REUTERS/BRENDAN MCDERMID

Hans Vestberg, Chairman and CEO of Verizon, rings the opening bell at the New York Stock Exchange (NYSE) in New York City, today.

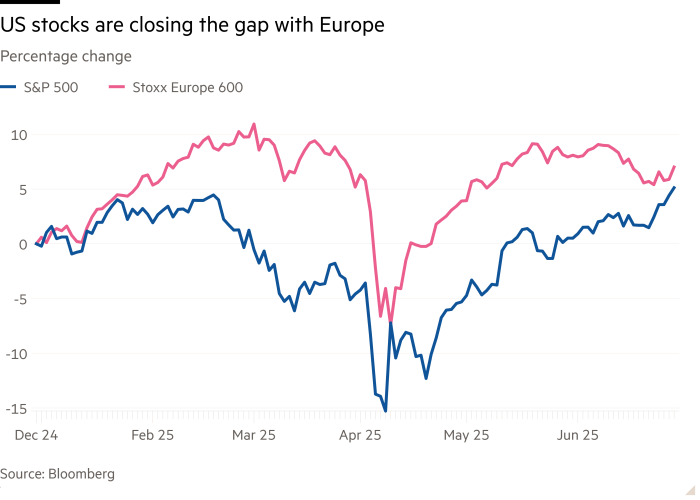

NEW YORK >> The S&P 500 and Nasdaq reached new record closing highs today, capping their best quarter in over a year as hopes for trade deals and possible rate cuts eased investor uncertainty.

Both indices ended the quarter with double-digit gains. Trade deals with China and the U.K. have fueled optimism that an all-out global trade war can be minimized, with hopes for more deals to be reached before President Donald Trump’s July 9 trade deadline.

The end of the quarter was also influenced by managers operating stocks to make their financial statements or portfolios look more attractive at the end of a reporting period.

“Animal spirits seem to have taken hold here,” said Roy Behren, co-president of Westchester Capital management fund. “It is also quite common for the last couple of days of a quarter to see strength because of the window dressing.

According to preliminary data, the S&P 500 gained 30.24 points, or 0.49%, to end at 6,203.31 points, while the Nasdaq Composite gained 96.28 points, or 0.48%, to 20,369.73. The Dow Jones Industrial Average rose 257.99 points, or 0.59%, to 44,077.26. On Sunday, Canada scrapped its digital services tax targeting U.S. tech firms, just hours before it was due to take effect, in a bid to advance stalled trade negotiations with the United States. But U.S. Treasury Secretary Scott Bessent warned today that countries could still face sharply higher tariffs on July 9, even if they are negotiating in good faith, and any potential extensions will be up to Trump. Meanwhile, U.S. Senate Republicans will try to pass Trump’s sweeping tax-cut and spending bill, despite divisions within the party about its expected $3.3 trillion hit to the $36.2 trillion national debt. Trump wants the bill passed before the July 4 Independence Day holiday.

Key economic data releases this week include monthly non-farm payrolls and the Institute for Supply Management’s survey on manufacturing and services sectors for June.

Don’t miss out on what’s happening!

Stay in touch with breaking news, as it happens, conveniently in your email inbox. It’s FREE!

Several U.S. central bank officials, including Federal Reserve Chair Jerome Powell, are scheduled to speak later this week.

A raft of soft economic data and expectations that Trump will replace Powell with someone dovish have pushed up bets of rate cuts from the Fed this year. Shares of big U.S. banks rose after most cleared the Federal Reserve’s annual “stress test,” paving the way for billions in stock buybacks and dividends.