at the Jackson Hole Symposium on Friday.

Historically, the Fed uses this speech to set the tone on what to expect when the bank meets in the September meeting.

AUD/USD Technical Analysis

The daily timeframe chart shows that the AUD/USD exchange rate was trading at 0.6500 on Monday, up from this month’s low of 0.6420. It has retested the lower side of the ascending channel and moved above the 100-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) has remained at the neutral point at 50. Therefore, the pair is likely to remain within this range on Monday as traders await the Jackson Hole Symposium. The key support and resistance levels to watch will be at 0.6420 and 0.6600.

Ready to trade our free Forex signals? Here are the best forex platforms in Australia to choose from.

Crispus Nyaga is a financial analyst, coach, and trader with more than 8 years in the industry. He has worked for leading companies like ATFX, easyMarkets, and OctaFx. Further, he has published widely in platforms like SeekingAlpha, Investing Cube, Capital.com, and Invezz. In his free time, he likes watching golf and spending time with his wife and child.