The record-setting rally in stocks is stumbling this week.

US stocks dropped on Thursday as traders took in strong economic data, revised their expectations for Fed rate cuts, and took in wearing momentum in the AI trade. All three major US indexes slipped lower in the early morning, putting them on track for their third straight day of losses.

Here’s where US indexes stood at 11:15 a.m. ET on Thursday:

Here’s why the rally is taking a breather.

1. Bond yields are climbing

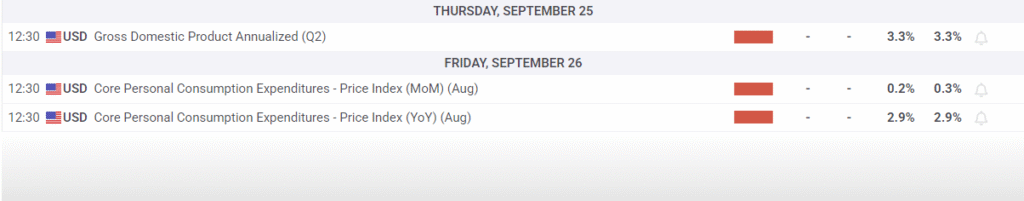

Bond yields rose on Thursday as the market took in two pieces of solid economic data:

- The economy continues to grow. Real GDP rose 3.8% over the second-quarter, according to the latest estimates from the Bureau of Economic Analysis. That’s faster than the 3.3% growth rate that was previously estimated.

- Fewer jobless claims. New applications for unemployment benefits eased to 218,000 in the last week, down from the 235,000 claims economists were expecting.

Both figures point to resilience in the economy. To investors, it’s a case of good-news-is-bad-news, as it could mean the Fed doesn’t have as much room to cut interest rates as previously thought.

The yield on the benchmark 10-year US Treasury inched up to around 4.18% on Thursday, up 18 basis points since it touched 4% earlier this month.

Rising bond yields hurt the appeal of stocks, as traders can park cash in a virtually risk-free asset at a relatively high yield.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

The economic data has also slightly clouded the outlook for more rate cuts.

The odds that the Fed will hold rates steady at its upcoming policy meeting doubled from 8.1% on Wednesday to 16.6%, according to the CME FedWatch tool. Still, the consensus view of another 25 basis point cut at the October meeting is still largely intact.

“On the margin the stronger economic readings likely provide less cover for additional rate cuts,” Eric Teal, the CIIO at COmerica Wealth Management, wrote in a note.

2. AI fatigue

JOSH EDELSON/Getty Images

After a fresh burst of optimism, the excitement around AI waned this week.

Oracle stock, which rose to a record high and saw its best-ever trading day after issuing colossal revenue guidance in its latest earnings, fell as much as 6% on Thursday. The stock is down 12% since Monday’s close.

Nvidia, the poster child of the AI boom, has also stumbled since it said it would invest $100 billion in OpenAI on Monday. The stock pared losses on Thursday to rise slightly by midmorning, but shares are down about 6% in three days.

“Investors trimmed their exposure to the artificial intelligence (AI) trade in a move which saw NVIDIA fall for a second day,” David Morrison, a senior market analyst at Trade Nation, said in a note about yesterday’s decline in the tech sector.

The exception is Intel, which is still seeing its stock climb after news that it was in talks with Apple for a potential investment. Shares rose 6%. It’s the latest positive catalyst for the stock since the company struck a deal with Nvidia last week.