By Naveen Thukral and Gus Trompiz

Chicago soybeans rose on Wednesday to recover some of the previous session’s losses, as Beijing’s confirmation that it was cutting tariffs on U.S. farm goods put attention back on a trade truce between the countries.

Gains remained capped by the lack of large Chinese purchases of U.S. crops since the truce, as well as wider losses in financial markets.

Chicago wheat and corn were little changed.

China will suspend retaliatory tariffs on U.S. imports following last week’s meeting of their two leaders, Beijing confirmed on Wednesday, but imports of U.S. soybeans will still face a 13% tariff.

The news spurred some gains for futures, shifting the focus back to what U.S. officials have cited as a pledge by Beijing to buy tens of millions of metric tons of U.S. beans, including 12 million over November and December, under last week’s truce.

But there was still widespread scepticism about such demand, particularly after market sources on Monday said Chinese soybean importers have stepped up purchases of cheaper Brazilian cargoes.

The suspension of the U.S. Department of Agriculture’s flash export sales reports, which usually track large export volumes, amid a month-long government shutdown has also made it harder for market participants to confirm any sales to China.

“For soybeans, operators are waiting for concrete signs from China, while Brazilian soybeans are proving more competitive on the export market,” Argus analysts said in a note.

The most-active soybean contract on the Chicago Board of Trade (CBOT) ZS1! was up 0.65% at $11.28-3/4 a bushel, as of 1237 GMT, approaching Monday’s 16-month peak.

CBOT corn ZC1! inched up 0.06% to $4.31-3/4 a bushel and wheat

ZW1! edged down 0.23% to $5.49 a bushel.

Corn has faced supply pressure after brokerage StoneX raised its forecast of the U.S. corn yield slightly, countering recent expectations of declining yield potential.

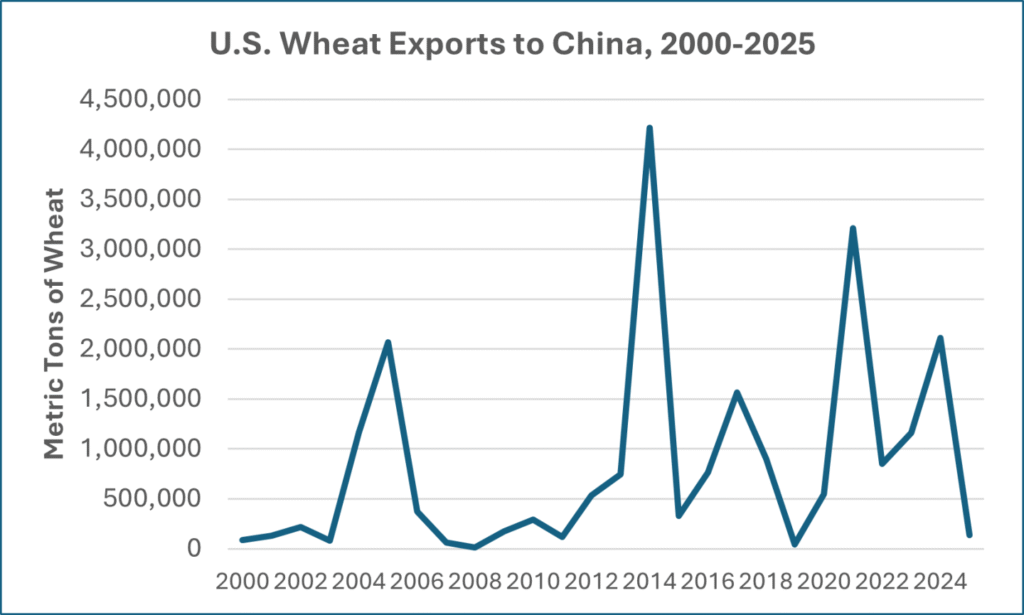

Wheat, which hit its highest since late July on Tuesday, remained underpinned by rumours of Chinese interest in U.S. supplies, though soybeans traders were cautious about potential volumes.

Accelerating Russian exports and the start of harvesting in Australia and Argentina were maintaining supply pressure in wheat.

The Russian government is considering a grain export quota of 20 million tons for the second half of the season, nearly double the year-earlier level, according to a draft document published by the Russian Grain Union lobby group on Wednesday.

|

Prices at 1237 GMT |

|||

|

Last |

Change |

Pct Move |

|

|

CBOT wheat |

549.00 |

-1.25 |

-0.23 |

|

CBOT corn |

431.75 |

0.25 |

0.06 |

|

CBOT soy |

1128.75 |

7.25 |

0.65 |

|

Paris wheat (BL2c1) |

194.75 |

0.00 |

0.00 |

|

Paris maize (EMAc1) |

193.00 |

0.00 |

0.00 |

|

Paris rapeseed (COMc1) |

480.00 |

1.00 |

0.21 |

|

WTI crude oil |

60.46 |

-0.10 |

-0.17 |

|

Euro/dlr |

1.15 |

0.00 |

0.05 |

|

Most active contracts – Wheat, corn and soy US cents/bushel, Paris futures in euros per metric ton |

|||