- The New Zealand dollar initially did try to rally during the trading session here on Friday, as we are testing the crucial 50 day EMA.

- The 50 day EMA of course attracts a lot of attention in and of itself.

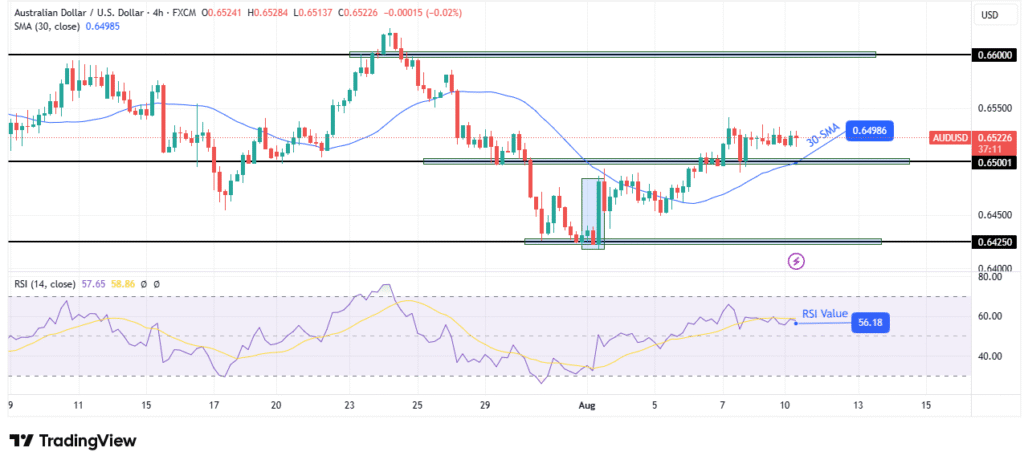

- I think that might be causing some of this sell off, but the New Zealand dollar just hasn’t performed as well as many other currencies against the US dollar, right along with the Australian dollar.

Both have been moving the same as you would expect. And we have made lower highs and lower lows. So if we fall from here, that could be the first sign that there’s something serious going on. A breakdown below the 200 day EMA could open up a move down to the 0.5850 level. But if we break down below there, look out below.

If We Rally

On the upside, if we can clear the 0.60 level, then it opens up an attack on the 0.6050 level, an area that previously had shown quite a bit of resistance. Ultimately, I think you’ve got a situation where traders are going to be looking at this through the prism of trying to get things to finally break out of this somewhat quiet range, but you should also keep in mind that this is the dead of summer.

So, volume is a little bit of an issue as there are concerns out there about the global economy and the overall risk appetite of traders in general. I think the New Zealand dollar will continue to be lackluster to say the least. Ultimately, I do favor the downside mainly due to the fact you get paid to short this pair, but right now, the Federal Reserve, a lot of people are expecting them to cut rates. So, I think you’ll continue to see a lot of noisy behavior, but overall, I do favor selling signs of exhaustion, just like the exhaustion that we saw on Friday.

Ready to trade our daily Forex analysis? Here’s a list of the brokers for forex trading in New Zealand to choose from.

Christopher Lewis has been trading Forex and has over 20 years experience in financial markets. Chris has been a regular contributor to Daily Forex since the early days of the site. He writes about Forex for several online publications, including FX Empire, Investing.com, and his own site, aptly named The Trader Guy. Chris favours technical analysis methods to identify his trades and likes to trade equity indices and commodities as well as Forex. He favours a longer-term trading style, and his trades often last for days or weeks.