Markets brace for US jobs data as the Trump and Musk divorce goes public

- Tesla stock plunges as President Trump and Elon Musk divorce gets heated.

- All eyes now turn to US jobs data for a check on the health of the economy.

- The likeliest outcome may also be the most painful for stocks and the dollar.

Financial markets were buzzing with morbid delight as brewing animosity between US President Donald Trump and his heretofore “first buddy”, billionaire industrialist Elon Musk, finally spilled out in public. Shares of Mr. Musk’s pioneering EV automaker Tesla Inc (TSLA) plunged 14.3%. That is its eighth-worst daily outcome on record.

The fireworks came after Musk’s criticism of the President’s flagship fiscal policy effort – the “One Big Beautiful Bill” (OBBB) now being debated in Congress and aiming to make permanent the tax cuts from Trump’s first term in office – reached fever pitch. He accused the Trump of covering up links to disgraced financier Jeffrey Epstein.

Stock markets wobble as President Trump clashes with Elon Musk

In response, the President said Musk “went crazy” after a measure to do away with the federal EV mandate was included in OBBB and threatened to strip the billionaire’s universe of companies – including SpaceX – of their federal contracts. TSLA stock lost about $152 billion in market capitalization in the aftermath, its biggest one-day loss ever.

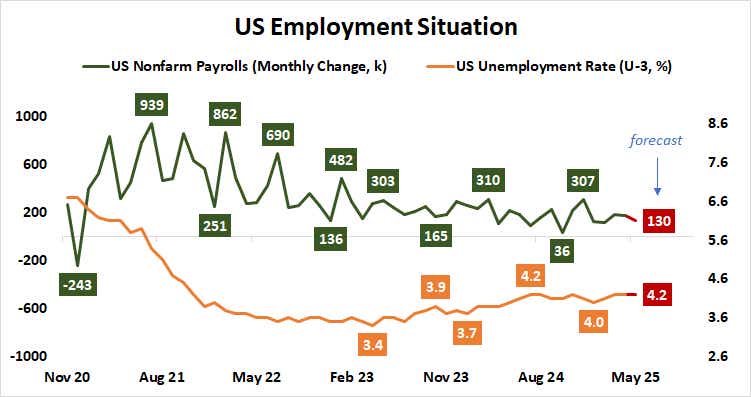

All this makes for a complicated backdrop as markets brace for the release of closely watched US employment data. The report is expected to show a rise of 130,000 in nonfarm payrolls. The unemployment rate is expected to remain unchanged at 4.2% for the third month straight.

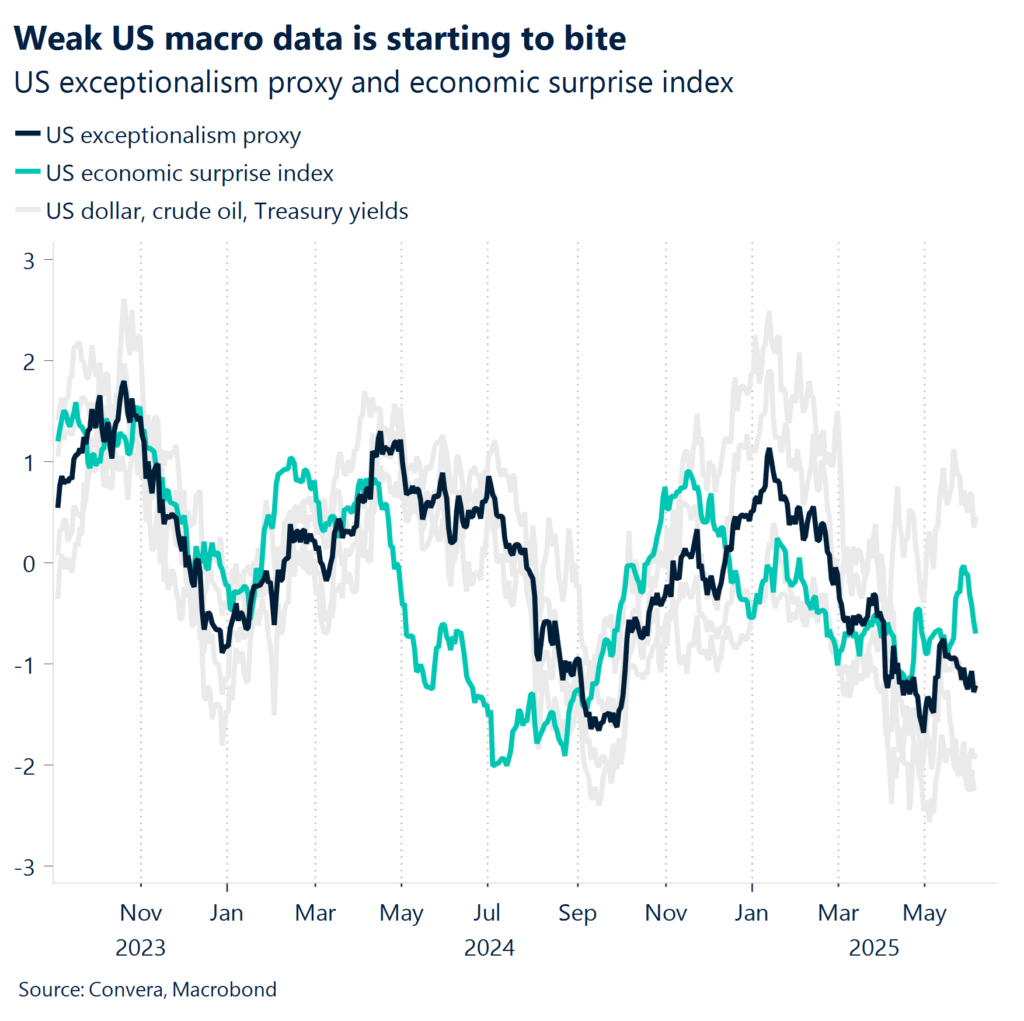

Conflicting cues abound ahead of the release. An estimate of private sector hiring from ADP Inc ahead of the official release produced a rise of just 37,000 jobs, the smallest since January 2021. The four-week average of initial jobless claims jumped to 235,000 in the last week of May, the highest in seven months.

US jobs data: the likeliest outcome may be the most painful

On the other side of the ledger, purchasing manager index (PMI) data from Institute of Supply Management (ISM) said job creation returned to the mission-critical services sector in May after two months of retrenchment. Staffing contracted again on the manufacturing side, but at the slowest pace since February.

A blistering US stocks rally stalled and longer-term Treasuries began to rise two weeks ago as traders seemingly concluded that the Federal Reserve will be slow to respond to a weakening economy amid tariff policy uncertainty. Jobs data broadly in line with expectations would sustain this status quo, pressuring Wall Street and boosting bonds.

In the unlikely event of a sharply positive surprise, stocks may cheer while yields rise as markets brush off noisy headlines to conclude that the underlying economy is still mostly healthy. An equally negative one may get a warm welcome as well, with traders reasoning that the Fed will come off the sidelines sooner rather than later.

Ilya Spivak, tastylive head of global macro, has 15 years of experience in trading strategy, and he specializes in identifying thematic moves in currencies, commodities, interest rates and equities. He hosts #Macro Money and co-hosts Overtime, Monday-Thursday. @Ilyaspivak

For live daily programming, market news and commentary, visit #tastylive or the YouTube channels tastylive (for options traders), and tastyliveTrending for stocks, futures, forex & macro.

Trade with a better broker, open a tastytrade account today. tastylive, Inc. and tastytrade, Inc. are separate but affiliated companies.