- SolarEdge Technologies reported its second quarter 2025 results, showing sales of US$289.43 million, up from US$265.41 million a year before, and a reduced net loss of US$124.74 million, along with revenue guidance of US$315 million to US$355 million for the coming quarter.

- Earlier in August, Schaeffler announced a partnership with SolarEdge to roll out around 2,300 electric vehicle charging points across European sites, highlighting growing adoption of SolarEdge’s integrated software and hardware solutions in the commercial and industrial sector.

- We’ll examine how SolarEdge’s improved sales alongside the Schaeffler EV charging deal shape its outlook and investment narrative.

The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer’s.

SolarEdge Technologies Investment Narrative Recap

For shareholders, the investment case for SolarEdge rests on confidence in long-term demand for integrated solar, storage, and EV solutions, alongside the company’s ability to return to profitability as market conditions stabilize. The latest quarterly results showed stronger sales and a narrower net loss, with management guiding for higher revenues, yet improvement in profitability remains the critical near-term catalyst, while persistent margin pressure and ongoing losses are the main risks. These results suggest some operational progress, but do not materially change the urgency of addressing margin recovery and earnings stabilization.

Among recent announcements, the Schaeffler partnership stands out, as it demonstrates uptake for SolarEdge’s commercial EV charging and software offering. This aligns with one of the key catalysts: ambitions for commercial segment growth and higher battery storage attach rates, both of which could support a turnaround if adoption accelerates and policy backdrops remain favorable.

However, in contrast, investors should be aware that gross margin challenges remain a major risk, especially if further pricing actions or mix shifts do not…

Read the full narrative on SolarEdge Technologies (it’s free!)

SolarEdge Technologies is projected to achieve $1.7 billion in revenue and $13.2 million in earnings by 2028. This scenario depends on a 20.7% annual revenue growth rate and an earnings increase of about $1.71 billion from current earnings of -$1.7 billion.

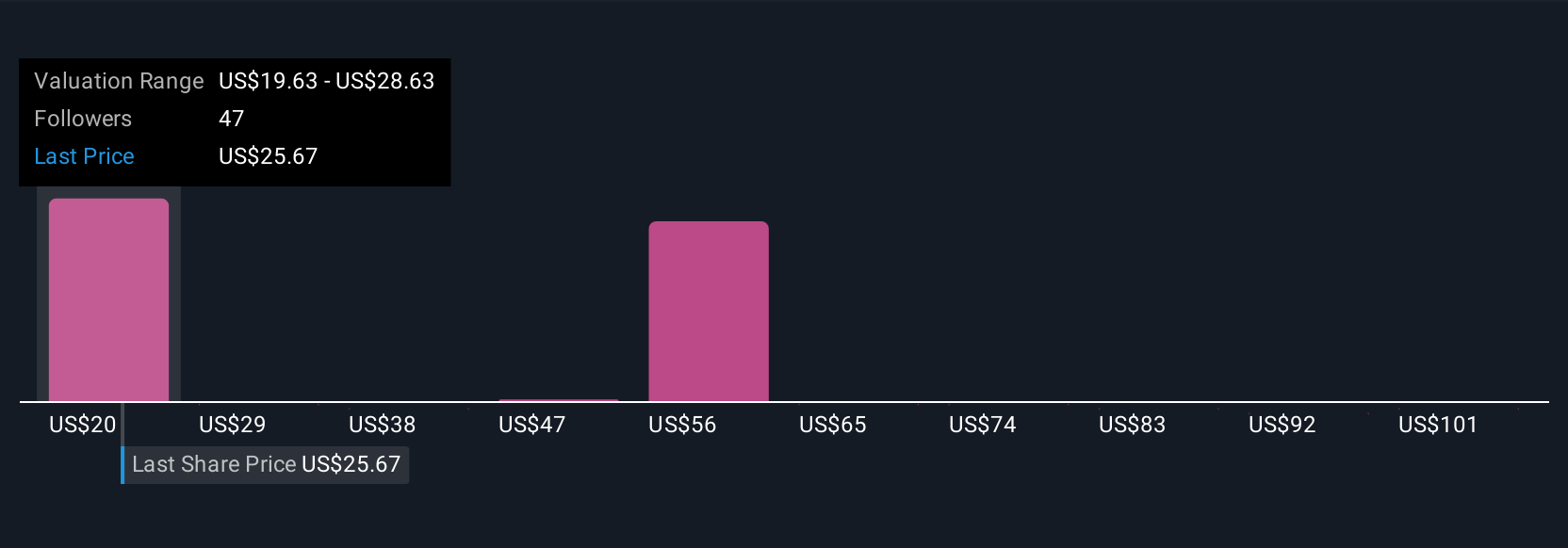

Uncover how SolarEdge Technologies’ forecasts yield a $19.64 fair value, a 35% downside to its current price.

Exploring Other Perspectives

Nineteen Simply Wall St Community fair value estimates for SolarEdge range from US$19.63 to US$109.67 per share, reflecting significant variation. As many expect margin expansion to drive recovery but see risks from price competition, explore these diverse views to inform your own assessment.

Explore 19 other fair value estimates on SolarEdge Technologies – why the stock might be worth over 3x more than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

No Opportunity In SolarEdge Technologies?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Try a Demo Portfolio for Free

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com