Today’s Gold Analysis Overview:

- The overall of Gold Trend: Strongly bullish.

- Today’s Gold Support Points: $4,190 – $4,140 – $4,060 per ounce.

- Today’s Gold Resistance Points: $4,260 – $4,290 – $4,340 per ounce.

Today’s Gold Trading Signals:

- Sell gold from the resistance level of $4,300, with a target of $4,050 and a stop loss of $4,360.

- Buy gold from the support level of $4,150, with a target of $4,330 and a stop loss of $4,120.

Technical Analysis of Gold Price (XAU/USD) Today:

As expected, the gold price index will remain strongly bullish. According to gold trading platforms, spot gold prices rose to the resistance level of $4,242 per ounce, a new all-time high for gold. As we mentioned in the specific technical analyses for gold, gold investors may not be concerned technically by all technical indicators reaching extreme overbought levels, as much as they are interested in the continuation of factors supporting the gold trading market. These factors include the U.S. Federal Reserve’s policy shift towards easing, increased trade tensions between the world’s two largest economies, rising global geopolitical tensions, record central bank purchases of gold bullion, and notable activity in gold Exchange-Traded Funds (ETFs).

Trading Tips:

Keep in mind that the strategy of buying gold on every strong price decline remains the best until further notice. Also, consider that after the market’s record gains, we could witness profit-taking selling operations at any time.

Will gold prices rise in the coming days? And to what extent?

According to gold analyst forecasts, the gold index appears to be undergoing its most stable upward period in years. According to commodity market analysts, the price of gold has risen by approximately 15% over the past month, with only minor pullbacks of less than 2%, indicating strong demand from both institutional and retail investors.

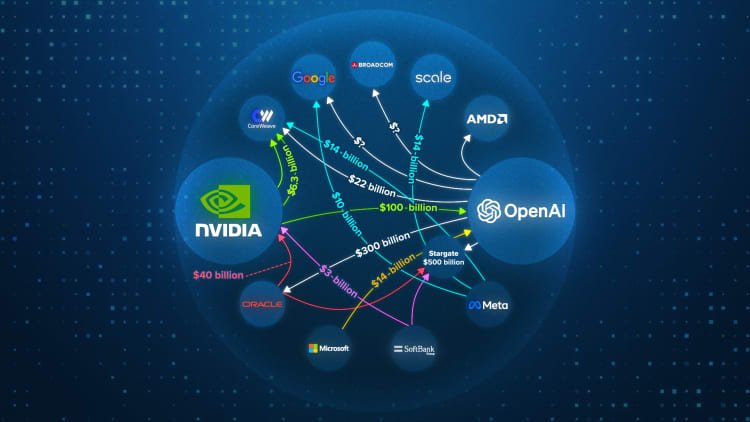

Gold trading has also become an essential component of diversified investment portfolios, with growing concerns about high U.S. stock valuations and increasing talk of a potential technology bubble. Although these concerns may be exaggerated, this perception alone continues to support gold as an anchor against these fears, which supports the continued rise in gold prices in the coming months.

Gold’s record run will continue

Across reliable trading company platforms, the price of gold rose to a record level, supported by escalating disputes between the United States and China and expectations that the U.S. Federal Reserve will continue its monetary easing policy until the end of the year, which boosted demand. During this week’s trading alone, the price of gold bullion has risen by approximately 5% and continues to climb, sustaining the sharp increase seen since mid-August. The buying wave also extended to other precious metals, with silver prices rising by more than 3% on Wednesday, as supply shortages persist in the London market.

Currently, traders are betting on at least one significant cut in U.S. interest rates by the end of the year, while Fed Chair Jerome Powell indicated this week that the U.S. central bank is on track for another quarter-point cut later this month. Lower borrowing costs tend to support precious metals, given that they do not pay interest.

For his part, President Donald Trump announced that the United States is now engaged in a trade war with China, raising concerns of prolonged damage to the global economy that could boost gold’s appeal as a safe haven, even as Treasury Secretary Scott Besant suggested extending the pause before tariffs are increased.

The ongoing U.S. government shutdown has also contributed to supporting gold prices, as has the so-called “devaluation trade,” where investors move away from sovereign debt and currencies to protect themselves from massive budget deficits. Enthusiastic buying by central banks formed another cornerstone, boosting the rise in gold prices by more than 60% so far this year.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.