Euro area borrowing costs lower after German inflation data

Euro zone bond yields are extending declines this morning after regional German inflation data.

The June consumer price index in the key industrial state of North-Rhine Westphalia came in at 1.8% on the year down from 2% in May, and and was down 0.1% on the month. Preliminary national inflation data will be released this afternoon.

The 10-year German bond yield, the euro area’s benchmark, was more than 2 basis points lower at 2.57%. The German 2-year yield was last down 2 basis points at 1.85%.

— Jonathan Stayton, Jenni Reid

Fed’s Bostic says inflation outlook won’t be clear by July

The U.S. Federal Reserve is unlikely to have enough clarity on the trajectory of the U.S. economy to justify an interest rate cut in July, Atlanta Fed President Raphael Bostic told CNBC’s “Squawk Box Europe” on Monday.

“We’re only going to have one more measure of inflation. We’re going to have a lot that’s unknown about how other policies are impacting the labor market. And without that kind of clarity, I don’t think it’s going to be my view that it’ll be appropriate to move in any direction at this point,” Bostic said.

Tackling the issue of when the data might be sufficient to support a move, Bostic said the Fed would be closely monitoring how businesses and consumers respond to tariffs and other economic factors.

“I’m hearing more [businesses] say that they may not expect this whole thing to play out, to where they’re at their final strategy, till even 2026, so this could be a much more extended period than I think many expect,” he told CNBC.

— Jenni Reid

European stock markets open slightly higher

European stocks opened in the green on Monday, with the Stoxx 600 index up 0.1% in early deals, building on last week’s gains. Global sentiment appears broadly robust, with Asia-Pacific stocks turning mixed but U.S. futures remaining higher.

In Europe, sectors are mixed, with autos down 0.6% and banks slipping 0.25% as financial services gain 0.6%.

Beneficiaries of the U.K.-U.S. trade deal, which took effect this morning, are slightly higher, having already notched strong gains on the previous announcement. Those include engine-maker Rolls-Royce, up 0.6%, and German automaker BMW, up 0.26% — though Aston Martin shares are 0.1% lower. The U.K.’s FTSE 100 is up 0.1%.

Stoxx 600 index.

Sterling higher, UK stocks to open in green as U.S. trade deal comes into effect

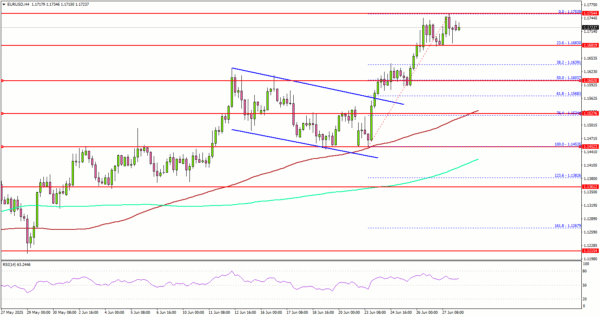

The British pound, which last week hit an almost four-year high against the U.S. dollar, is up 0.1% against the greenback at 7:39 a.m. in London to around $1.373. Futures data meanwhile points to higher opens for both the FTSE 100 and the broader FTSE 250.

GBP/USD.

Monday marks the start of the trade deal between the U.K. and U.S. which was brokered last month. Key details include British car export tariffs being reduced from 27.5% to 10%, along with duties on aerospace goods such as engines and aircraft parts being slashed to zero.

The U.K. has still been left with a baseline 10% tariff and an outlined agreement that will put zero tariffs on core steel products has not been finalized.

The U.K.’s statistics agency meanwhile on Monday confirmed that economic growth for the first quarter of 2025 was 0.7%, in line with its previous estimate.

— Jenni Reid

Here are the opening calls

The London skyline on Sept. 15, 2023.

Yui Mok – Pa Images | Pa Images | Getty Images

Welcome to CNBC’s live blog covering all the action in European financial markets on Monday, and the latest regional and global business news, data and earnings.

Futures data from IG suggests a positive start for European markets, with London’s FTSE looking set to open unchanged at 8,794, Germany’s DAX up 0.3% at 24,104, France’s CAC 40 up 0.3% at 7,709 and Italy’s FTSE MIB up 0.2% at 39,911.

The positive start for Europe comes after similar sentiment in Asia-Pacific markets overnight, as investors parsed details on trade negotiations and data points, including Japan’s industrial output figures for May and China’s manufacturing activity for June.

Meanwhile, U.S. stock futures rose early Monday as investors look to cap an exuberant month for stocks, despite uncertainty over global trade negotiations.

— Holly Ellyatt

What to watch for today

Market watchers in Europe will be looking at the latest inflation data out of Italy and Germany on Monday, as well as German retail sales, for signs of inflationary pressures and a hit to consumer confidence.

Traders will also be digesting data out of China earlier that showed manufacturing activity contracted for a third straight month in June, despite Beijing’s stimulus efforts helping to stabilize certain aspects of the industrial sector.

— Holly Ellyatt