- Wall Street is bullish on U.S. stocks this morning, with S&P 500 futures strongly up, premarket. Traders seem to think that Trump will eventually be forced to make a trade deal with China that keeps rare earth materials and AI chips flowing between the two.

S&P 500 futures are strongly up this morning after the index fell by 2.71% on Friday, when investors reacted with dismay to President Trump’s threat to impose a new set of 100% tariffs on China. The reversal in favor of optimism this morning suggests investors now think Trump will eventually chicken out and Washington and Beijing will come to a deal.

Trump may not have a choice: China holds an unexpectedly strong hand in the trade war, and the U.S.’s tariffs have been counterintuitively positive for China.

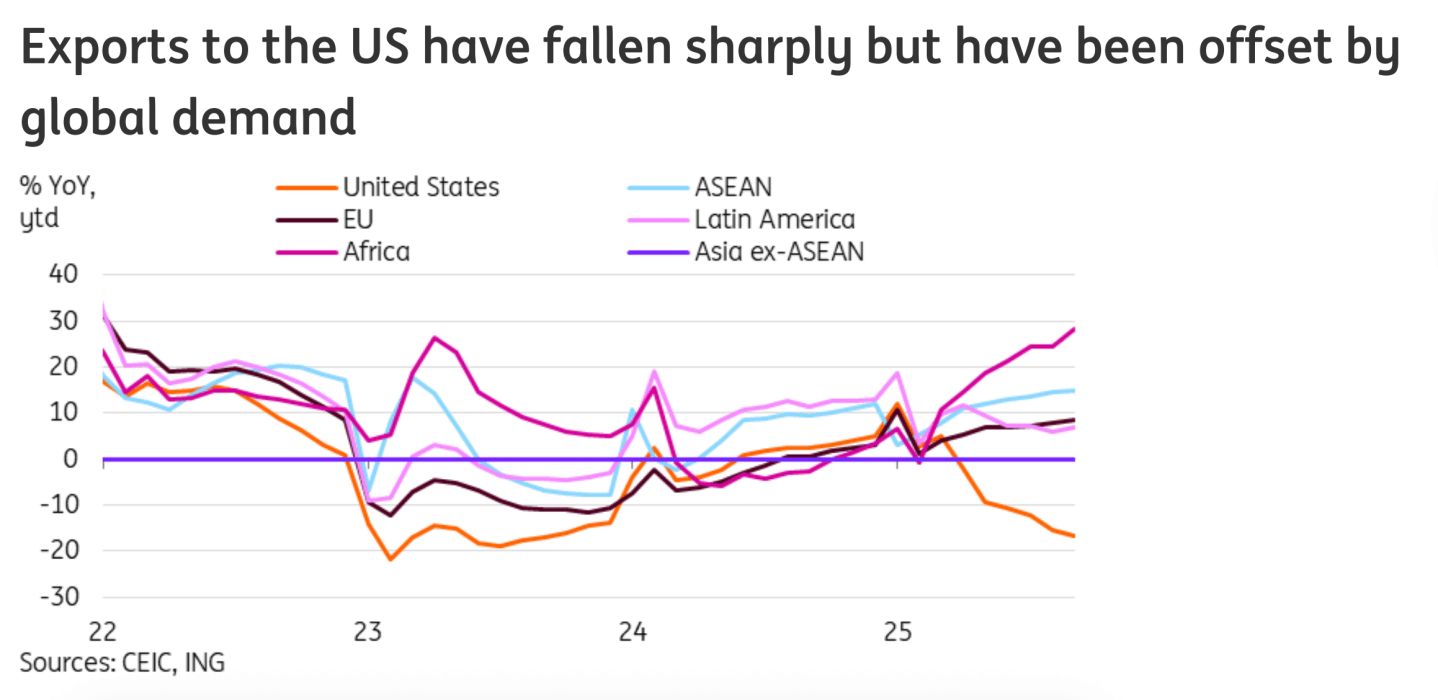

Chinese exports were up 8.3% in September year over year, according to RBC’s Peter Schaffrik, an increase from 4.4% the month before. The increase beat analyst expectations. Although China’s exports to the U.S. fell by 27% year on year, exports to Europe and Asia rose sharply as other nations took advantage of the U.S.’s withdrawal from the Chinese market. Trade to Africa, for instance, was up a massive 57%.

“The bigger surprise was the surge of imports to hit a 17-month high. This resilience shows that China has strengthened trade with the rest of the world amid US protectionism,” ING’s Lynn Song told clients this morning.

She also noted that while import prices to the U.S. have gone up due to the tariffs, prices of Chinese goods have fallen for the rest of the world: “Trade volume [is] generally outpacing trade value growth, indicating that export prices have generally fallen due to heavy competition.”

Trump’s tariff threat came after China announced it would impose export controls to the U.S. on rare earth minerals. China controls up to 90% of the rare earth market, and the minerals are needed by the West for everything from high-powered magnets, defense equipment, and semiconductor computer chips. Trump had previously placed export restrictions to China on Nvidia’s best-quality AI chips.

That would make life extremely difficult for U.S. tech companies, if Trump can’t negotiate an alternative, according to Dean Ball, a former senior advisor in the White House Office of Science and Technology Policy. “We should not miss the fundamental point on rare earths: China has crafted a policy that gives it the power to forbid any country on Earth from participating in the modern economy,” he wrote on X.

With the two nations apparently at an impasse, and China potentially holding the upper hand, investors bailed out of U.S. stocks on Friday. By Sunday, Trump apparently felt he needed to soothe everyone’s nerves with a post on Truth Social: “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!”

There is good reason to believe that Trump and Xi will eventually work things out. U.S. tariffs on China (currently suspended) don’t actually come into effect until November 10, and Trump and Xi will likely both be at the Asia-Pacific Economic Cooperation summit that starts on October 31. Trump loves to make a deal, especially if he can do so face-to-face.

Here’s a snapshot of the markets ahead of the opening bell in New York this morning:

- S&P 500 futures were up 1.33% this morning. The index closed down 2.7% in its last session.

- STOXX Europe 600 was up 0.4% in early trading.

- The U.K.’s FTSE 100 was flat in early trading.

- Japan’s Nikkei 225 was down 1.01%.

- China’s CSI 300 was down 0.5%.

- The South Korea KOSPI was down 0.72%.

- India’s Nifty 50 was down 0.19% before the end of the session.

- Bitcoin was down to $115.4K.