U.S. equity futures were mostly flat on Sunday evening with the S&P 500 trading near a record high and a busy week of potential market-moving news ahead.

S&P 500 futures dipped about 0.1%. Nasdaq 100 futures drifted lower by 0.2%, while futures tied to the Dow Jones Industrial Average ticked down 45 points, or 0.1%.

The move in futures comes after all three of the major indexes notched their second-straight winning week. The S&P 500 closed above the 6,000 level for the first time since Feb. 21, and is now less than 3% away from its record closing high.

Chris Verrone, chief market strategist Strategas, said Friday on “Closing Bell” the rally shows that concerns about tariffs and the U.S. economy are easing among many traders and investors.

“The message of the market is still one that is largely pretty constructive here,” Verrone said, mentioning S&P 500 hitting a three-month high.

“Maybe most importantly, cyclicals continue to hum along. I know the data on balance has been softer, but the market’s saying ignore it. Cyclicals making new highs versus defensives says, ‘Hey, the economy’s largely OK here,’ ” he added.

The coming week will bring plenty of opportunities to either reinforce or undermine the market’s confidence.

On Monday, officials from the U.S. and China are expected to hold trade talks in London, President Donald Trump announced Friday.

In the U.S., Apple’s 2025 Worldwide Developers Conference kicks off on Monday. The tech giant’s stock has been an area of weakness this year, sinking more than 18%.

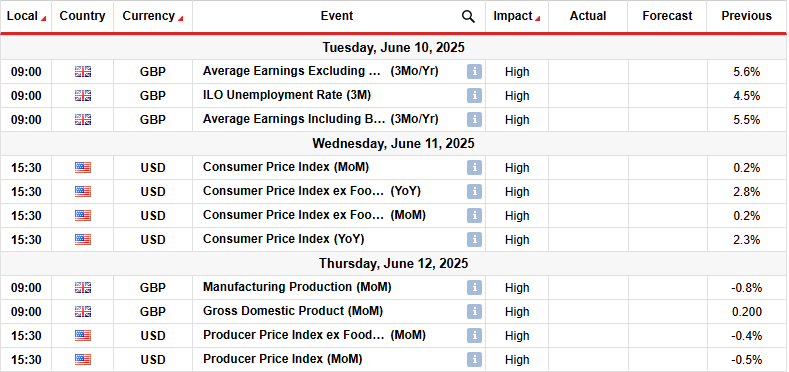

Inflation data is expected to be a key topic later in the week. The latest consumer price index is due out on Wednesday, followed by the producer price index on Friday. Traders will be looking for clues as to how the current tariff rates are flowing through the economy.

A new consumer sentiment reading from the University of Michigan — which includes data around inflation expectations — is due out on Friday.

![[Yoo Choon-sik] President Lee should look beyond market cheers](https://koala-by.com/wp-content/uploads/2025/06/news-p.v1.20250608.c3de5fa082994a0b9703c29f42d6141a_P1.jpg)