Spencer Platt/Getty Images

subscribers. Become an Insider

and start reading now.

Have an account? .

- BofA analysts say risks of a stock market bubble in the second half are building.

- The bank’s Michael Hartnett said expectations for rate cuts and lower taxes are fueling inflows to stocks.

- His team says a top trade is owning US growth stocks and international value stocks.

A Bank of America analyst sees the risk of a speculative stock market bubble increasing as expectations that the Federal Reserve will cut interest rates continue to rise.

In a note on Friday, BofA’s Michael Hartnett highlighted a shift that he sees approaching, one that could lead to complications for investors—and he also shared his view on a trade to hedge such a scenario.

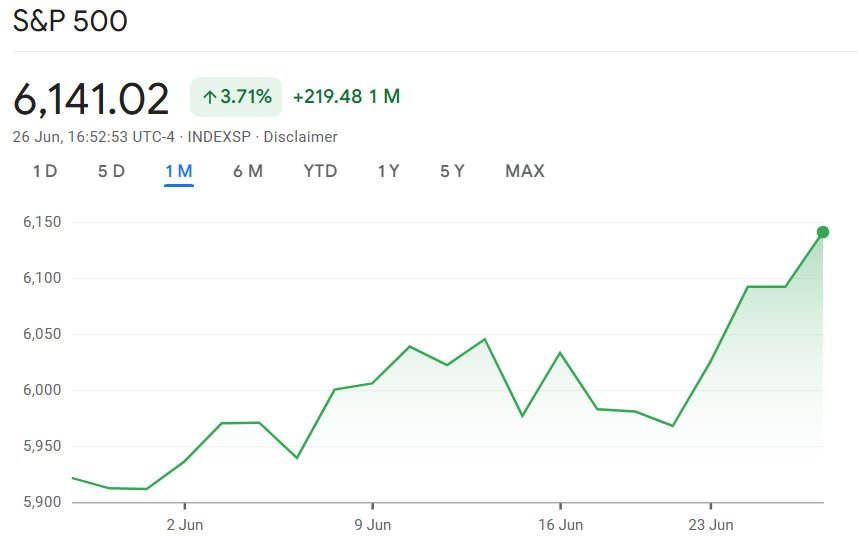

Geopolitical tensions and tariff updates from President Donald Trump have been headwinds for markets. But with the Israel-Iran ceasefire continuing to hold, the focus has shifted to the possibility of interest rate cuts in July.

Federal Reserve chairman Jerome Powell opted to leave rates steady at this month’s meeting, but several top officials since then have come out in support for a cut as soon as next month.

As Hartnett’s team sees it, investors have begun to adjust for a higher likelihood that Powell will pivot in his stance and cut interest rates. On top of that, Trump’s “Big Beautiful Bill” is likely to result in lower taxes for corporations and some households.

“H2 bubble risk high as Trump/Powell pivot from tariffs to tax cuts/rate cuts to incite US$ devaluation/US stock bubble,” Hartnett wrote.

Hartnett and his team go on to say that the best way for investors to play the market against the backdrop of a potential bubble is by owning US growth stocks and international value stocks, presenting it as a means of finding a balance between risk and reward.

They highlight this strategy as an effective way to guard against the potential impact of the predicted second-half bubble, as it offers exposure to growth in both US and international markets.

Other experts have shared similar strategies for handling this year’s high levels of market and economic uncertainty. Investor Bill Gross said this week he was eyeing a small bull market for stocks and a small bear market for bonds, highlighting the strategy of buying one and selling the other.