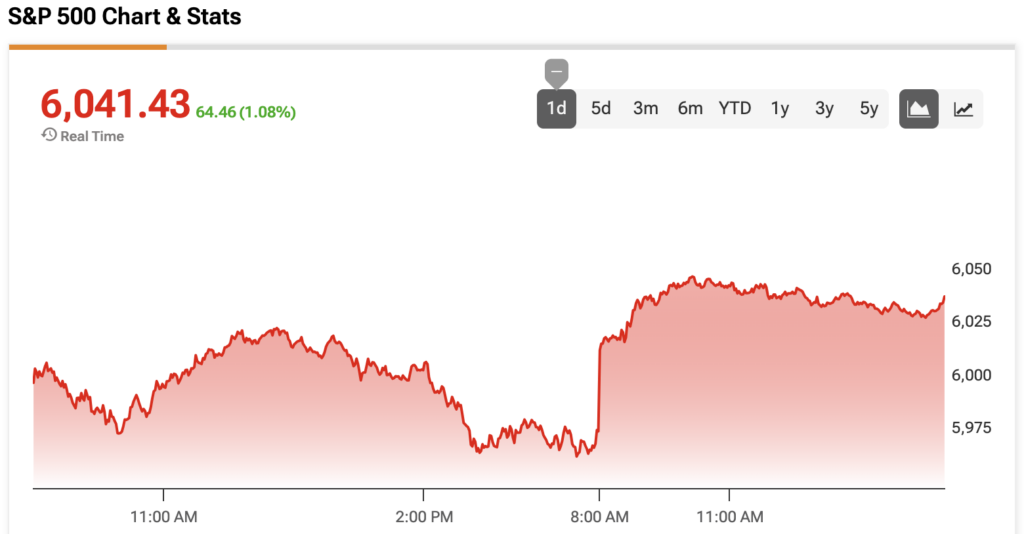

US stocks appear to be digesting the initial shock of Israel’s attack on Iran and the subsequent retaliation by Tehran, but there are three ways the conflict could drag the stock market down, RBC says.

Altogether, headwinds from the conflict could drag the S&P 500 down to 4,800-5,200 range, the bank wrote in a note on Sunday, implying as much as a 20% drop in the benchmark index.

Strategists said that, while sentiment and seasonal indicators have suggested that stocks could keep rallying, the bank’s analysis of stock valuations, earnings, and economic growth has suggested the market has “gotten ahead of itself.”

“Developments in Israel/Iran since late last week have come at a complicated time for the US equity market,” they wrote. “The broader the conflict becomes and the longer it lasts, the more problematic we think it will be for US equity markets,” they added.

Here are the three risks RBC sees hanging over stocks:

1. Risk to valuations

The price-to-earnings ratio of the S&P 500 has tended to contract in time of rising geopolitical uncertainty.

RBC US Equity Strategy, S&P Capital IQ/ClariFI, CIQ estimates, IBES estimates, Haver

The bank also said that valuations never dropped to levels that could be considered “cheap” during the April tariff meltdown, and prices are back near records now. That means valuations are looking vulnerable to any shifts in the bull narrative.

“This challenge comes at a time when stocks should be vulnerable to bad news from a valuation perspective,” the bank said.

2. The conflict could hit sentiment

Escalation in the Middle East could also cause sentiment to sour among consumers, investors, and businesses in the US.

Sentiment, particularly among investors, had been improving in recent weeks and has been a “key driver” of the latest stock rally, RBC said. Yet, that optimism could ebb if the Israel-Iran

Corporations and consumers, meanwhile, have already been displaying heightened caution. CEO confidence dropped to its lowest level in about three years in the second quarter, according to the Conference Board’s latest survey.

The Conference Board, The Business Council, NBER

Consumer confidence, meanwhile, saw a modest increase in May, but Americans generally remain concerned about tariffs, extreme weather events, and other headwinds, RBC’s analysis found.

Mentions of geopolitics and war have also been on the rise in recent corporate calls, RBC said, citing its analysis of call transcripts.

RBC US equity strategy, AAII, Bloomberg

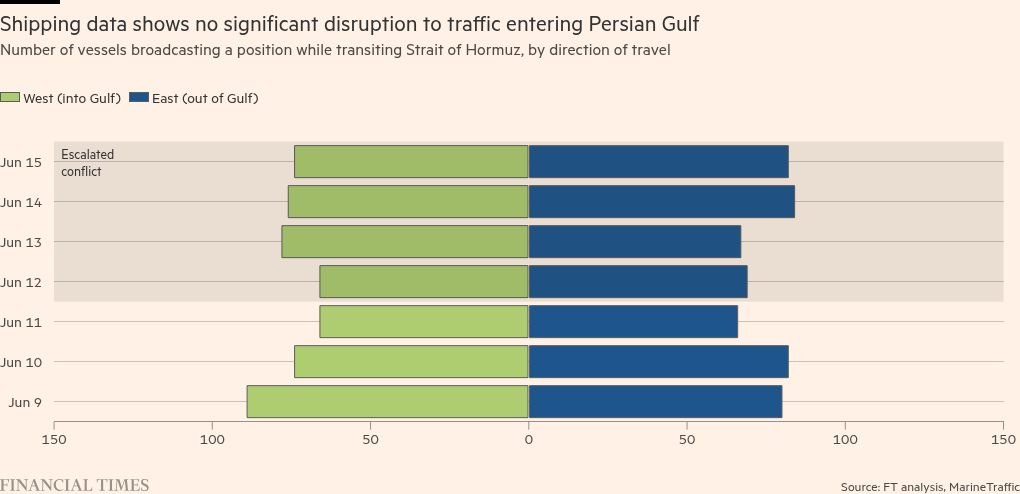

3. A spike in oil prices could drive up inflation

Associated Press

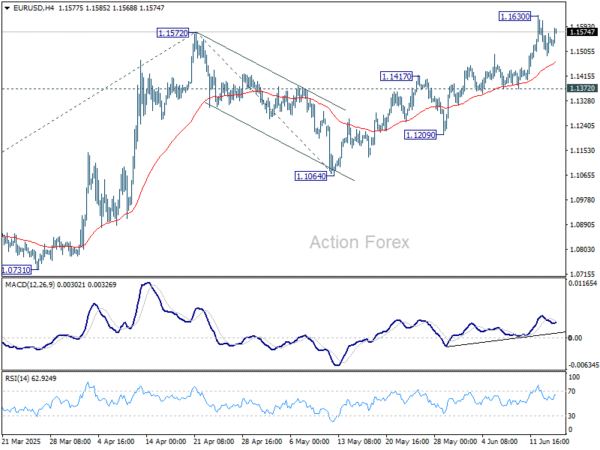

Oil prices could rise further if the conflict causes supply disruptions in the Middle East, RBC’s commodities strategists said. That could end up stoking inflation and limit Fed rate cuts in 2025 — something that could also weigh on valuations, given how much of the bull story in 2025 hinged on the central bank taking interest rates lower, the bank said.

RBC estimated that Personal Consumption Expenditures inflation, the Fed’s preferred inflation measure, could rise as much as 4% on the back of the Israel-Iran conflict. Inflation at that level could limit the Fed to just two rate cuts in the second half of the year, strategists estimated.

“This stress test points to fair value for the S&P 500 at the end of 2025 in the 4,800-5,200 range, near the bottom of our 2nd tier of fear and a retest of the early-2025 lows,” strategists wrote.

RBC recently lifted its year-end price target for the benchmark index to 5,730, implying 4% downside from the benchmark index’s current levels.

Still, most forecasters on Wall Street expect stocks to post a positive, but more muted, year of gains in 2025. JPMorgan, Citi, and Barclays recently revised their forecasts, with all anticipating the S&P 500 to end the year in the 6,000-6,300 range.