If you’re fretting over a bubble, don’t sell your stocks just yet.

That’s the takeaway from the latest Citi research, which outlined the bank’s ideal investing playbook as the stock rally continues and valuations get frothy.

The main strategy investors need to know: Stay in the market— at least until one of two indicators suggests it’s time to sell, strategists led by Adam Pickett, Citi’s head of global market strategy, said.

“On our definition, US equities are in a bubble,” strategists wrote in a client note on Friday. “Historically, markets display strong forward returns after entering a bubble, and being bearish is only beneficial once you exit bubble territory,” they added.

Stick with stocks

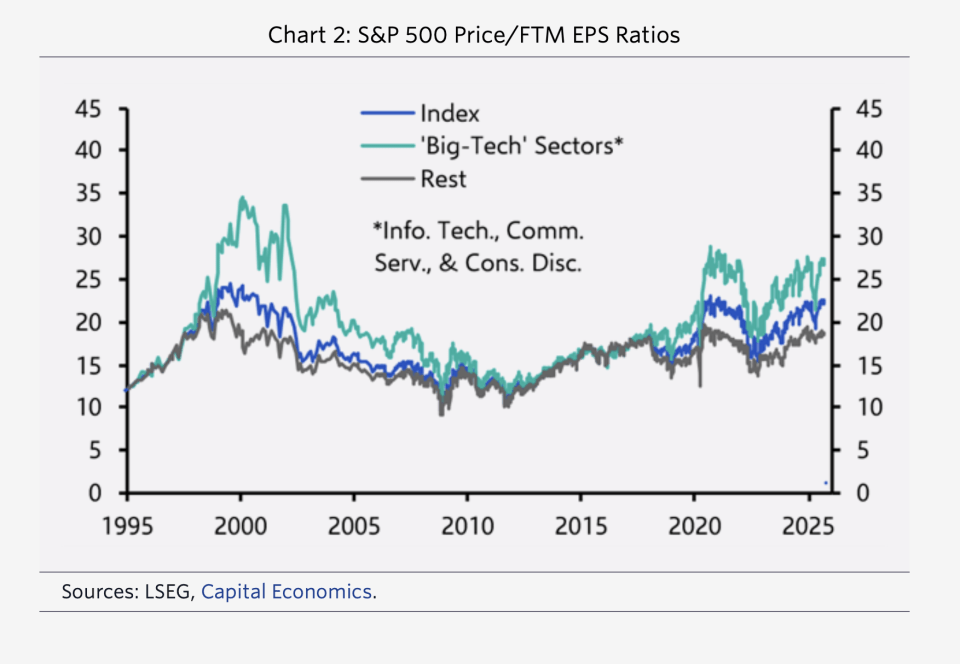

Investors have been increasingly worried about stocks being overvalued in recent months, with the S&P 500 on a seemingly unstoppable march higher in the latter half of this year.

The benchmark index is up 35% from its low in early April, and has long looked overvalued by several popular metrics, including the Case-Shiller price-to-earnings ratio and the Warren Buffett indicator.

But there are several reasons to believe that the market has further upside potential before things go south, Citi strategists said.

Related stories

Business Insider tells the innovative stories you want to know

Business Insider tells the innovative stories you want to know

- The bubble is in its early stages. The stock bubble looks young by historical standards, strategists said, citing their analysis of eight other market bubbles dating back to 1929.

- Fed rate cuts are here. The central bank has restarted its easing cycle, which is unusual during stock bubbles. “Fed will likely be cutting into a bubble when they hiked into every previous one, stay long.”

- The Fed could cut rates more than expected. Investors are expecting 75 basis points worth of rate cuts over the next six months, but Citi said it expects the Fed to cut rates by 100 basis points over that timeframe — another catalyst that could continue to boost stock prices.

“In short, don’t fade a bubble, do sell a bursting bubble,” strategists wrote.

When to sell

How do investors know it’s time to get out of the market? The strategists said there are two indicators that could tell investors it’s time to head to the exit:

-

POLLS indicator. This indicator is a composite gauge that measures market positioning, optimism, liquidity, leverage, and stress — and may signal when the bubble is beginning to pop if its reading rises past a certain level, strategists said.

The bank said it saw improvements to risk-adjusted returns if it followed a rule of “cutting out of the market” when the POLLS was at a level of 18 or higher. The indicator is currently at a level of 13.

- “When the Generals Fail” Indicator. This indicator suggests the market is “turning over” when 3 out of the 7 leading stocks in the S&P 500 are below their 200-day moving average. The indicator is also not flashing a warning for stocks at the moment, Citi added.

Other prominent bears on Wall Street have sounded the alarm for a stock market bubble in recent weeks, but sell-side analysts generally expect the market to grind higher through the end of the year and into 2026. Bank of America recently lifted its 12-month price target for the S&P 500 to 7,200, and earlier this year, Goldman Sachs bumped its 12-month price target to 6,900.