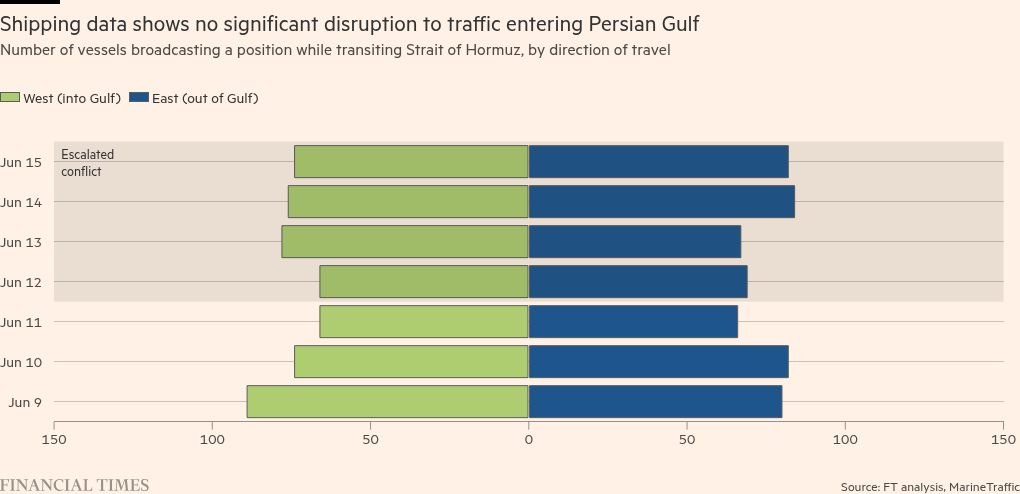

Following Israel’s strikes on Iran’s nuclear and military facilities on Friday, the conflict has now stretched into day 4 as both sides trade attacks. At the same time, the S&P 500 (SPX) has shrugged off the risk on Monday and is less than 2% from surpassing its all-time high of $6,147.43.

Confident Investing Starts Here:

Iran wants to begin negotiations with Israel, according to the Wall Street Journal. Iran has informed Arab intermediaries that it is open to discussing an end to the hostilities and its nuclear program with Israel on the condition that the U.S. does not involve itself in the conflict.

“The Iranians know the U.S. is supporting Israel in its defense, and they are sure the U.S. is supporting Israel logistically,” said an Arab official. “But they want guarantees the U.S. won’t join the attacks.”

On the trade front, a U.S.-UK trade deal is near completion and will be finalized “very soon,” said UK Prime Minister Keir Starmer. The leaders of both nations are attending the Group of Seven (G7) summit in Canada today and will discuss the terms of a deal.

The S&P 500 is up by % at the time of writing.

Which Stocks are Moving the S&P 500?

Let’s take a look at TipRanks’ S&P 500 Heatmap, which illustrates the stocks that have contributed to the index’s performance.

The Magnificent 7 stocks are leading the charge, with leaders like Nvidia (NVDA) and Meta Platforms (META) both up by about 2.5%. Elsewhere, technology stocks like Advanced Micro Devices (AMD), Palantir (PLTR), and Broadcom (AVGO) are also well in the green. AMD is up by nearly 10% following its “Advancing AI” event last week that unveiled its new Instinct MI350 chips. In addition, Piper Sandler raised its AMD stock price target to $140 from $125.

Utility stocks within the index are noticeably red, as this sector is considered defensive and tends to exhibit weakness when investors are willing to take on more risk, as shown with the strength in technology stocks today.

SPY Stock Moves Higher with the S&P 500

The SPDR S&P 500 ETF (SPY) is an exchange-traded fund designed to track the movement of the S&P 500. As a result, SPY moves in correlation with the SPX.

Wall Street expects further upside for SPY. During the past three months, analysts have issued an average SPY price target of $664.22 for the stocks within the index, implying upside of 10.27% from current prices. The 505 stocks in SPY carry 423 buy ratings, 74 hold ratings, and 8 sell ratings.

Looking for a trading platform? Check out TipRanks’

Best Online Brokers

guide, and find the ideal broker for your trades.