By Ka Sing Chan

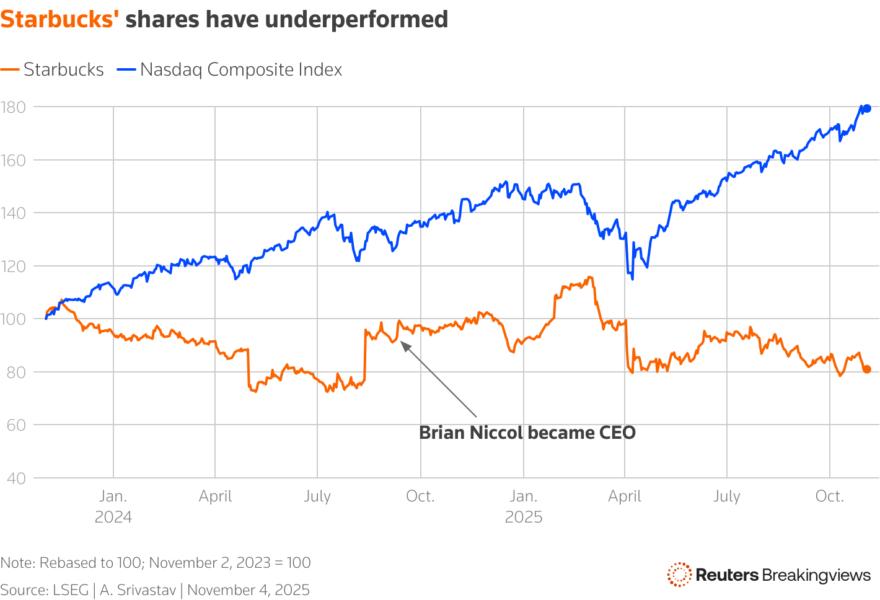

Starbucks’ SBUX long-awaited China deal is far too murky. The Seattle-based roastery on Monday announced it will sell control of its mainland retail operations to Boyu Capital in a deal worth $4 billion. Yet it also says the whole business is worth three times that amount. Licensing fees can provide an extra shot, but that still leaves a huge disconnect.

As part of the agreement, the $92 billion coffee group will form a new joint venture in which the Temasek-backed Boyu will hold an “up to 60% interest” while Starbucks will license the brand and other intellectual property to the entity. Based on a cash-free, debt-free enterprise value, the retail JV is worth approximately $4 billion – or just 8 times the $500 million in EBITDA Starbucks’ China unit is expected to generate this year, according to Reuters. That’s far lower than the parent’s multiple of 17 times and its nimbler Chinese rival Luckin Coffee’s LKNCY 11 times – albeit on the over-the-counter market.

The problem is the seller also says it expects the “total value of its China retail business” to “exceed” $13 billion. Proceeds from Boyu could account for up to $2.4 billion. The rest would reflect Starbucks’ own valuation of its retained interest in the joint venture and the net present value of its licensing fees, though the company provides details for neither.

The obfuscation on the numbers suggests Boyu has the better deal. Starbucks boss Brian Niccol will be betting his new partner, whose founders include the grandson of former Chinese President Jiang Zemin, can supersize growth in an ultra-competitive market where the American brand has lost market share. Indeed, Niccol reiterated in a statement on Monday the group’s vision to grow to as many as over 20,000 locations in the world’s second-largest economy, from 8,000 today. McDonald’s offers a useful blueprint: in 2017, the fast-food chain sold control of its China business in a similar deal; local partners, including Citic Capital, have since helped it triple its presence to more than 7,000 stores. Starbucks will be desperately hoping Boyu will lead it to a similar result.

CONTEXT NEWS

Starbucks said on November 3 it has agreed to sell control of its China retail operations to investment firm Boyu Capital.

As part of the deal, Starbucks and Boyu will operate a joint venture worth $4 billion on a cash-free, debt-free enterprise value of approximately $4 billion. Boyu will hold up to a 60% interest, while Starbucks will retain the rest and continue to own and license the brand and intellectual property to the new entity.

Starbucks also said it expects the total value of the China retail business to be $13 billion.