Stablecoin issuer Circle will list on the New York Stock Exchange (NYSE) today. It has expanded its stock offering for a second time and also raised the maximum offer price to $31. Circle and existing investors had planned to sell a combined maximum of 36.8 million shares but they expanded that by 2.3 million yesterday, including an underwriter’s option to buy 5.1 million. That means that the company and investors will raise up to $1.2 billion, which would give the company a market capitalization of just over $7 billion. Amid this good news there is a surprising finding that the company’s Chief Financial Officer, has chosen to cash out three quarters of his stock.

Circle is the second largest stablecoin issuer with its USDC having an issuance of $61.5 billion compared to market leader Tether with $153.7 billion. Currently these are the two dominant players, but they have very different market positions. Circle wants USDC to be onshore and regulated, whereas Tether is currently offshore and has withdrawn from the EU.

This market position, combined with the capital and acquisition flexibility that comes from going public, positions Circle to expand through acquisition. The stablecoin issuer doesn’t see its role as only fulfilling the basics. Apart from issuing its stablecoins on numerous blockchains, it provides a wallet solution and more recently launched the Circle Payments Network, aiming to provide banking on- and off-ramps, FX and currency liquidity. It’s a big step toward vertical integration. We can expect the company to use its newly listed stock as a means to flesh out that strategy.

While Circle positions itself for growth, the IPO has crystallized substantial personal wealth for its leadership team.

Executive stakes and IPO windfalls

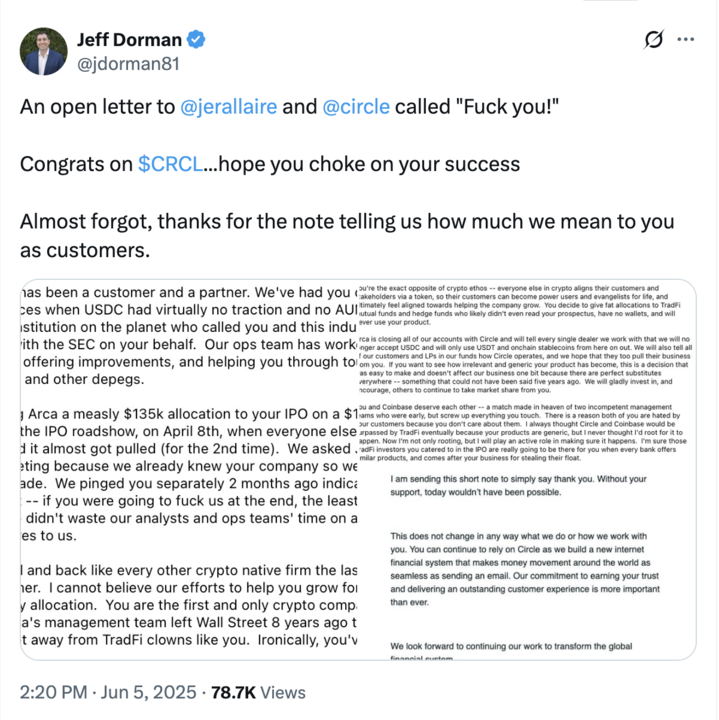

The company operates with two share classes, with Class B shares carrying special voting rights that account for 30% of all votes. Only founders Jeremy Allaire and P. Sean Neville hold Class B shares, with Allaire controlling 77.1% of this voting bloc. Despite selling $49 million worth of shares in the IPO, Allaire retains stock valued at $580 million.

Among the senior leadership team, President and Chief Legal Officer Heath Tarbert – former CFTC Chair under the first Trump administration – has built significant equity since joining Circle two years ago. His current holdings are worth $26 million, excluding stock options.

Chief Technology and Product Officer Nikhil Chandhok doubled his planned stock sale during the IPO process, ultimately selling shares worth $18.6 million and reducing his total holdings by 31%. His remaining stake is valued at $42 million.

The most dramatic selloff came from Chief Financial Officer Jeremy Fox-Green. While Circle’s prospectus initially indicated Fox-Green owned 1.6 million shares and planned to sell just 200,000, recent beneficial holdings disclosures reveal he actually sold approximately 1.2 million shares, representing three quarters of his total position.

The transaction netted Fox-Green roughly $37 million, which reduced his direct holdings to 405,000 shares. While it’s common for executives to sell portions of their stock during IPOs, Fox-Green’s actual sale was six times larger than his originally disclosed plan – a significant departure from stated intentions.